You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListCoreLogic Reports December Home Prices Increased by 4% Year Over Year

February 07 2020

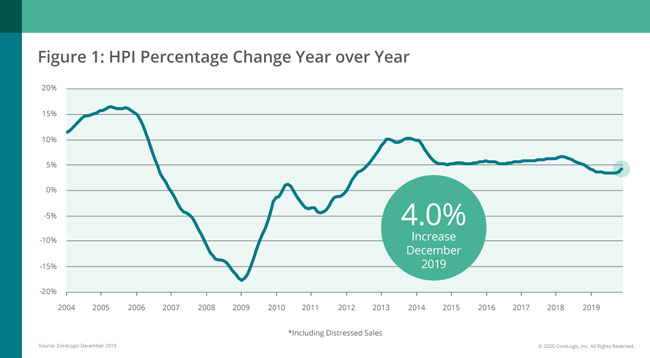

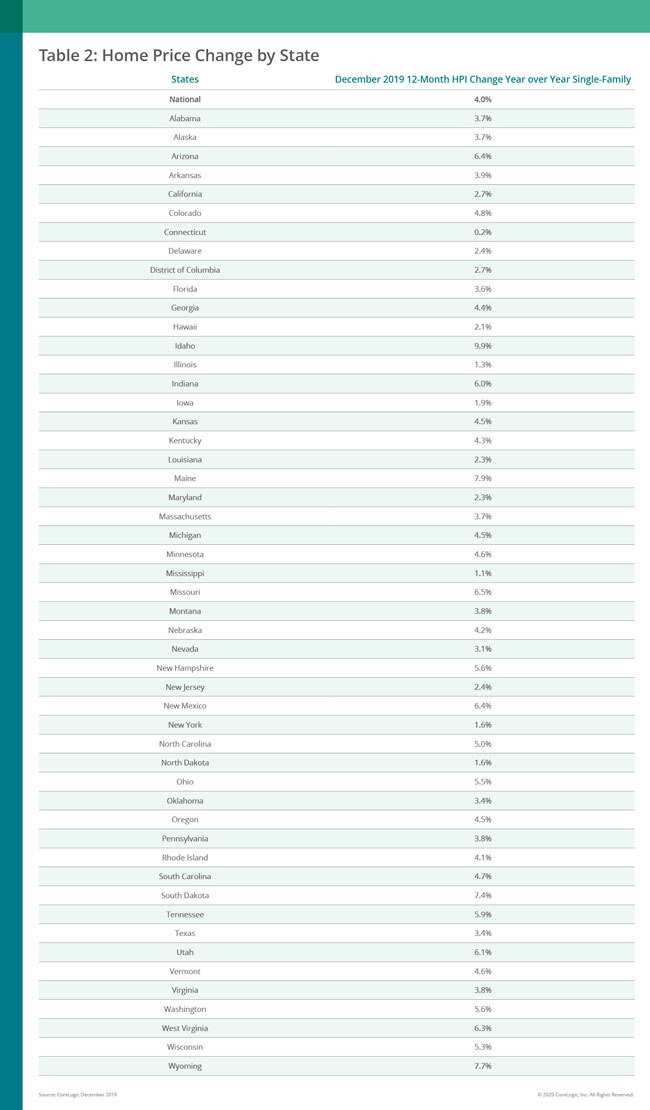

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI) and HPI Forecast for December 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 4% from December 2018. On a month-over-month basis, prices increased by 0.3% in December 2019. (November 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Home prices continue to increase on an annual basis with the CoreLogic HPI Forecast indicating annual price growth will be 5.2% from December 2019 to December 2020. On a month-over-month basis, the forecast calls for U.S. home prices to increase by 0.1% from December 2019 to January 2020, which would mark a new peak in prices since the last recorded peak in April 2006. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

"Moderately priced homes are in high demand and short supply, pushing up values and eroding affordability for first-time buyers," said Dr. Frank Nothaft, chief economist at CoreLogic. "Homes that sold for 25% or more below the local median price experienced a 5.9% price gain in 2019, compared with a 3.7% gain for homes that sold for 25% or more above the median."

