You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListI Owe U: Student Debt Total Reaches $1.5 Trillion, Nearly Doubles U.S. Housing Market

October 15 2019

The average student loan borrower owes more than the typical down payment for a home; Millennial debt totals $498 billion

SANTA CLARA, Calif., Oct. 15, 2019 -- Realtor.com, The Home of Home Search, today released new data that found total student debt could buy every U.S. house on the market 1.9 times over. With the rising costs of education, students are borrowing more and more money, which has led to delayed homeownership as the average student loan borrower owes $34,500 -- $8,500 more than the typical down payment off $26,000.

"Student debt has ballooned to an all-time high as the price of education continues to outpace wage growth, and this is holding back many potential buyers from being able to purchase a home," according to realtor.com®'s Senior Economist, George Ratiu. "Student debt is already impacting borrowers' ability to buy a home and education debt is expected to hamper consumers' financial decisions for many years down the road."

Students are taking on more debt to cover their expenses than ever before, according to the Department of Education. This is in part due to the fact that wage growth has been stagnant in comparison to the rapid growth in cost of higher education. The typical tuition at a public university has grown at four times the rate of the average wage since 1986, and private university tuition has grown at seven times the rate of the average wage over the same time.

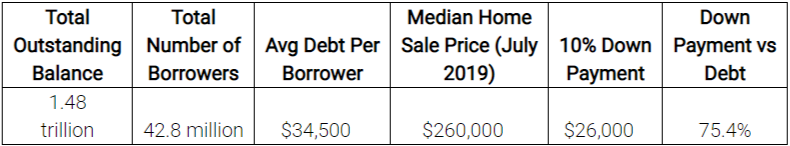

Nationally, the median sale price of a U.S. home is $260,000, according to realtor.com®. With a typical down payment of 10 percent that would come out to $26,000, which is $8,500 less than the average student debt of $34,500. Additionally, the total value of U.S. homes on the market is $780 billion. That is 1.9 times less than the total outstanding student debt of $1.5 trillion shouldered by 42.8 million borrowers.

At 15.1 million strong, millennials make up 34 percent of all student borrowers. The generation's total debt has accumulated to $498 billion -- over half the value of all U.S. homes for sale. Millennials have an average balance of $33,000 per borrower, which is $7,000 more than the typical down payment on the median U.S. home. In comparison, the median down payment for millennials is $11,400, according to realtor.com.

"The important implication of rising debt is that young generations are delaying major life decisions," added Ratiu. On the real estate front, the affordability crisis in major cities is driving young families to more affordable Midwestern and Southern markets, where savings for a down payment stretch much further and can turn owning a home from a future dream into today's reality."

According to a recent NAR report, 26 percent of millennials cite student loans as the primary barrier to saving up for a down payment. Additionally, 61 percent of those millennials say their student loans have delayed their home purchase.

