You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListAgent Survey Reflects Continued Optimism Ahead of Anticipated Industry Changes

April 17 2024

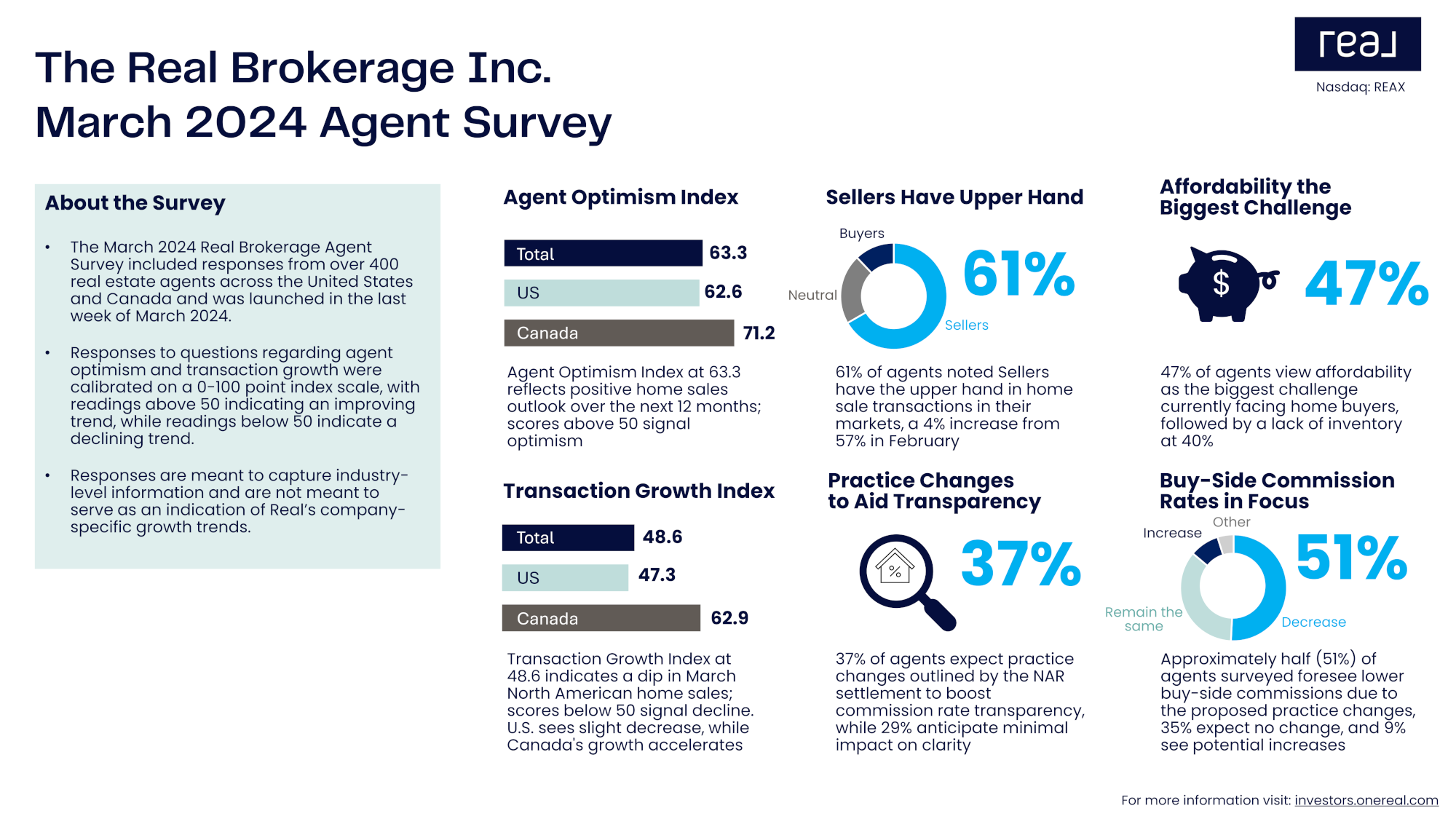

The Real Brokerage Inc. announced results from its March 2024 Agent Survey, offering insights into housing market trends and real estate agent expectations across the United States and Canada. The survey reveals continued optimism among agents about future market conditions in both the United States and Canada, despite expectations of a continued year-over-year decline in industry transactions in March. The survey also highlights agent expectations for improved transparency and readiness as the industry prepares to implement practice changes associated with the National Association of Realtors (NAR) recently announced settlement agreement.

