You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListDo We Need a National MLS?

January 02 2019

The Pros and Cons of It

Today we're tackling a big question: Do we really need a national MLS? Who stands to benefit the most? Who would suffer? Below is an overview of the pros and cons and common questions I've had during conversations with home buyers, real estate technology companies, and brokers.

What Is the MLS and What's the Problem?

Below is a pretty high level overview of what exactly the MLS is. Knowledgeable folks can skip below.

The Multiple Listing Service (MLS) is, among other things, the central database of available homes for sale. This data is disseminated through applications such as Redfin, local brokers within the MLS and other apps, including proprietary tools, available to buyers and sellers.

Historically, MLSs across the country have built their database and operations independently, as their primary function is to aggregate local listings and allow agents from different firms within the same geographic area to view and share listings for their clients.

As the industry has changed and sites like Zillow have created demand for a nationwide MLS, the question is should there be an actual, consolidated, and single MLS?

There are pros and cons to consolidating the 680+ MLSs across the country, and participants stand to both gain and lose from this.

The Pros of a National MLS

The pros center around unifying data, perceived cost savings, accelerated technological developments, and cross-border access. Let's tackle each of these:

Cleaner Data

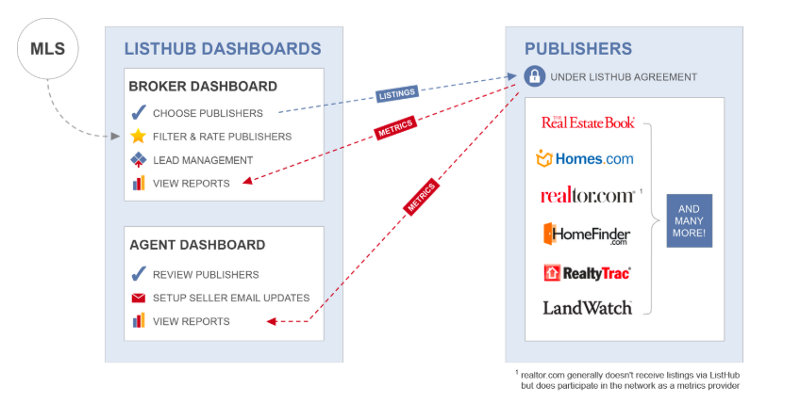

Then most obvious benefactor here is technology providers who need listings from multiple MLSs. These could be IDX developers for national brokerages or companies such as Homesnap or Homebloq that build software for brokers and agents. Companies such as WolfNet, CoreLogic, and ListHub are tackling this problem, too.

ListHub aggregates MLS data for publishers (credit: ListHub.com)

As the graphic above shows, aggregating, scrubbing, and standardizing real estate data would enable easier app development. This could, to the ire of agents, benefit companies such as Zillow. While this sounds disadvantageous for agents, the argument could be made that if clients, whole generally prefer Zillow to MLS, are better off, then are not agents, as serving clients is the penultimate goal?

Cost Savings

Consolidating to a single MLS would potentially result in major cost savings for the industry as a whole. Explicitly, merging technology creates synergies, such as needing only single agreements and contracts, but there are also implicit benefits resulting from single management and a unified vision for future development.

Technology

Cleaner data is part of a broader benefit for the industry as a whole when it comes to technology. Agents would benefit from more rapid tech development, smoother integration of new apps, ability to leverage previously inaccessible resources, and potentially ally with the portals and align their workflow with that of their clients.

On that last point, it is clear that consumers prefer the portals to the MLS. Portals often offer more intuitive design and the ability for consumers to better control their search parameters. A national MLS feed could allow portals to improve their data and actually create a shared platform where both agents and clients exist and collaborate together.

Better Cross-Border Access

National brokerages already exist, and we've touched on the cost savings. However, for boutiques and agents themselves, a national MLS could present the opportunity to work across borders in different areas of the country. The downsides of this are obvious and detailed below, but would being able to help a client who is selling locally to buy elsewhere be beneficial?

Compass appears to be challenged with their ability to scale nationally by acquiring agents, as their strategy appears to now be focused on acquiring firms (such as their acquisition of Conlon/Christie's here in Chicago). Skilled players in the market may find scalability less challenging, as well—is that a good thing or a bad thing?

The Cons of a National MLS

The drawbacks include diluting local market expertise, misaligned incentives, loss of control over listing data, and unexpected complications from aggregation.

Foreign Agents

A common and valid counterargument is the fact that agents who have no prior knowledge could enter your local market. Here, almost everyone loses. This, however, assumes that a national MLS means cross border operations would be allowed.

The insurance industry requires reps to have state licenses to operate in the state, and the real estate industry could effect a similar requirement (similar to the bar exam for lawyers). Generally, the benefits appear to be outweighed by the costs, even considering the potential added value to clients by opening the possibility of expanding the options for agents in the market.

Conflicts of Interest

Wherever there are new markets, there are opportunities for fraud and conflicts of interest. An extreme example would be a scenario where an agent has an incentive to push clients into a more expensive area of the county (if the client's search is really wide open).

Ethical concerns could exist where brokers and agents shift operations to areas with fewer laws. This is a concern in the financial securities and broker industry where business can be settled or conducted in less regulated areas (of the world, however).

Loss of Control

There's a certain comfort in writing an email to friends than, say, a blog post. Similarly, the feeling of control over your content, which for agents and brokers is listing data, can become lost when that gets fed into a national black box. Admittedly, this is a weaker argument than most, but there are certain advantages to working directly with your local MLS or association that may be lost on a national scale.

Externalities

There are always the unknown unknowns and external costs that can't necessarily be predicted. Agents know this well with clients who seem like a slam dunk and end up being anything but. Cost overruns, internal disagreements, and changes in economics always influence large mergers and acquisitions.

In my first job, I was an analyst in the back office of a commercial bank that had recently acquired a smaller, local bank. Part of my job was assisting in migrating loan data from one system to the next. It was nearly impossible, took months longer than expected, and was generally viewed within the bank as a massive failure. It happens.

To view the original article, visit the Homebloq blog.