You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListHomes.com Traffic Trends Point to Emerging Recovery

June 04 2020

A mere five months after the world was introduced to COVID-19, the impact has already left a permanent mark on each of us. Historical viewpoints describing this unusual period will be formed based on the stories currently being recorded and archived for future generations.

A mere five months after the world was introduced to COVID-19, the impact has already left a permanent mark on each of us. Historical viewpoints describing this unusual period will be formed based on the stories currently being recorded and archived for future generations.

While the historical impact will be measured over years, the economic impact is being felt in real time. Unprecedented business shutdowns and historic job losses have interrupted economic activity across nearly every industry. Some will recover more quickly than others. Fortunately we are already seeing signs of housing demand being unleashed and an early recovery emerging.

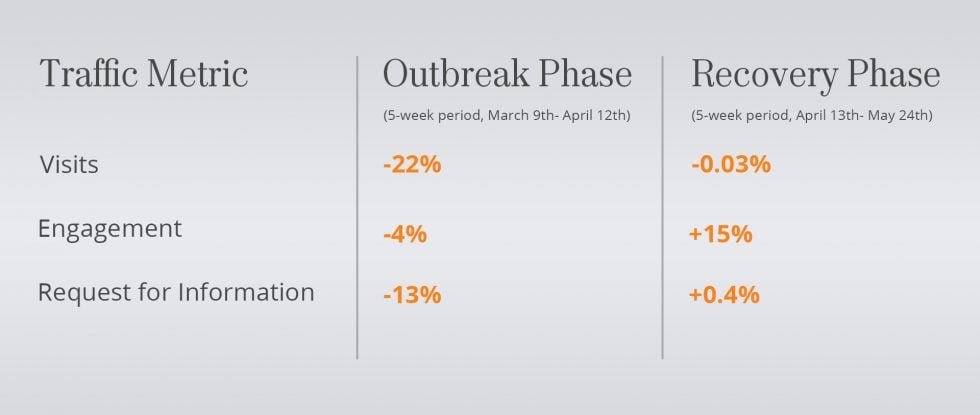

The three traffic metrics we monitor most closely at Homes.com are site visits, engagement, and requests for information. The first variable, site visits, is the equivalent of customers walking through our door, while engagement measures their activity on the site, including page views. Strong metrics in these first two categories typically result in increased requests for information, driving business to our broker and agent advertising partners.

During the peak of stay-at-home orders, weekly visits to Homes.com declined by as much as 35%, measured against the weeks leading up to the outbreak. This is a significant decline, especially during the time of year when housing demand typically picks up for the spring and summer. Thankfully, the bounce back seems to have occurred as quickly as the decline.

Accurately measuring pent up demand is an inexact science, but it appears to be accelerating an emerging recovery. The following analysis shows the decline and recovery of Homes.com traffic measured against the "Pre-Pandemic Phase" from February 3rd through March 8th, the 5-week period leading up to widespread stay-at-home orders.

Interestingly, while the number of customers walking through our doors at Homes.com declined by nearly a quarter during the Outbreak Phase, site engagement remained fairly high, dropping by only 4%, as requests for information, a measure of intent to buy in the near term, fell by 13%.

This early trend of steady site engagement proved to be a strong indicator of pent up demand. As traffic returned during the Recovery Phase, and is now flat with the Pre-Pandemic level, engagement has soared by 15%, and intent to buy in the near term is back to slightly above Pre-Pandemic levels. Also encouraging, first time mortgage applications are up 9% year over year, after being down 35% just six weeks ago.

During conventional economic cycles, pent up demand builds during a recession alongside high savings rates. Once confidence returns and a recovery starts, pent up demand is released and consumers spend more. While this is certainly not a conventional cycle, these Homes.com metrics are a strong indication that pent up demand is driving a recovery of housing activity: a positive sign we are heading towards a promising summer season for the real estate industry.

To view the original post, visit the Homes.com blog.