You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListRentSpree Celebrates 2 Million Users Milestone on Its Rental Platform

November 06 2023

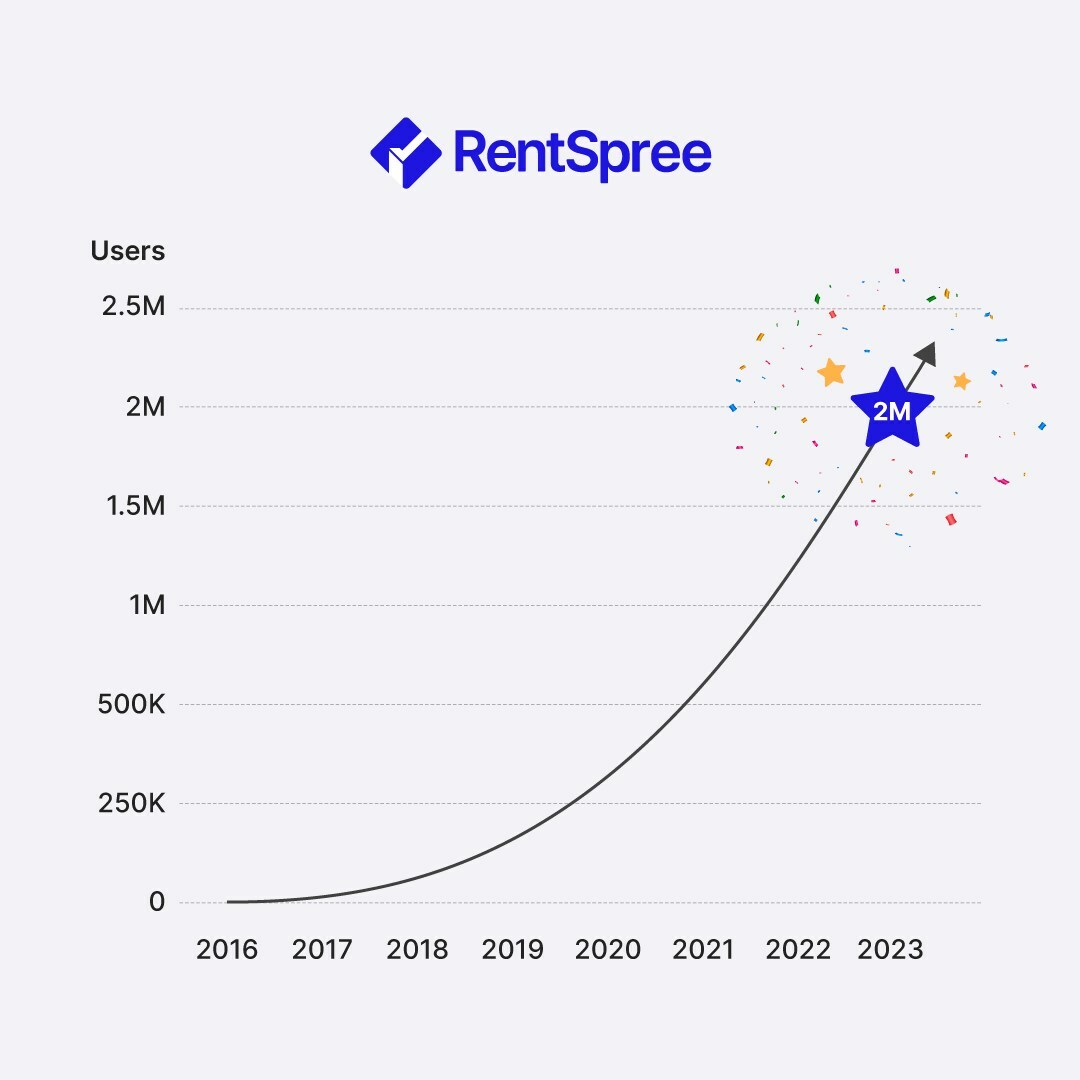

RentSpree's user base doubles in less than two years

LOS ANGELES, Oct. 31, 2023 -- RentSpree, the industry's premier end-to-end rental management software provider, today announced it reached two million users on its platform, effectively doubling its user base in less than two years.

