You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListLet's Invest: A Look at Real Estate Stock

July 31 2014

There is a small percentage of Americans who pay their bills, fully fund their 401K, fully fund their child's education fund, and still have a bit left over. That extra money needs to go into non-sheltered savings accounts. Where do you invest?

Perhaps the safest place for the money would be in a government savings bond. I checked today, and depending on the term of the bond, you might get about 1% interest on your money. If I invest $10,000 at 1%, after 10 years I will have a whopping $11,051.25.

Because interest rates are so low, it may make more sense to invest in the stock market. The Dow Jones yield in 2013 was 26.5%. Moreover, if invested in an index like the Dow Jones Industrial average, there was a 2.07% dividend. In other words, investing in the stock market in 2013 would blow away the earnings in a savings bond. Even the dividend alone is double!

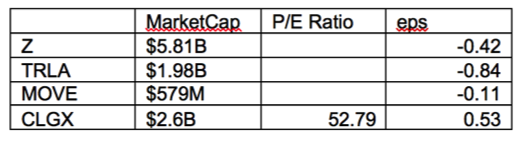

Suffice it to say, smart money is in the stock market. I use the term "smart money" loosely. There are 30 companies in the Dow Jones. 3M does $30B in sales and earns $6.7B. Microsoft does $77B in sales and earns $8.4B. But the truth is, I really don't know those companies. I know real estate technology companies – Z, TRLA, CLGX, MOVE. Here is how they stack up.

So, if I am still trying to be that smart money investor and I look at these four stocks, using the Dow as my guidepost – I but CLGX – CoreLogic – They are the only company with earnings. The company losing the most is TRLA. The company losing the least is MOVE.

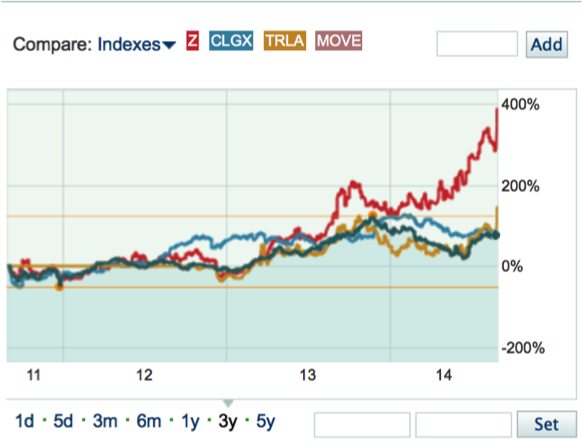

Boy, what a mistake. Take a look at the three-year performance of Zillow! They are the red line in my chart.

In truth, I do not understand the fundamentals of why that company is having such a surge. Sales in 2013 for Z were $197M ($2M in bad debt). They have $300M in cash. They lose $12.5 M a year, so they are not very likely to run out of money anytime soon. About 4 million homes sell per year, so they collect about $50 in revenue across every home sale.

TRLA sells $143M per year. They lost about $6.2M. They have $225M in cash. They collect about $35 for each home sold per year.

MOVE sells $227M each year – slightly ahead of the others. They basically break even. They have $118M in cash. They collect about $56 per home sale. What is interesting to note is that MOVE's revenue continues to climb. One would think that the growth of revenue and competition from Z and TRLA would be taking revenue away from MOVE. That is not really happening.

CLGX has sales of $1.3B. It is down a little. But profits are good, hovering at about $500M per year. They carry $155M in cash.

So the truth is, I am a confused investor. The company that is the best stock performance is Z. The company with the best income is CLGX. None of this makes any sense to me.