You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListCoreLogic Reports U.S. Overall Delinquency Rate Lowest for a September in at Least 20 Years

December 30 2020

For the 11th consecutive month, the U.S. foreclosure rate was the lowest in at least 20 years

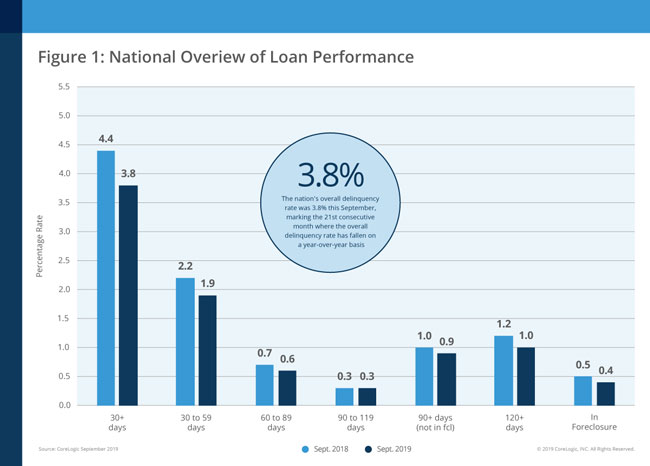

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report. The report shows that nationally, 3.8% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in September 2019, representing a 0.6 percentage point decline in the overall delinquency rate compared with September 2018, when it was 4.4%.

As of September 2019, the foreclosure inventory rate – which measures the share of mortgages in some stage of the foreclosure process – was 0.4%, down 0.1 percentage points from September 2018. The September 2019 foreclosure inventory rate tied the prior 10 months as the lowest for any month since at least January 1999.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To monitor mortgage performance comprehensively, CoreLogic examines all stages of delinquency, as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.9% in September 2019, down from 2.2% in September 2018. The share of mortgages 60 to 89 days past due in September 2019 was 0.6%, down from 0.7% in September 2018. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.3% in September 2019, down from 1.5% in September 2018. The serious delinquency rate has remained consistent since April 2019.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 0.8% in September 2019, marking a 0.4% decline compared to September 2018 when the transition rate stood at 1.2%. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2%, while it peaked at 2% in November 2008.

