You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListAVMs and the Weather Forecast

October 14 2014

Automated valuation models or AVMs have long challenged real estate agents and brokers since the consumer release of Zillow's Zestimate™. To some degree, consumers fight the same challenge. The reality is, sometimes AVMs are right on, sometimes they are close, and sometimes they are really wrong.

Automated valuation models or AVMs have long challenged real estate agents and brokers since the consumer release of Zillow's Zestimate™. To some degree, consumers fight the same challenge. The reality is, sometimes AVMs are right on, sometimes they are close, and sometimes they are really wrong.

As I was watching last nights' weather report, I had a moment of clarity. The best way to understand AVMs is to compare them to the weather report. The weather report is never accurate! Yet, for some reason, we watch the weather report every day because it gives us a fuzzy truth about what the weather conditions are most likely going to be.

AVMs are just that, fuzzy truths.

Brokers are thinking about AVMs and if or how they might deploy them on their consumer website. At issue is the notion that if AVMs are not accurate, are we taking a risk by putting them on our listings? It is a difficult question to be answered. You can break the question down into two questions to dissect the issue. First, is the AVM an accurate valuation of the subject property? The answer is a fuzzy yes, or sometimes. The second question requires you to alter your perspective. Is the AVM accurate?

What is an accurate AVM? I would tell you that AVMs are always accurate. They are the exact sum of a calculation that yields results the exact same way every time as long as the components of that calculation remain the same. In many ways, the AVM is not very different than an agent's suggested listed price.

There is a science and testing process behind AVMs. Companies like CoreLogic, Black Knight Financial, Collateral Analytics,RPR, subscribe to this testing. I am not sure if Zillow does or not. The test involves running the AVM across the same 1000 properties. The results are calculated in quartiles, but look something like this. 90% of the time, the AVM came within +/- 10%. It begs the question, 10% of what?

The fact is, the actual value of a home can only be calculated exactly by one process. The actual value of a home is always exactly equal to the price that a willing seller and a willing buyer agree to. Interestingly enough, the primary influencers of the long tail of accuracy (+/- 10%) have more to do with emotion and motivation than anything else. Choosing to agree to a price as a seller; or, choosing to make an offer as a buyer, are driven by emotions and motivation and justified by facts. It is a human calculation.

I mentioned, "Justified by facts." There is an important role that AVMs play in real estate. They are used by the banking industry as a guide to appraising their portfolio of properties and to make lending decisions. The lending decision is only partially impacted by the AVM, but is used every time in concert with an appraisal, and considerations related to credit score and loan to equity ratios (think down payment).

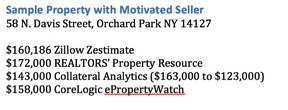

Here is a sample property that I ran through 4 AVM tools available to real estate professionals today – Zillow's Zestimate, RPR, Collateral Analytics, and CoreLogic ePropertyWatch (aka RealAVM if you are in Realist).

Which number is correct? The answer is like the weather. If you look at four weather forecasts for tomorrow, you will see that they are all different, but generally the same within a range of accuracy. If four forecasts say that there is a 80% chance of afternoon rain, bring a rain coat or umbrella! The same holds true for a property. If four AVMs say the home is worth between $143,000 and $172,000, then you might want to price the property in that range.

A quick note about pricing strategies – homes priced below market sell at or above market prices over a shorter period of time. Homes priced above market take longer to sell and typically bring below market prices. Pricing this home at $143,000 is likely to drive the actual transaction price to the High $160s or $170s. Price it in the $180s or $170s and it is likely to transact at $145k to $150k – see Terradatum. Agents and their buyers get a feel for the market and know a good price when they see one. They get emotionally attached to winning the home and wind up paying more – it is the auction rule. Once you have a commitment to buy, price becomes less of an issue.

When you price high, everyone ignores your property or sends in low-ball offers. Over time, the low ball offers wear down the seller and they drop the price and accept a below market offer.

So, the next time you have a problem with an AVM, explain to the customer that they are like weather forecasters. They are always wrong, but give you a good indication of what to expect. They use big data in making the calculations that lumps the property into an average. No two homes are the same – each has its own microclimate.

If you want to display the AVM on your broker website, go for it. But I suggest that you display more than one, if possible. Showing the degrees of separation between multiple AVMs explains their fuzzy math to the seller, ipso facto.

Zillow offers an API for website integration. You will need to call the other firms to discuss the ability to use their AVM for public display. Until the demand is there, it is not a service that is actively offered to my knowledge. But it can be.