You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListHomebuyers With Access to Flood-Risk Data Bid on Lower-Risk Homes

September 12 2022

Redfin users who viewed homes with severe and/or extreme flood risk prior to a Redfin experiment proceeded to bid on homes with 54% less risk after gaining access to flood-risk data

SEATTLE -- Homebuyers who have access to flood-risk information when browsing home listings online are more likely to view and make offers on homes with lower flood risk than those who don't have access, according to a new report from Redfin, the technology-powered real estate brokerage.

That's according to a three-month randomized controlled trial involving 17.5 million Redfin.com users, half of which had access to property-level flood-risk scores (treatment group) and half of which did not (control group).

Redfin users who viewed homes with an average flood-risk score of 8.5 (severe/extreme risk) prior to the study went on to bid on homes with an average score of 3.9 (moderate risk) after gaining access to flood-risk data—a decrease of 54%. By comparison, users who viewed homes with an average score of 8.5 before the study but did not get access to risk data went on to bid on homes with an average score of 8.5.

Redfin only saw this impact on users who had been viewing homes with severe/extreme risk prior to the study, suggesting that flood danger is currently unlikely to change homebuyer decisionmaking unless it's substantial. When users who viewed homes with lower risk (minimal, minor, moderate and/or major) prior to the study gained access to flood-risk scores, there was no statistically significant change in the risk level of homes they proceeded to bid on.

"We now have definitive evidence that the risks posed by climate change are affecting where Americans choose to live. Before Redfin's experiment, that was just a hypothesis," said Redfin Chief Economist Daryl Fairweather. "Equipping people with flood-risk information helps them make more informed decisions. Some will opt to move out of risky areas altogether, while others will stay put but invest in making their homes more resilient to disaster."

Fairweather continued: "As more house hunters become aware of climate risk, homes in endangered areas will likely receive fewer offers, causing home values to fall. At the same time, we may see prices in lower-risk, inland areas rise as more Americans move there to avoid flooding."

Flood-Risk Data Also Impacted Which Homes Buyers Viewed Online

Giving house hunters access to flood-risk data also impacted their online search behavior. Redfin users who were viewing homes with an average risk score of 9.5 (extreme) prior to the study went on to view homes with an average risk score of 8.5 after gaining access to flood-risk data—a decrease of about 10%. There was no meaningful change in the average risk score of homes viewed by users in the control group who had been viewing extremely risky homes prior to the experiment.

The impact increased over time for users who had access to flood-risk data. On average, users who viewed homes with extreme risk before the study were viewing homes with 25% less risk than the control group after nine or more weeks in the experiment, compared with just 7% less risk during week one.

"Climate-risk data may start to have an even bigger impact on homebuyer decisions now that the housing market is slowing and tilting more in buyers' favor," said Sebastian Sandoval-Olascoaga, the MIT researcher who co-conducted the experiment. "Today's buyers have more leeway to seek out the home features they really want. For some buyers that might mean considering only turnkey homes, and for others it might mean limiting their search to homes with minimal flood risk."

Redfin Users in Cape Coral, FL and Houston Were Most Likely to Click on Flood-Risk Data

Redfin also measured how frequently Redfin users in the experiment took the additional step of clicking into a home listing page's "Flood Risk" section, where more information can be found on future risk, FEMA flood zones and disaster insurance. Nationwide, users in the treatment group clicked into the flood-risk section 2.8% of the time. Many users likely didn't feel the need to expand the flood-risk section because they found the preview of the flood-risk data sufficient—one reason the clickthrough rate appears low.

