You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListGender gap widens: Growth trend reverses for young single women homeowners

March 29 2023

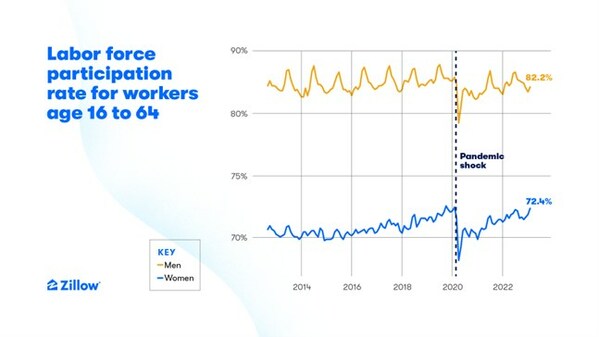

Women have returned to the workforce in near pre-pandemic numbers, but homeownership remains elusive for those who are single

SEATTLE, March 24, 2023 -- Single men have long been more likely than single women to own a home, but that gap narrowed sharply in recent years, nearly closing in 2021. However, a new Zillow® analysis shows that it widened again last year, shining light on the homebuying challenges single women face, including lower salaries and a more volatile workforce experience.

In 2016, 19.4% of young single women owned a home, compared with 29.6% of young single men — a gap of 10.1 percentage points. The gap shrunk throughout the next five years as more and more women entered the workforce — leading to record-high numbers in 2020 — and women's incomes began to rise. By 2021, that gap was a mere 1.8 percentage points.

But that progress was wiped out in 2022. The first year of the pandemic saw an outsize share of women leave their jobs to take on caregiving responsibilities, as child-care and eldercare options were in flux. Women also continue to earn significantly less than men on average, receiving approximately 82 cents to every dollar earned by men. As a result, young single women have fewer options when it comes to affordable home listings than young single men.

"Single women had made great strides in narrowing the homeownership gap, but the pandemic reminded us that progress is not always linear," said Skylar Olsen, chief economist at Zillow. "Despite women showing remarkable resilience in returning to the workforce, single women's homeownership rate took a heavy hit in 2022. With rising and volatile mortgage rates furthering affordability challenges, the road to affordable homeownership remains an uphill battle, and it may take creative solutions or even doubling up in a home to achieve that dream."

After growing to 28.6% by 2021, the homeownership rate for single women dropped to 24.5% last year, wiping out almost half the gains made since 2016, when single women's homeownership was at an all-time low of 19.4%. At the same time, the homeownership rate for single men increased 2.7 percentage points in 2022 to 33.1%.

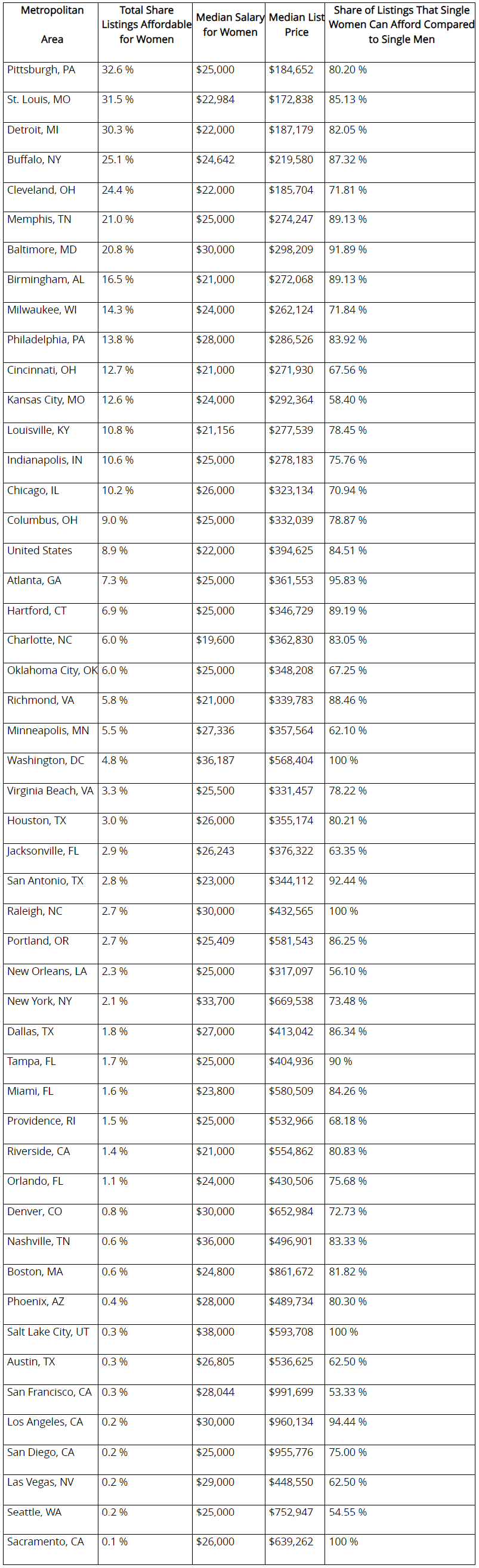

Single women looking to buy a home in Pittsburgh, St. Louis or Detroit — which are among the nation's 50 largest metro areas — will find the highest share of affordable listings. Single women in Atlanta, Baltimore, Washington, D.C., and Raleigh are most able to compete with single men in the for-sale market; single women in those metros, on average, can afford at least 2% of all active listings and at least 90% of the listings single men can afford. On the other hand, Cincinnati, Kansas City, Oklahoma City, Minneapolis, Jacksonville and New Orleans see the largest gender-based disparity in housing affordability, with single women able to afford fewer than 70% of the homes that single men can afford.

Sources and Methodology

Labor force participation rates for working age adults (ages 16–64 years) are produced by the Bureau of Labor Statistics and pulled from the FRED API. Annual homeownership rates of households headed by 25- to 35-year-olds (annually from 1980 to 2022) and broken out by employment, marital status and living arrangement were estimated by Zillow Economic Research using individual records from the Current Population Survey provided by IPUMS CPS, at the University of Minnesota, www.ipums.org. Information regarding gender pay equity was obtained from the Pew Research Center, www.pewresearch.org.

The number and share of active listings on Zillow that are affordable for single women and single men (limited here to employed singles between ages 18 and 44) were estimated using all listings ever active on Zillow during February 2023 and median individual incomes by gender, estimated by Zillow Research using individual responses to the American Community Survey, also provided by IPUMS at the University of Minnesota. A home is considered "affordable," in this case, if the estimated mortgage payment on the listing takes up no more than 30% of income. We set the mortgage rate for this analysis at the average weekly mortgage rate, reported by Freddie Mac, for February.

About Zillow Group

Zillow Group, Inc. (NASDAQ: Z and ZG) is reimagining real estate to make it easier to unlock life's next chapter. As the most visited real estate website in the United States, Zillow® and its affiliates offer customers an on-demand experience for selling, buying, renting, or financing with transparency and ease.

Zillow Group's affiliates and brands include Zillow®; Premier Agent®; Zillow Home Loans℠; Zillow Closing Services℠; Trulia®; Out East®; StreetEasy®; HotPads®; and ShowingTime+℠, which includes ShowingTime®, Bridge Interactive®, and dotloop® and Listing Media Services. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org).