You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListA Closer Look: U.S. Homes Expected to Lose Nearly $700 Billion in Value This Year

December 26 2011

Further insights from the Zillow Research blog . . .

Homes in the United States are expected to lose more than $681 billion in value during 2011, which is 35 percent less than the $1.1 trillion lost in 2010, according to recent analysis of the Zillow Real Estate Market Reports.

The bulk of the total value lost during 2011 was in the first half of the year. From January to June, the housing market lost $454 billion. From June to December, Zillow projects that residential home value losses will be $227 billion.

Only 7 percent (9 markets) of the 128 markets tracked by Zillow showed gains in total home values during 2011. Among those were the New Orleans metropolitan statistical area (MSA), which gained $3.5 billion in value, and the Pittsburgh MSA, which gained $2.7 billion.

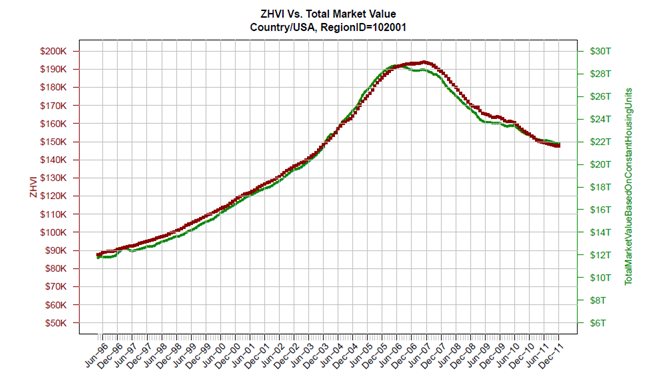

Nationally, the total market value peaks in Q2 of 2006 which is different from the peak of Zillow Home Value Index (ZHVI) in Q2 of 2007. This is caused by the different measurements namely average vs. median. While the median of Zestimates is the core component of the ZHVI, the average of Zestimates is the core component of the total market value.

A breakdown of the results by metropolitan statistical area can be viewed here.

Methodology

We calculated total market value of homes as the total number of homes multiplied by the average of Zestimate values:

Total Market Value = Total Number of Homes * Average of Zestimates

Total home value change is calculated by subtracting the value of all homes in an area in December 2011 from the total value at December 2010. The methodology is summarized by 6 steps below:

- Estimate Total Number of Homes

- Calculate Raw Average Zestimates

- Apply Systematic Error Correction

- Apply Simple 3-Month Moving Average

- Remove Seasonality

- Forecast to Year-End

Estimate Total Number of Homes

Only single family homes, condominiums and cooperatives are included in our calculation of the total market value. According to the U.S. 2010 census data, total housing units in 2010 are 131.7 million with 25.9% being multi-dwelling structures. Multi-dwelling structures include condominiums, cooperatives and multiplexes. We estimated the total number of homes that are single family, condominium and cooperative in the U.S. to be 103 million.

Let mj be the total number of single family homes, condominiums and cooperatives in the j-th region (national or a metro). We estimate mj by the following formula

mj = CHUj – CMSj – mobilesj+ condominiumsj + cooperativesj

where CHUj and CMSj are census number of total housing units and multi-dwelling structures respectively; mobilesj, condominiumsj and cooperativesj are number of homes in Zillow database for the three home types respectively.

Calculate Raw Average Zestimates

Let zj(t) be the vector of Zestimates for all homes at time t in the j-th region having

hj(t) = length(zj(t))

Thus, hj(t) is the number of homes with Zestimates at time t in the j-th region. For example, hj(t) is 83 million for j corresponding to the national and t=Oct. 30, 2011. The raw average of Zestimates, rj(t), is

rj(t)=Average(zj(t)) over hj(t)

rj(t) is an element of the vector r(t), which represents the time series of the raw average Zestimates for all regions (national and MSAs) tracked by Zillow.

Apply Systematic Error Correction

Zestimate errors are both time and region dependent. While the errors produced by the Zestimate algorithm are generally equally distributed above and below the actual sale price, there can be some residual systematic error detected once more historical sales are known (systematic error here defined as the median raw error being slightly greater or less than zero). Raw average Zestimates are corrected by dividing by a correction factor. See ZHVI methodology for details on how we calculate residual systematic error. Then, the corrected average Zestimate is

uj(t)= rj(t)/{1+ bj(t)}

where bj(t) is the systematic relative error for the j-th region and uj(t) is an element of the vector u(t) which represents the time series of the error adjusted average Zestimates for all regions tracked by Zillow.

Apply Simple 3-Month Moving Average

We apply a simple 3-month moving averages to u(t) to filter out noise in the data.

ma(t)={u(t)+ u(t-1)+ u(t-2)}/3

The resultant vector ma(t) is a smoother time series of the error adjusted average Zestimate time series.

Remove Seasonality

Home sales are affected by seasons within the same year. Adjusting for the seasonality is desirable to provide a trend for ease of comparison and forecasting. Since Zestimates depend on sale prices, the time series ma(t) contains seasonality. We remove seasonality using STL method. STL is a seasonal-trend decomposition procedure based on Loess developed by Cleveland et al (1990). It is a filtering procedure for decomposing a time series into seasonal, trend, and remainder components:

ma(t)= s(t)+trend(t)+ re(t)

where s(t), trend(t) and re(t) are the seasonal, trend and remainder components respectively. The remainder component, re(t), represents irregular features in the time series which we preserved. We add the trend and the remainder components to form the final average Zestimate. Then, the total market value is

tmvj(t)= mj * {trendj(t)+ rej(t)}

where mj is constant in time, t, and is the total number of home in the j-th region estimated by the formula in step 1 above. We only remove seasonality so that month-over-month and quarter-over-quarter changes are not confused by the oscillation of market values due to different seasons within each year.

Forecast to Year-End

Since Zestimates and transactional data are not available to the end of the year yet, we apply a time series forecasting method to extend the total market values to the end of December 2011 using the Exponential smoothing state space model (Hyndman, et al).

Methodology changes

With more available Zestimates which increased from approximately 70 to 100 million homes and from 750 to 3000 counties, we modified the methodology to be more robust and more reflective of the market. We apply a 3-month moving average to the time series rather than smoothing splines. The smoothing splines can potentially remove too much variability. The variability caused by seasonal fluctuation is now explicitly adjusted via the STL method.

By adding 18 million homes to this calculation, we’re able to provide more accurate estimates of total market values at both the national and metro level. At the metro level, these changes are relatively minor since most homes within the major metropolitan areas were already covered previously. Nationally, the addition of homes in more rural locations (typically with lower values) results in a lower national total market value. The peak total market value under the old data footprint was nearly $32 trillion whereas the peak in the new data footprint is less than $29 trillion. The full historical total market value time series for this new data footprint has been re-computed back to 1996 so that there is no discontinuity.

Figure 1: National ZHVI vs. NationalTotal Market Value

References

R. B. Cleveland, W. S. Cleveland, J.E. McRae, and I. Terpenning (1990) STL: A Seasonal-Trend Decomposition Procedure Based on Loess. Journal of Official Statistics, 6, 3–73.

Hyndman, R.J., Koehler, A.B., Ord, J.K., and Snyder, R.D. (2008) Forecasting with exponential smoothing: the state space approach, Springer-Verlag.

View the original post on the Zillow Research blog.