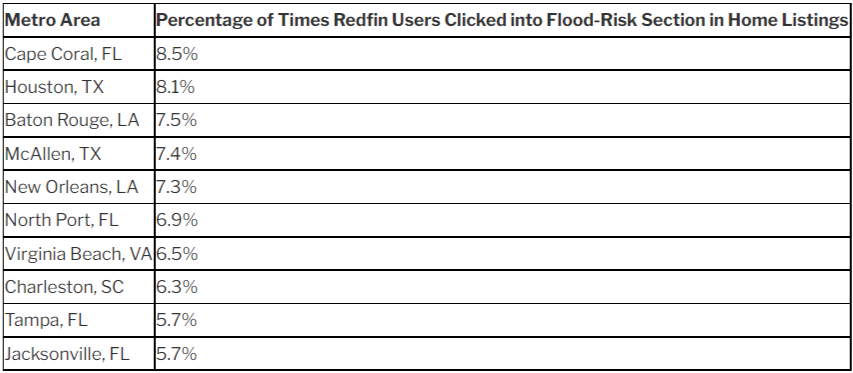

In Cape Coral, FL, users in the treatment group clicked into the flood-risk section 8.5% of the time, the highest rate among the 100 most populous U.S. metropolitan areas. Next came Houston (8.1%), Baton Rouge, LA (7.5%), McAllen, TX (7.4%) and New Orleans (7.3%). Three other Florida metros—North Port, Tampa and Jacksonville—were also in the top 10.

All of these areas face flood risk, and some have attracted an influx of homebuyers during the pandemic. Tampa, Cape Coral and North Port all consistently rank on Redfin's list of most popular migration destinations—an analysis based on net inflow, or how many more Redfin.com users are looking to move into an area than leave.

Top 10 Metros Where Redfin Users Were Most Likely to Click on Flood-Risk Data

Alexis Malin, a Redfin buyer's agent in the Jacksonville, FL area, recently worked with a buyer who opted out of purchasing a home due to its high flood-risk rating.

"I had a buyer from the Northeast who toured a beachfront home in the Jacksonville area and was close to making an offer, but changed his mind after seeing that the flood-risk rating on Redfin was almost a 10 out of 10," Malin said. "He loved the house and the location, but decided the purchase was just too big of a financial risk. He ended up staying in the Northeast and buying a home there instead."

People Have Access to Climate-Risk Data—What Now?

Individuals should be aware that if they own or buy a home with high natural-disaster risk, it may require costly disaster insurance and could ultimately drop in value. It's possible this will disproportionately impact disadvantaged communities, which are often more exposed to flooding. Formerly redlined areas have a larger share of homes with high flood risk than areas that weren't redlined, a 2021 Redfin analysis found. While redlining has been outlawed for years, formerly redlined areas are still more likely to house people of color than non-redlined areas.

"Home prices haven't yet started to broadly plummet due to natural-disaster risk. That means communities that face the highest risk still have time to act," Fairweather said. "If a homeowner thinks their property will lose value due to flood risk, they may want to relocate now to keep both themself and their finances safe. Unfortunately, that may mean passing on the risk to someone else. Governments can help prevent that by purchasing and demolishing at-risk homes, or subsidizing climate-resilient improvements. Upgrades like landscaping, flood walls and flood openings to direct water away from homes can help an at-risk property retain value."

Fairweather continued: "Local and federal leaders should also be using climate-risk data to inform their policy decisions. Lawmakers in lower-risk cities should consider changing zoning laws to allow for denser housing, which would provide more options for people who face flood risk but don't have a place to go."

Redfin conducted this experiment from Oct. 12, 2020 to Jan. 3, 2021 in partnership with researchers from University of Southern California, the National Bureau of Economic Research and Massachusetts Institute of Technology. Flood-risk scores came from First Street Foundation's Flood Factor. Redfin now publishes climate-risk data (including fire, heat, drought, storm and flood) for nearly every U.S. home, with the exception of rentals.

To view the full report, including charts, graphics and methodology, please click here.

About Redfin

Redfin is a technology-powered real estate company. We help people find a place to live with brokerage, instant home-buying (iBuying), rentals, lending, title insurance, and renovations services. We sell homes for more money and charge half the fee. We also run the country's #1 real-estate brokerage site. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can take an instant cash offer from Redfin or have our renovations crew fix up their home to sell for top dollar. Our rentals business empowers millions nationwide to find apartments and houses for rent. Since launching in 2006, we've saved customers more than $1 billion in commissions. We serve more than 100 markets across the U.S. and Canada and employ over 6,000 people.