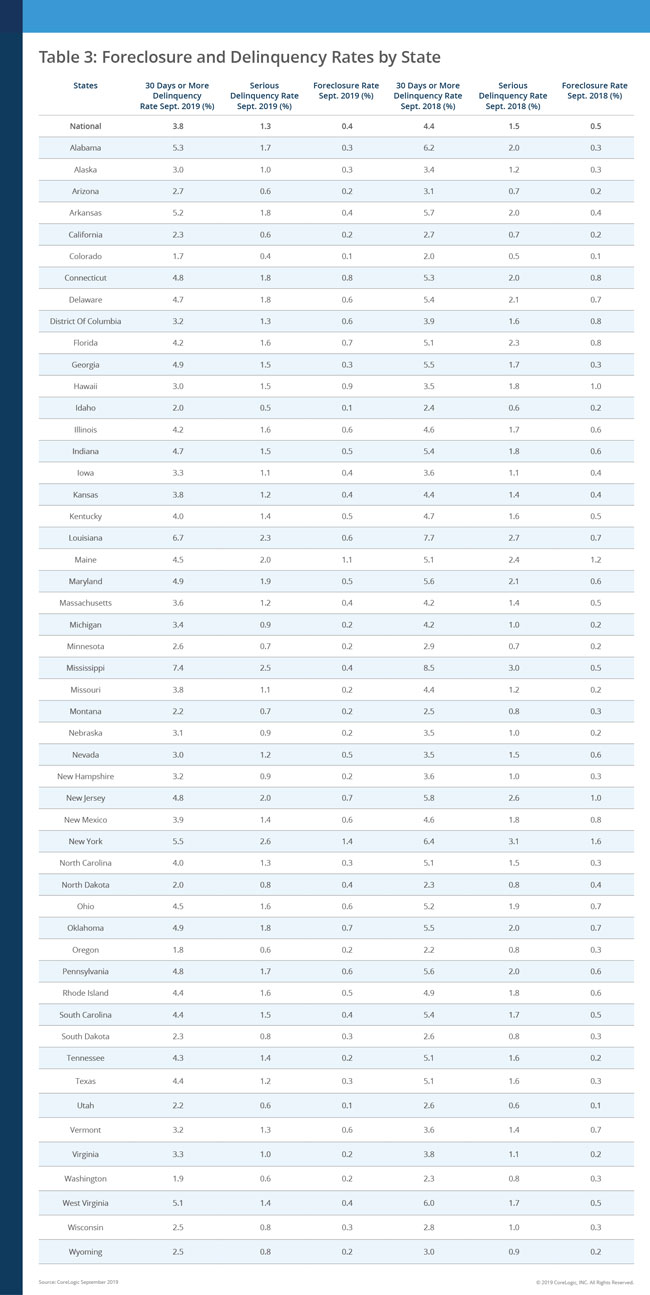

"The decline in delinquency rates in North and South Carolina compared with a year ago reflect the recovery from Hurricanes Florence and Michael, which hit in the autumn of 2018," said Dr. Frank Nothaft, chief economist at CoreLogic. "Shortly after a natural disaster, we tend to see a spike in delinquency rates. Depending on the extent of devastation, serious delinquency rates generally return to their pre-disaster levels within a year."

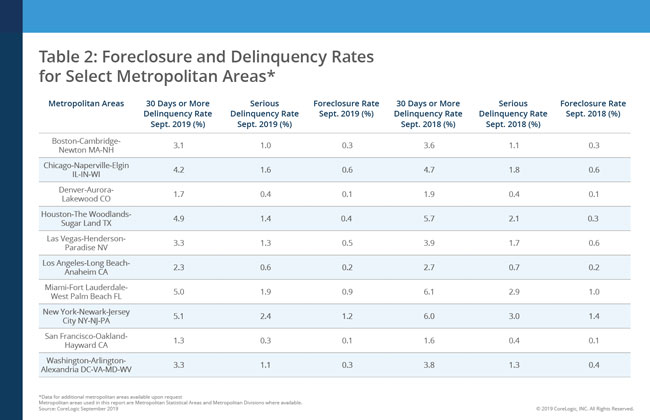

No states posted a year-over-year increase in the overall delinquency rate in September 2019. The states that logged the largest annual decreases included: Mississippi (-1.1 percentage points), North Carolina (-1.1 percentage points), Louisiana (-1.0 percentage points), New Jersey (-1.0 percentage points) and South Carolina (-1.0 percentage points).

In September 2019, four metropolitan areas in the Midwest and Southeast recorded small annual increases in overall delinquency rates. These metros include: Dubuque, Iowa (0.8 percentage points), Pine Bluff, Arkansas (0.6 percentage points), Dalton, Georgia (0.2 percentage points) and Eau Claire, Wisconsin (0.1 percentage points).

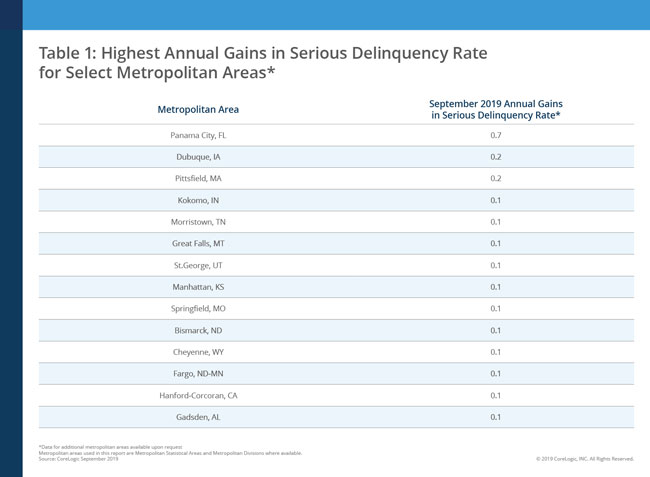

While the nation's serious delinquency rate remains at a 14-year low, 14 metropolitan areas recorded small annual increases in their serious delinquency rates. Metros with the largest increases were Panama City, Florida (0.7 percentage points), Dubuque, Iowa (0.2 percentage points) and Pittsfield, Massachusetts (0.2 percentage points). The remaining 11 metro areas each logged an annual increase of 0.1 percentage point.

"The strong labor market in the United States along with continued prudent underwriting practices for mortgage origination have combined to power favorable loan performance over the past few years," said Frank Martell, president and CEO of CoreLogic. "Unemployment reached a 50-year low in September 2019, which helped push annual delinquency rates downward for the 21st consecutive month and we expect this trend to continue as we enter into the new year."

The next CoreLogic Loan Performance Insights Report will be released on January 14, 2020, featuring data for October 2019.

For ongoing housing trends and data, visit the CoreLogic Insights Blog: www.corelogic.com/insights.

Methodology

The data in this report represents foreclosure and delinquency activity reported through September 2019.

The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not typically subject to foreclosure and are, therefore, excluded from the analysis. Approximately one-third of homes nationally are owned outright and do not have a mortgage. CoreLogic has approximately 85% coverage of U.S. foreclosure data.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.