You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListAre You Prepared to Launch Your Flight to Quality?

January 22 2015

It is at best a bizarre situation. As this article is being prepared, the American residential real estate industry is but 213 days from an event that many experts believe may be the industry's seminal moment for the decade. The centerpiece and stimulus for all of this activity is the Consumer Financial Protection Bureau (CFPB). The 1,888-page RESPA-TILA (Truth in Lending Act) Integrated Mortgage Disclosures Rule issued in 2014 by the Consumer Financial Protection Bureau will probably not end the residential real estate business as we know it, but it will certainly change the way it currently operates.

It is at best a bizarre situation. As this article is being prepared, the American residential real estate industry is but 213 days from an event that many experts believe may be the industry's seminal moment for the decade. The centerpiece and stimulus for all of this activity is the Consumer Financial Protection Bureau (CFPB). The 1,888-page RESPA-TILA (Truth in Lending Act) Integrated Mortgage Disclosures Rule issued in 2014 by the Consumer Financial Protection Bureau will probably not end the residential real estate business as we know it, but it will certainly change the way it currently operates.

When the RESPA-TILA rule takes effect (currently slated to take effect in August of 2015) it will integrate information currently provided to consumers in four separate documents to satisfy the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA), boiling it down to two documents: a loan estimate and closing disclosure.

As most of our readers already know, the Dodd Frank Wall Street Reform and Consumer Protection Act created the CFPB during the 2010 congressional session. The agency began operations in 2011. It hit the ground running with a campaign directed at debugging the national student loan act.

Its noteworthy and unfettered staff includes an unusual number of young "go getters," many fresh out of college, without the "industry" baggage that has crippled so many prior efforts to "make a regulatory difference." During those first few years, it managed to find the time to draft, approve and implement thousands of pages of new procedures, rules and regulatory edicts. Even when assaulted by constant political attacks regarding the Bureau's purpose and methodologies, it quickly became an effective regulator and attacked some of the country's most outrageous consumer traps. The agency next went after the credit card, automobile loan and mortgage industries. One of its current targets is the residential real estate industry.

The Bureau has collected tens of thousands of consumer complaints relative to the above subjects, including real estate related transactions. From its very beginning, it has taken the time and effort to form a very solid relationship with the American consumer. Pursuant to its charter, consumer education and assisting the recovery of consumers who have been harmed by predatory practices have been at the top of its "to do" list. With respect to its efforts aimed at the residential real estate experience, it currently offers a 90-page document comprised of such complaints and experiences.

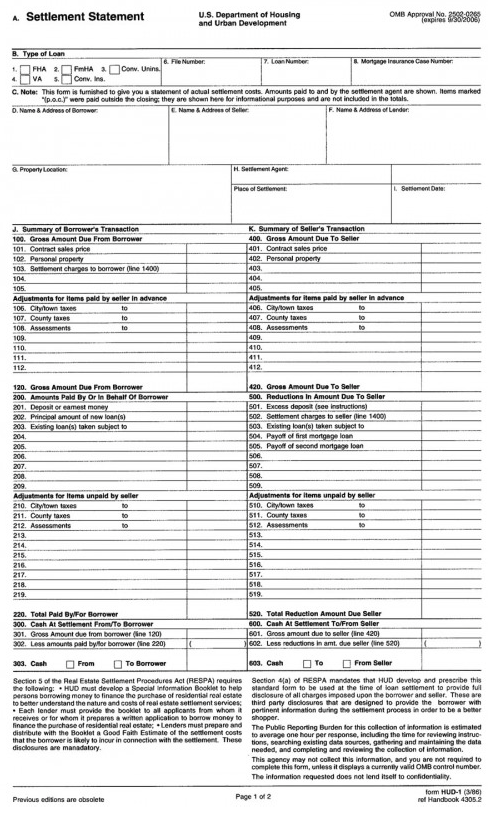

When the Bureau's RESPA-TILA rule takes effect in August, it will integrate information currently provided to consumers in four separate documents (including the famous HUD #1 accounting document) to satisfy the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA), into two documents: a loan estimate and closing disclosure. While this is easy to say it is, in fact, "a giant step forward" for real estate industry regulation.

By and large, organized real estate (ORE) has ignored the bureau's current intuitive approach, apparently relying on Dodd-Frank provisions that suggest nothing in the act can impact state licensees working within the scope of their license. The Bureau's regulatory activities over the past year would seem to cast doubt over ORE's position.

First of all, the act transferred RESPA jurisdiction from HUD to the Bureau. There are few brokerages in the country that could escape even the most cursory RESPA audit without fault. Secondly, the simple fact is that it is quite common for licensees to wander outside of the provisions of state licensure statutes. Only the almost complete lack of state level non-complaint driven enforcement has allowed this situation to go unnoticed.

Those who doubt the potential impact of the current RESPA-TILA initiative on state licensees would do well to examine how other real estate related industries have responded to the upcoming event.

-

The American Land Title Industry has invested significant time and in energy into creating a document entitled Title Insurance and Settlement Company Best Practices. Through these new guidelines it has addressed licensing, escrow accounts, privacy and security, settlement procedures, insurance coverage issues, and a new consumer complaint process.

-

The Signing Professionals Workgroup representing notaries has also established a new set of standards that address significant issues raised by the Bureau.

-

The Appraisal Institute has adopted a new uniform standard of Professional Appraisal Practice that addresses requirements for the development and reporting of a real estate appraisal.

-

The Escrow Institute of California has adopted EIC Model Policies and Procedures that address similar matters within the scope of its member's real estate transaction related responsibilities.

-

The Mortgage Bankers Association has adopted new standards in the form of a uniform closing dataset requirement intended to work in tandem with the CFPB's Closing Disclosure program.

Prudent brokers ought to consider the following actions:

-

Learn about the new integrated disclosures. Even if the broker believes that neither the brokerage or its agents have liability, the fact remains that, effective August 15th, their clients are going to be subjected to a closing experience that neither the broker nor the agent can explain. Many consumers are going to find that such convenient ignorance may not be consistent with the consumer value proposition they are expecting.

-

Within the new concept, there is a requirement that the consumer must receive full disclosure documents a number of days before the scheduled closing. If, during this period, there is a substantial change in the number (and when isn't there), the closing must be cancelled and rescheduled. One might think this provision may require some brokerage or agent involvement.

-

Brokers should discuss the upcoming events with the mortgage, title and escrow companies with which they commonly work. How do these players anticipate collaborating with the real estate services side (perhaps they don't)?

Get prepared for what the Bureau refers to as a "flight to quality" through standards. Your success with a Bureau audit might depend on how well you can demonstrate efforts made to install standards and best practices within your firm.

It is nonsensical on its face for brokers to assume that August 15th will not be a seminal event with respect to their operations and consumer relationships. Get prepared--there will be no invitation!

To view the original article, visit the RECON Intelligence Services blog.