"It took us more than five years to get to the first million mark and less than two years to add the second million," said Michael Lucarelli, CEO and co-founder of RentSpree. "This is a testament to the power of our platform, our prolific industry partnerships and strong demand for smart rental solutions."

Since a $620,000 pre-seed round in 2017, RentSpree has been able to raise a total of $28 million in Series A and B financings. The funds have enabled the company to expand product offerings for agents, landlords and renters and secure additional strategic partnerships. The company's exponential growth - a 598 percent revenue increase over three years - has landed it on the Inc. 5000 of fastest-growing private companies in the U.S. this year.

RentSpree's key feature, its tenant screening solution, allows agents to view a rental applicant's report instantly. Over the years, RentSpree added a substantial array of additional rental solutions for agents, landlords and renters. Its latest is Credit Builder, RentSpree's rent payment reporting tool that allows renters to opt into having on-time payments reported to a credit bureau.

RentSpree's comprehensive suite of tools helped boost transactions on the platform in any one month to a record 485,000 in July. These transactions include running tenant screening reports, agents adding properties to the system and renters submitting reviews for agents. Demand for rentals continues to be a timely topic as mortgage rates hovering around 8 percent and continuously increasing property prices have made buying a home out of reach for many. According to a recent study by CBRE, the cost comparison between purchasing a home and renting one has reached its most significant disparity since at least 1996. The study reveals that the average monthly new mortgage payment is now 52 percent higher than the average apartment rent.

As part of its strategy to reach the largest number of users to benefit from its rental solutions, RentSpree has also formed hundreds of partnerships, including with three of the top five multiple listing services (MLS) in the United States – California Regional Multiple Listing Service (CRMLS), First Multiple Listing Service (FMLS), and Bright MLS. Other key partners include Beaches MLS, Miami Association of REALTORS®, Austin Board of REALTORS®, RE/MAX and Realty ONE Group, along with more than 250 of the most trusted brands in real estate, such as Lone Wolf Technologies. RentSpree's latest partnership includes OneKey® MLS, the largest multiple listing service in New York.

RentSpree's key offerings include:

- Rental Application - Rental Application allows for easy-view, easy-to-read, and mobile-friendly applications. No need to be tied down to an office or computer to find the best tenants.

- Tenant Screening - Tenant Screening allows for agents to screen prospective tenants with a comprehensive background check from a credit bureau.

- Rental Client Manager - Rental Client Manager (RCM) leverages key milestones to help agents provide real estate guidance to clients.

- Listing Pages - With Listing Pages, RentSpree empowers agents to market their properties with a best-in-class user experience.

- Agent Profiles - Agent Profiles enable agents to create a personalized profile to promote their experience, feature their expertise, and market their listings.

- Accept/Deny Letters - Send a congratulatory welcome letter to new tenants and get off on the right foot, or a standardized denial letter to make it as painless as possible.

- Rent Payment - Rent Payment ensures all your rental transaction needs can be managed under one roof. RentSpree partners with Stripe to safely deposit payments into your bank account and automates the process to make sure to remind tenants when rent is due.

- Credit Builder - Renters can opt in to have on-time rent payments reported to a credit bureau to help boost their credit score.

- E-Sign Documents - Upload and send documents for fast and convenient signing anytime, anywhere. Agents can stay organized by uploading only the documents needed for the transaction and tracking the signature status.

- Renters Insurance - Insurance can help avoid issues during the lease. Tenants can purchase renters insurance or submit proof of their policy in one step.

- Rent Estimate - Rent Estimate helps agents discover similar properties in the area and develop strategies to maximize property values.

About RentSpree

Los Angeles-based RentSpree is a provider of award-winning rental software that helps easily connect real estate agents, landlords, and renters to simplify the entire rental process. The platform is known across all 50 states for its seamless and secure interface and suite of rental tools, including tenant screening, rent payments, marketing and renter management. To date, RentSpree has partnered with more than 250 of the most influential MLSs, real estate associations and brokerages to serve over one million users in the U.S. RentSpree was ranked on Inc. 5000's fastest-growing private companies in 2022 and 2023. Visit http://www.rentspree.com for more information.