You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListHow the New FHA-Approved 40-Year Mortgage Can Save Buyers Money in the Short Term

April 20 2023

A new type of mortgage has recently been approved by the Federal Housing Administration (FHA) that offers a longer repayment period of up to 40 years. In this post, we explore the benefits of the newly approved FHA 40-year mortgage, and how it can save homebuyers money in the short term.

A new type of mortgage has recently been approved by the Federal Housing Administration (FHA) that offers a longer repayment period of up to 40 years. In this post, we explore the benefits of the newly approved FHA 40-year mortgage, and how it can save homebuyers money in the short term.

So, what exactly is the FHA 40-year mortgage?

The FHA 40-year mortgage is a new type of loan that allows homebuyers to borrow money over a period of 40 years. This is longer than the typical 15- to 30-year mortgage terms. The FHA 40-year mortgage is designed to make monthly mortgage payments more manageable for homebuyers. The monthly payments are decreased by spreading out the repayment period over 40 years, which makes it simpler for those on a tight budget to afford a home.

The fact that the FHA 40-year mortgage can help homebuyers save money in the short term is one of its most important advantages. As was already mentioned, the smaller monthly payments result from the longer repayment period, which makes it simpler for homebuyers to afford their mortgage payments.

Homeowners that are struggling with their mortgage payments are able to do a loan modification to this new FHA 40-year mortgage. By doing so, a lower monthly payment will allow them to allocate more of their funds to other costs.

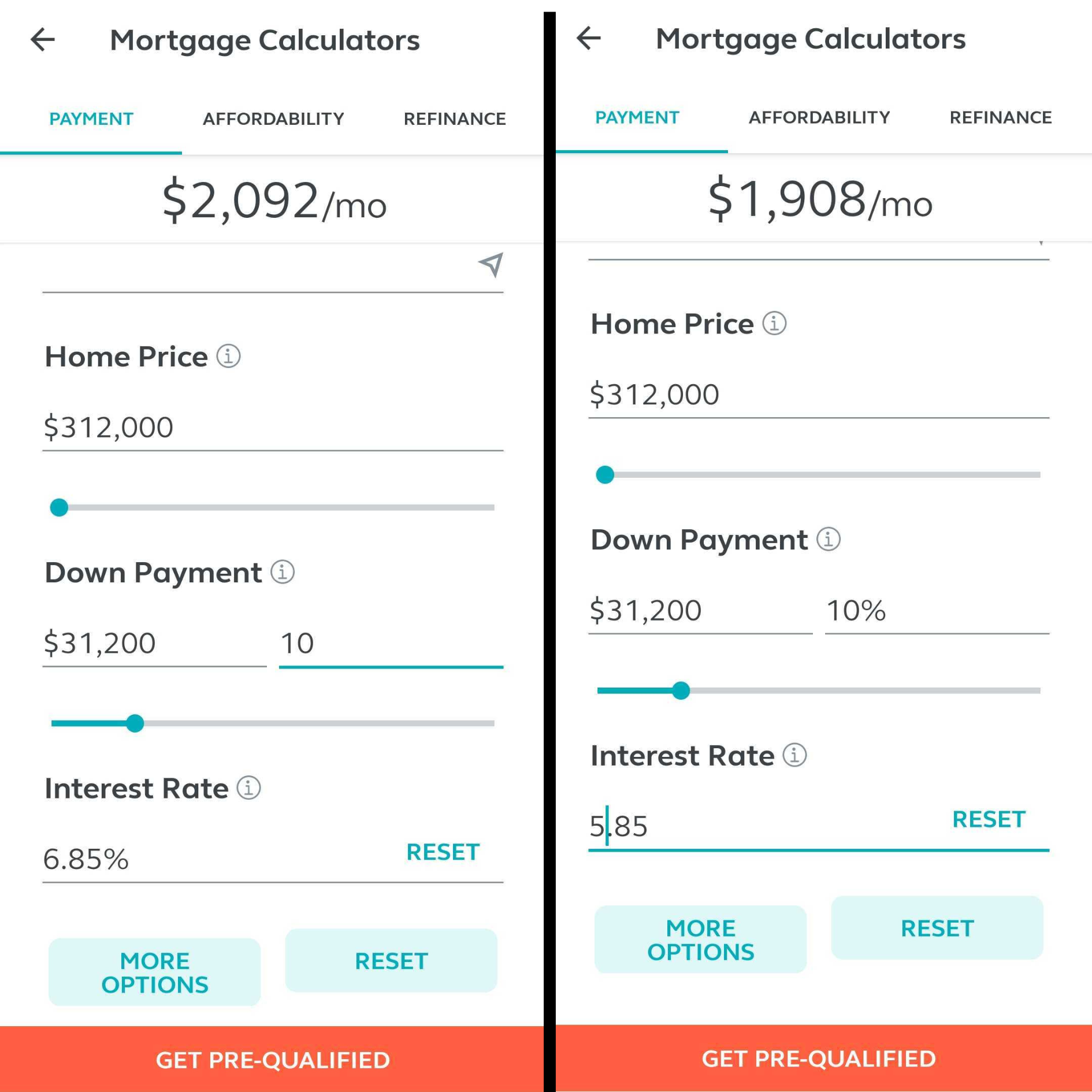

According to a recent Yahoo article, Bankrate recently compared 30- and 40-year mortgages and found on a $312,000 loan at 6.85% interest, the monthly payments were $2,044 for 30 years and $1,904 for 40 years.

In connection with such, below is a breakdown of the amount of potential savings you could get when comparing a 30-year mortgage at 6.85% and 5.85%. Please note that we used 5.85% to depict the amount of savings you'd basically get from a 40-year mortgage (a 40-year mortgage is the equivalent of reducing your 30-year mortgage by a 1% interest rate).

The FHA 40-year mortgage can save buyers money in the short term, but it's important to remember that in the long run, buyers will pay more. So even though monthly payments may be lower, buyers will end up paying more in interest over the course of the loan.

The FHA 40-year mortgage is still a great choice for homebuyers on a budget even though they will end up paying more in interest. People may find it easier to afford a home and to save money for other expenses as a result of smaller monthly payments. Additionally, homebuyers can be confident that they are receiving a competitive interest rate because the loan is backed by the FHA.

In addition to such, history has shown that interest rates fluctuate. With a 40-year mortgage, as interest rates go down, buyers can potentially refinance to a shorter term mortgage to save money, making the 40-year mortgage an introductory type loan, thus further assisting first-time homebuyers.

To view the original article, visit the Transactly blog.