You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListCan Blockchain Restore Trust in Real Estate Transactions?

January 07 2018

Why are we even talking about trust in real estate transactions?

In a poll of 1,147 adults, 67.5 percent of Americans reported that they do not trust real estate agents. This poll, sponsored by Choice Home Warranty, and released by Google Consumer Surveys in October 2013, rated real estate agents just slightly higher than journalists, who were not trusted by 74 percent of respondents. Based on a Gallup poll in 2012, real estate agents are trusted roughly as well as bankers and chiropractors.

An August 1, 2016 post on Houwzer.com reported that the level of mistrust was nearly 73 percent for those between 18-24 years old.

Houwzer, of course, has a personal stake in this discussion. Their agents are on salary, which they find supports trust more than commissions. But that does not negate the data.

There can be a wide variance between perception and reality, as we see in today's news, just as there can be between a few well reported failures and the real estate practitioners at the other end of the spectrum who get less air time.

It may also be useful to think about how real estate agents are represented in mass media, whether as dysfunctional families on sitcoms or contestants on The Bachelor. While the fictional characters have never actually closed a side, and contestants on The Bachelor may not be top producing agents, they do help form our culture's perception, for good or ill.

Then there are programs that sell a title, such as Premier Agent. Internet savvy consumers are aware that such designations come with a cost, but are not always earned.

And what about the Code of Ethics? The industry can say that only REALTORS® have The Code. And they can say that all REALTORS® adhere to the code. The difficulty with that stance, regardless of how true it is, is that only a few well publicized 'fails' besmirch everyone else who make the claim.

We have often written here about how today's consumer demands transparency. This is not part of the standard package within real estate in past decades. Shell games that worked in the past are more easily exposed these days. Bravado will not sway as many as it once would.

What will happen when your potential customers will be able to see how many sides you closed last year, and how your customers rated your performance? We have written about this also. For the most part, the industry did not want to pursue these offerings, so those outside the industry took the lead.

What is a blockchain?

Blockchain is a network of verifiable relationships. In Blockchain Revolution (2016), Don and Alex Tapscott wrote, "The Blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value."

Blockchains reduce the lifecycle of transactions by confirming data and pre-establishing trust relationships based on data and experience, far more than on perception and marketing. Blockchain is about accountability, about far fewer secrets swept under the rug, about far fewer human errors and last minute surprises.

Some may think that blockchain is about cryptocurrency. While cryptocurrency is a type of blockchain, the terms are not synonymous.

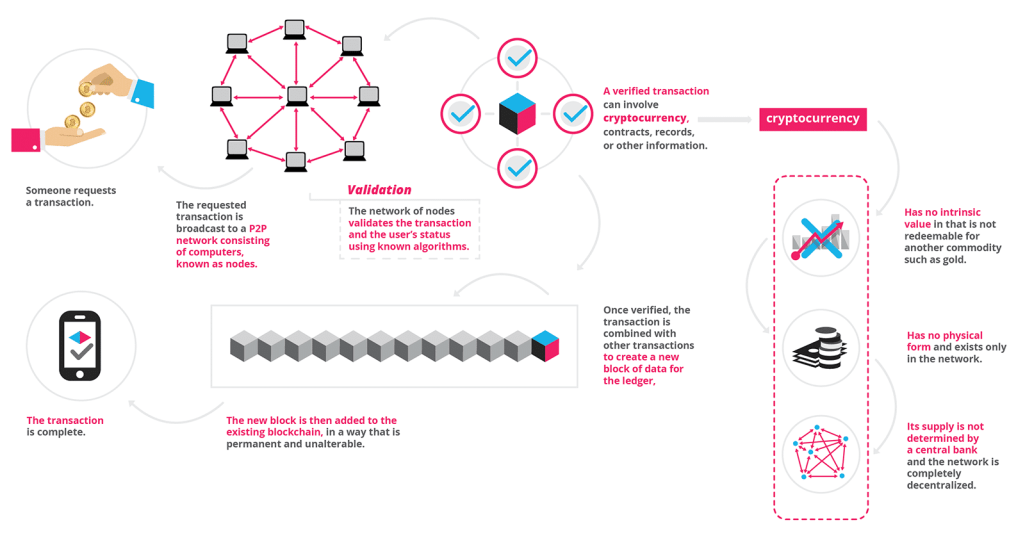

The chart below shows some of the blocks in the chain that make blockchains so potentially valuable.