"We are grateful for the perspectives of our growing agent base, which has now surpassed the 17,000 milestone," said Tamir Poleg, Chairman and CEO of Real. "Their opinions and insights are essential in guiding our approach, ensuring we remain thoughtful and agile as we navigate industry shifts together."

"Embracing change and fostering transparency are cornerstones of our culture," remarked Sharran Srivatsaa, President of Real. "Our agents' continued resilience and adaptability are critical as we position the company to capitalize on evolving industry dynamics and emerge even stronger."

Key Findings

Agents Remain Positive About Forward Outlook, Although Optimism Index Ticks Down Sequentially from February Level

Real asked agents at the end of March 2024, "Compared to one month ago, are you more optimistic or pessimistic about the outlook for your primary market over the next 12 months?" Among the agents surveyed, 45% felt more optimistic and an additional 15% felt significantly more optimistic about the next 12 months, outweighing the 13% who felt more pessimistic and 7% who felt significantly more so.

The average response among survey participants resulted in a weighted index reading of 63.3 on a 0-100 scale, with scores above 50 reflecting a positive outlook and those below 50, a negative one, thus signaling an expectation for improving year-over-year growth trends in the year ahead. March's index level showed a slight decline from February's 69.2, indicating lower optimism compared to the end of February, primarily due to a decline among U.S. agents, which offset improved optimism among agents surveyed in Canada.

Balance of Power Shifts Further Towards Sellers

When asked "Would you consider your primary market to be a buyer's market, seller's market, or balanced market?" 61% percent of agents noted sellers have the upper hand, an increase of 4 percentage points from February, while only 13% of agents believe buyers have the upper hand in their markets.

Total North American Home Sale Industry Transactions Expected to Decline Year over Year in March

Real asked agents, "In your primary market, how would you describe the number of transactions closed in March 2024 compared to March 2023?" The average response among survey participants resulted in a weighted index reading of 48.6 on a 0-100 scale, with scores above 50 indicating growth and below 50, a decline. The results suggest a modest decline in total industry transactions across the U.S. and Canada during March 2024 compared to March 2023, with a decline in the U.S. home sales market, while the Canadian market is expected to grow. March's index reading of 48.6 was slightly below February's 48.7 level.

-

More Pronounced Decline Expected in the U.S. in March - The total number of U.S. home sale transactions is expected to decline in March 2024 compared to March 2023. Agent responses indicate a more pronounced pace of decline in March relative to February, with the average response among survey participants resulting in a March weighted index reading of 47.3, below the 48.5 level reached in February.

-

Canada Market Growth Accelerates - Agents surveyed in Canada signaled accelerating year-over-year growth compared to February, with the average response among survey participants resulting in the overall Canadian weighted index rising to 62.9 in March from 51.8 in February.

Affordability and Low Inventory Remain the Biggest Challenges

Challenges for prospective home buyers include affordability/interest rates (47%) and inventory shortages (40%), with economic uncertainty and buyer competition tying for a distant third (each at 5%).

Over One Third of Agents Expect Practice Changes to Improve Commission Rate Transparency

Agents were asked whether they believe (i) a new rule prohibiting offers of buyer broker co-op compensation on the MLS and (ii) a requirement that MLS participants working with buyers enter into written agreements with their buyers, would improve transparency regarding commission rates in real estate transactions. Thirty-seven percent of agents surveyed believe these industry practice changes would improve transparency, compared to 29% who believed the changes would be neutral, and an additional 29% who believed the changes would not improve transparency.

Agents See Buyer Agency Agreements as an Opportunity to Communicate the Value Agents Bring to a Transaction

Forty-five percent of agents surveyed believe securing written buyer agent agreements will be relatively easy, contrasting with 27% who foresee potential difficulties. Meanwhile, 23% of agents are neutral on the issue, believing the ease of securing a written agreement will depend on each client's understanding of industry practices.

Approximately Half of Agents Anticipate a Decline in Buy-Side Commission Rates Due to the Proposed Practice Changes

Thirty-nine percent of agents surveyed expect buy-side commission rates to decline slightly as a result of the proposed practice changes, while an additional 12% expect buy-side commission rates to decrease significantly. This compares to 35% of agents who expect buy-side commission rates to remain about the same, and 9% who see an opportunity for buy-side commission rates to increase as a result of the proposed changes.