You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListMillennials: New Year, New Home?

January 10 2019

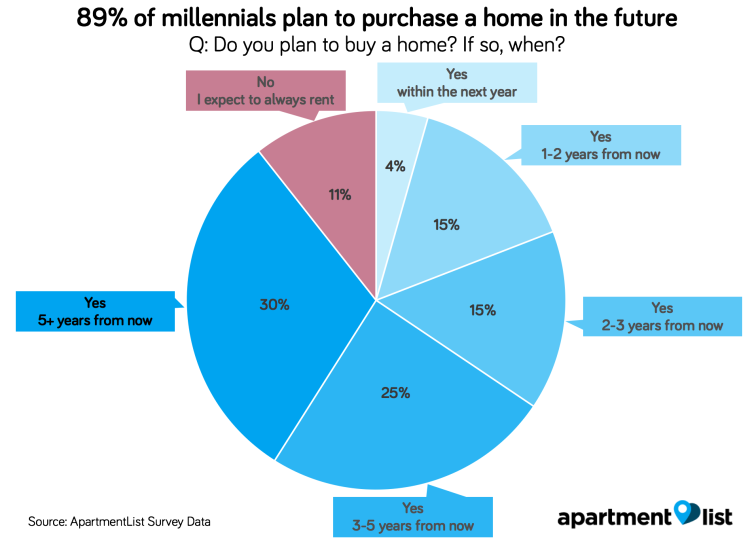

It turns out a lot of millennials want to buy a home someday--a whooping 89 percent according to a new Apartment List survey. But, just 5 percent expect to buy in 2019 and 34 percent say they will wait at least five years. Why the lag?

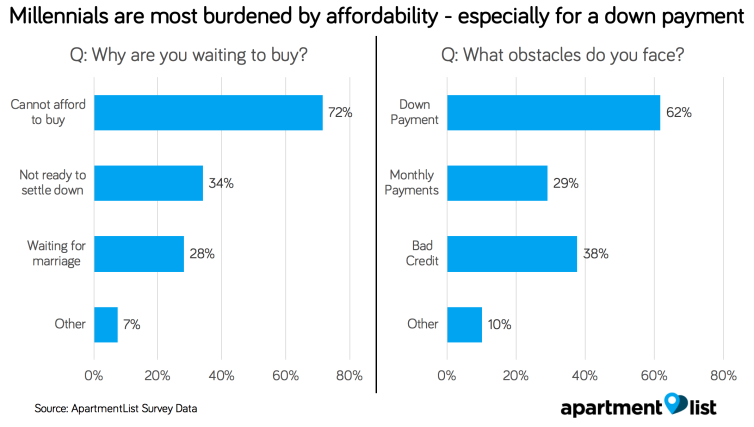

While the dream of homeownership is strong, 72 percent cite affordability as the critical issue.

Down payment funds are primary challenge

Sixty-two percent of millennials specifically mention the lack of funds for a down payment. Only 11 percent have saved $10,000 or more for a home and 48 percent have zero down payment savings.

What the study overlooks

The survey also found that two-thirds of Millennial renters would require at least two decades to save enough for a 20 percent down payment on a median-priced condo in their market.

What this study overlooks is that a 20 percent down payment isn't required and isn't even typical for a first-time homebuyer. The average down payment for a first-time buyer is about 7 percent today, according to the National Association of REALTORS. So, potential millenial home buyers shouldn't despair — they have options.

Today, there are multiple loan programs are available with as little as 3 or 3.5 percent required as a down payment. Some loan programs such as the VA loan program and the USDA Rural Development loans require zero down payment. Plus, there are more than 2,500 homeownership programs across the country that provide assistance with down payment and closing cost funds. Your clients can check their eligibility on this online program search.

To view the original article, visit the Down Payment Resource blog.