Blockchain is NOT about one massive data center. Fundamentally it assumes a decentralized, verifiable and cooperative infrastructure. Data ownership will be a building block of blockchains. However, hiding information will be counter to the concept of Distributed Ledgers.

Rather than undertaking an explanation relative to the specifics of blockchain theory, I recommend reading the eBook provided by IBM here.

How will Blockchain change the current 'normal' for real estate transactions?

All stages of the real estate transaction are likely to be affected by blockchain in the near future, from finding a real estate agent, to preparing a property marketing package, to searching for potential properties to buy, to the closing process, to post-closing evaluations of all parties involved.

Most blockchain experts agree that one of the most powerful and negative forces impacting the real estate market today is the vulnerability and lack of trust being experienced by the consumer. The risks are everywhere. They dominate how the transaction is executed and how the consumer is treated.

It is not that these same risks haven't been present for many years – the fact is that they have. The issue is that, while the contemporary consumer has become sophisticated enough to know that that these risks are present, there has not been a corresponding improvement in their ability to mitigate them, exacerbating distrust.

By way of example, a number of the leading iBuying entities are demanding that if any of a property's depreciating mechanical elements (appliances, heating, air conditioning, etc.) are over a certain age the seller must pay for their replacement. Institutional buyers are setting the terms of the risk they are willing to accept. Can consumers be far behind?

Why isn't this same informational accommodation being demanded by all buyers? The answer is that the institutional buyers have access to information regarding the "useful life" of the appliance whereas other buyers don't. Most buyers go into the transaction with a compelling informational deficiency that wildly expands their risk exposure.

One of the benefits of blockchain networks is that they can offer a source of totally dependable (trustworthy) information across the entire range of the real estate transaction. This dependability provides a level of transparency that contributes to trust and, ultimately, to the transaction being accountable. These are the attributes that today's consumer is seeking and this is what blockchain may be able to provide.

Another way to consider the potential impact of blockchain theory is to conduct a comprehensive risk analysis of any residential transaction. As part of this exercise, consider all the ways that risk mitigation figures into the real estate transaction—matters regarding title and encroachments or limitations of title, matters surrounding the current mortgage process, limitations regarding the past, current and future condition and use of the property.

The current real estate transaction process assumes that one or more of the parties or third parties connected with the transaction is going to be mistaken, lying or cheating. Efforts to mitigate this risk through the work of such intermediaries as lawyers, title companies, escrow officers, inspectors, credit agencies, and lenders have greatly increased both the costs and negative pressures on the transaction and its parties. The question moving forward is whether or not the positive effect of this process is greater than their negative impact.

Blockchain networks may also have the potential of improving the quality of the MLS experience for participants. Imagine all of the MLS related information that could be made available. Tour information, showings, lockbox information, web access, observations, price changes, offers, withdrawn offers, etc., etc.

It seems clear that blockchain networks and related technologies will offer significant solutions to the real estate industry challenges set forth above.

Will Bblockchain be good for organized real estate as an industry?

As with many revolutions, there will be winners and losers. You are probably making decisions even today that will propel you one way or the other.

Likely Winners

- Real estate sellers

- Real estate buyers

- Mortgage lenders (as an industry) – better data

- Data aggregators

- Some real estate agents and brokers – those who are able to embrace the technology AND maintain high evaluations

Likely Losers

- Super-small MLSs

- Title companies – reduced role

- Marketing companies – less smoke and mirrors

- Some real estate agents and brokers – those who plan to keep doing things the way they have always done things

- Lawyers – reduced need for services

- Those whose reputation is built on a "trust me" platform

Where are you headed in this coming blockchain revolution? Are you choosing to work towards being a winner, or a loser? One thing is pretty well assured – a blockchain type of future is something you can depend on.

To view the original article, visit the RECON Intelligence Services blog.