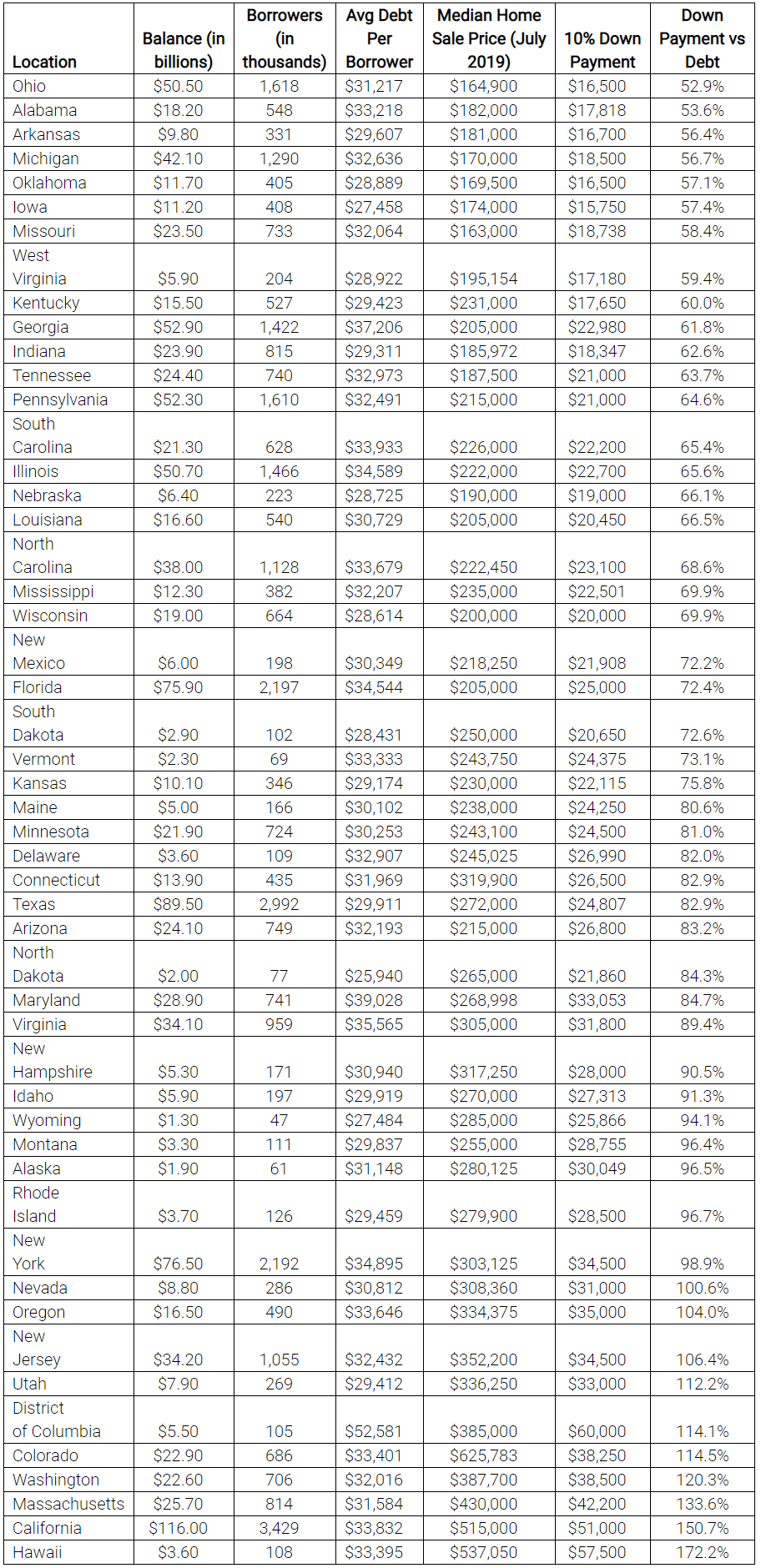

On a state level, the state with the greatest outstanding loan balance is California, with $116 billion in student debt. Meanwhile, Washington, D.C. has the largest average balance per borrower at $52,581.

Ohio has the most affordable down payment, compared with educational debt load, where the average down payment on a median priced home in Ohio is 53 percent of the average student loan balance. Ohio is followed by Alabama, Michigan, Arkansas, and Oklahoma. In the short term, a high down payment to student debt ratio will delay many buyers' ability to enter the market, while reducing access to available inventory.

National Breakdown - Down Payment vs. Debt

State Breakdown - Down Payment vs. Debt

Methodology

Federal student loan debt data taken from U.S. Department of Education, Q2 2019.

Home sale prices taken from realtor.com home sales database, July 2019.

Total market value derived from realtor.com residential listings database, September 2019.

Millennial median down payment is based on a realtor.com analysis of a sample of residential mortgage loan originations from Optimal Blue.

About realtor.com®

Realtor.com®, The Home of Home Search, offers the most MLS-listed for-sale listings among national real estate portals, and access to information, tools and professional expertise that help people move confidently through every step of their home journey. Through its Opcity platform, realtor.com® uses data science and machine learning to connect consumers with a real estate professional based on their specific buying and selling needs. Realtor.com® pioneered the world of digital real estate 20 years ago, and today is a trusted resource for home buyers, sellers and dreamers by making all things home simple, efficient and enjoyable. Realtor.com® is operated by News Corp [Nasdaq: NWS, NWSA] [ASX: NWS, NWSLV] subsidiary Move, Inc. under a perpetual license from the National Association of REALTORS®. For more information, visit realtor.com.