You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListBetter to Buy Bank Owned or Short Sale?

March 13 2013

Short sales are on the rise as a better alternative to foreclosure in many areas — good news for buyers and investors in markets where short sales are closing more quickly at solid discounts. But buying from the bank may still be a better option in other markets because of increasing REO inventory, deeper discounts and shorter times to close.

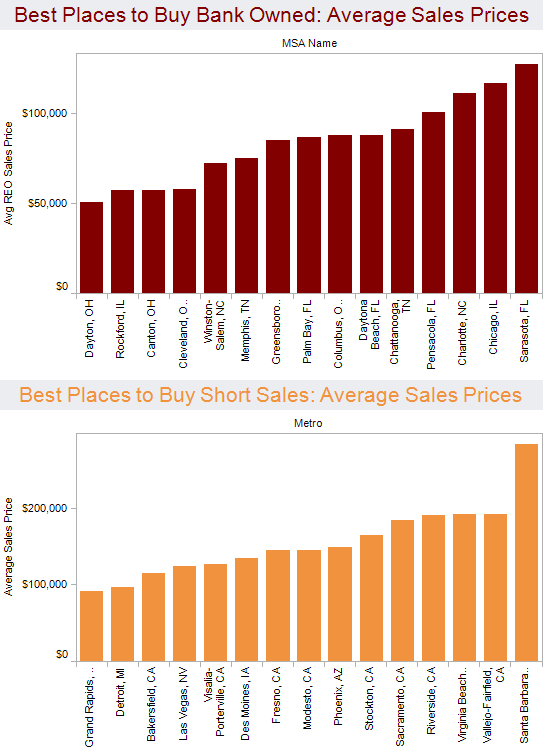

Analyzing data from the RealtyTrac Foreclosure & Short Sales Report from the fourth quarter of 2012 in more than 900 metro areas nationwide, we've come up with the top 15 markets for buying bank-owned homes in 2013 and the top 15 markets for buying short sales in 2013.

Better to Buy Short Sale

Short sales — both of properties in the foreclosure process as well as those not in the foreclosure process — surged in the fourth quarter compared to a year ago in the top 15 markets for buying short sales, ranging from a 37 percent annual increase in Detroit to a 107 percent annual increase in Santa Barbara, Calif.

Only markets with at least 200 short sales in the fourth quarter of 2012 were included in the list. Average sales prices on short sales in the top 15 markets ranged from $91,145 in the Grand Rapids, Mich., metro to $283,825 in the Santa Barbara, Calif., metro.

The average amount short — difference between the sales price and the loan amount owed to the bank — ranged from $53,158 in Grand Rapids to $178,201 in Santa Barbara. The average amount short was more than $100,000 in seven of the top 15 markets, indicating banks are willing to realize a significant loss with a short sale in exchange for avoiding the increasingly complex and costly foreclosure process.

Better to Buy Bank Owned

The top 15 markets for buying bank-owned homes all saw sharp increases in bank-owned sales in the fourth quarter — ranging from an annual increase of 141 percent in Cleveland, Ohio, to a 19 percent increase in Sarasota, Fla.

The top 15 list was limited to markets with at least 200 bank-owned sales in the fourth quarter where bank-owned sales accounted for at least 10 percent of all residential sales. In addition, the average sales price of a bank-owned home was at least 30 percent below the average sales price of a non-distressed home in all 15 metro areas selected.

In all 15 markets, the average number of days from bank repossession to sale was below the national average of 178 days in the fourth quarter.

To view the original post, visit RealtyTrac.