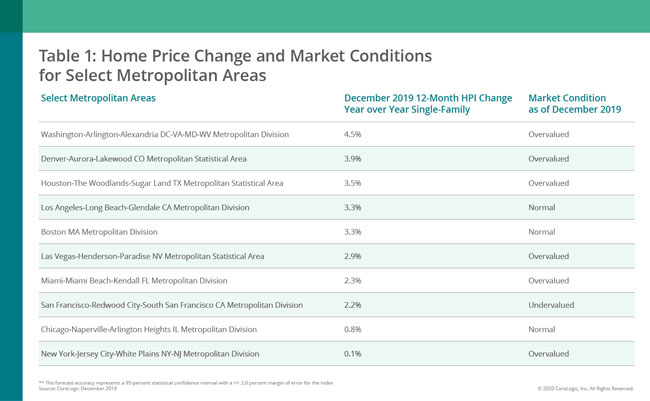

According to the CoreLogic Market Condition Indicators (MCI), an analysis of housing values in the country's 100 largest metropolitan areas based on housing stock, 34% of metropolitan areas have an overvalued housing market as of December 2019. The MCI analysis categorizes home prices in individual markets as undervalued, at value or overvalued, by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals such as disposable income. As of December 2019, 26% of the top 100 metropolitan areas were undervalued, and 40% were at value.

When looking at only the top 50 markets based on housing stock, 40% were overvalued, 20% were undervalued and 40% were at value in December 2019. The MCI analysis defines an overvalued housing market as one in which home prices are at least 10% above the long-term, sustainable level. An undervalued housing market is one in which home prices are at least 10% below the sustainable level.

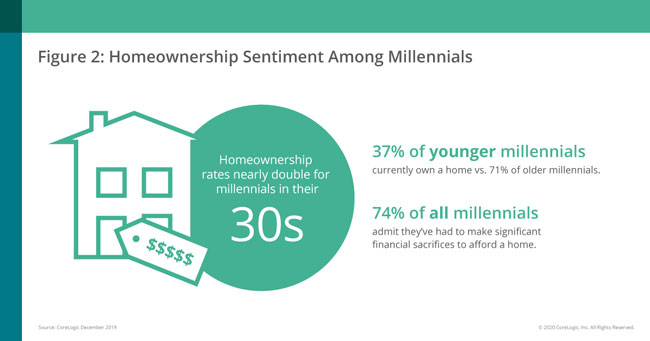

During the second quarter of 2019, CoreLogic, together with RTi Research of Norwalk, Connecticut, conducted an extensive survey measuring consumer-housing sentiment among millennials. The study revealed a significant contrast between younger millennials (ages 21-29) and older millennials (ages 30-38) regarding lifestyle preferences and aspirations for homeownership. Though 79% of younger millennial renters express a desire to purchase a home in the future, very few have previously owned a home, and many do not currently feel the need to own a home. However, due to homeownership rates nearly doubling for millennials once they reach their 30s, many enter a transitional period around 29-30 years old and reconsider their priorities.

"On a national level, home prices are on an upswing," said Frank Martell, president and CEO of CoreLogic. "Price growth is likely to accelerate in 2020. And while demand for homeownership has continued to increase for millennials, particularly those in their 30s, 74% admit they have had to make significant financial sacrifices to afford a home. This could become an even bigger factor as home prices reach new heights during 2020."

About the CoreLogic Consumer Housing Sentiment Study

In the second quarter of 2019, 877 renters and homeowners were surveyed by CoreLogic together with RTi Research. This study is a quarterly pulse of U.S. housing market dynamics. Each quarter, the research focuses on a different issue related to current housing topics. This first quarterly study concentrated on consumer sentiment within high-priced markets. The survey has a sampling error of +/- 3.1% at the total respondent level with a 95% confidence level.

About RTi Research

RTi Research is an innovative, global market research and brand strategy consultancy headquartered in Norwalk, CT. Founded in 1979, RTi has been consistently recognized by the American Marketing Association as one of the top 50 U.S. insights companies. The company serves a broad base of leading firms in Financial Services, Consumer Goods, and Pharmaceuticals as well as partnering with leading academic centers of excellence.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.