You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListBroker Pain Points, RESO Solutions Highlight Tech Survey

June 26 2020

RESO's Broker Advisory Workgroup is hosting discussions that illustrate ongoing pain points for brokerages.

RESO's Broker Advisory Workgroup is hosting discussions that illustrate ongoing pain points for brokerages.

Access to data is at the top of the list. Brokers regularly cite high costs for MLS data – which brokers consider to be their own – and access to data in general as ongoing concerns.

Brokers regularly turn to aggregators to clean up the data they receive from multiple MLS sources. Data consolidation and normalization are needed, as data directly from MLSs often varies dramatically and presents challenges.

WAV Group reached out to customers of several leading MLS technology and service providers for its 2020 Data Services Survey to learn what services customers want to see from their providers and how RESO standards can help to pave the way. Respondents were purchase decision makers, and nearly half of them self-described as C-suite or VP-level.

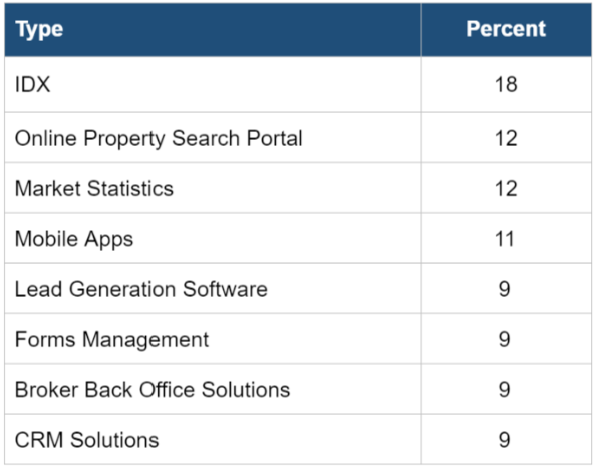

Top technology items purchased included:

The data that brokers provide their agents includes property activity (current listings, pending sales, sold data), local community information (schools, neighborhoods, public records, flood information) and company information (broker's listing history, membership/agent rosters, VOW data).

Brokers see a growing need for more data to fuel their businesses in the future. The top data needs brokers are considering adding to their applications in the future, in priority order, include:

- Public Records

- Broker Listings History

- Sold Property Data

- Flood Zone Information

- Neighborhood / School Information

The most modern data feeds today are supplied via APIs (Application Programming Interfaces). Although RETS (Real Estate Transaction Standards) data feeds from MLSs still play a significant role today, there is a growing desire to progress to the RESO Web API standard.

Collectively, RESO-compliant data feeds blanket the real estate data services marketplace, and it's clear that the trend is moving away from RETS to RESO Web API. Among survey respondents, 68 percent would like to see most of their data feeds delivered by RESO Web API in the next 12–18 months.

The number of organizations who have not yet moved to the RESO Web API is diminishing dramatically, according to Marilyn Wilson of WAV Group, who oversaw the survey. Those that haven't switched yet are hoping for more consistent, seamless integrations across systems, which is an ever-present effort at RESO.

Some holdouts have said that the Web API does not always deliver the data needed, but these situations arise based on decisions made by local MLSs and their vendors, independent of the Web API standard. RESO continues to work with MLSs and technology companies to ensure that the most robust data sets are available to MLS participants and their technical staff via the Web API. Improvements in testing, training and functionality are occurring on a near-weekly basis and can be tracked in RESO's Transport Workgroup.

Fans of the RESO Web API point to ease of integration, the support of the development team to use APIs in general, and the fact that the RESO Web API is easier to interface with and manage.

Brokers who are reliant upon a single MLS data feed are atypical, as 58 percent of respondents stated that they secure data from multiple MLS and third-party data services providers, while 31 percent said they received their data solely from the MLS and 11 percent received data solely from third-party providers.

Aggregated data feeds – one service that combines access to multiple types of real estate data – were viewed as very to extremely valuable by two out of three respondents. More than one data services provider (e.g., Trestle, Bridge, MLS Grid, Spark API, MLS Aligned) is often used by individual brokerages.

For those who prefer to work in a non-aggregated data services environment, reasons cited included the ability to get more data and have more transparency by working directly with each MLS individually. This, again, is a situation created through limited data access in individual implementations of the Web API, not the Web API standard's overall capabilities.

Adopting a standard data services approval process was desirable for 71 percent of brokers. Much like many colleges and universities have standardized their application processes, brokers would like to have clarity in the data access process when joining a new MLS.

One of the most striking pain points disclosed in the survey was that just 16 percent of brokers believe that they are getting good or great value from the data services charged by individual MLSs.

The primary messages to MLSs and third-party data services providers from the survey results are as follows:

- Provide reliable and complete broker back office data feeds

- Create clear processes for data access that are easy to find and have predictable documentation

- Move data access from RETS to RESO Web API

- Offer the RESO Web API as the default data feed and make it accessible, not as a secondary option which requires a special request to access

- Price data services to reflect the critical role data plays in the brokerage business and not as a hindrance to broker innovation

The work RESO is doing today is addressing current broker pain points. Continued collaboration and problem solving among RESO, brokers, MLSs and technology companies will continue to allow brokers better technology and data at lower prices and with more efficient means to deliver value to their customers.

To view the original article, visit the RESO blog.