You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListCoreLogic Reports the Negative Equity Share Fell to 3.8% in the Second Quarter of 2019

September 24 2019

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released the Home Equity Report for the second quarter of 2019. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 4.8% year over year, representing a gain of nearly $428 billion since the second quarter of 2018.

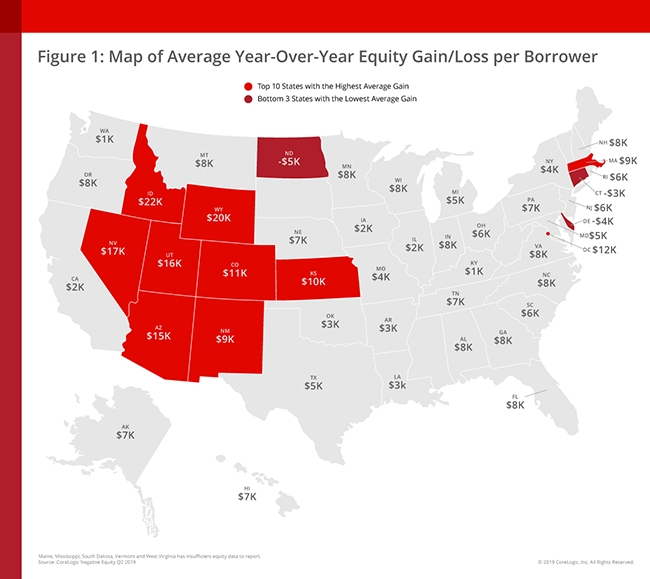

The average homeowner gained $4,900 in home equity between the second quarter of 2018 and the second quarter of 2019. States that saw the largest gains include Idaho, where homeowners gained an average of $22,100; Wyoming, where homeowners gained an average of $20,400; and Nevada, where homeowners gained an average of $16,800 (Figure 1).

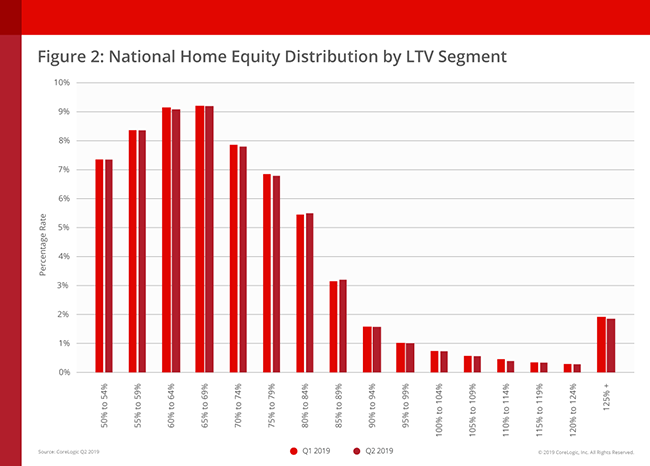

From the first quarter of 2019 to the second quarter of 2019, the total number of mortgaged homes in negative equity decreased by 7% to 2 million homes or 3.8% of all mortgaged properties. The number of mortgaged properties in negative equity during the second quarter of 2019 fell by 9%, or 151,000 homes, compared with the second quarter of 2018 when 2.2 million homes, or 4.3% of all mortgaged properties, were in negative equity.

"Borrower equity rose to an all-time high in the first half of 2019 and has more than doubled since the housing recovery started," said Dr. Frank Nothaft, chief economist for CoreLogic. "Combined with low mortgage rates, this rise in home equity supports spending on home improvements and may help improve balance sheets of households who could take out home equity loans to consolidate their debt."

Negative equity, often referred to as being underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in a home's value, an increase in mortgage debt or both. Negative equity peaked at 26% of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis, which began in the third quarter of 2009.

The national aggregate value of negative equity was approximately $302.7 billion at the end of the second quarter of 2019. This is down quarter over quarter by approximately $2.6 billion, or 0.8%, from $305.3 billion in the first quarter of 2019 and up year over year by approximately $21 billion, or 7.5%, from $281.7 billion in the second quarter of 2018.

"Home values have continued to rise in most parts of the country this year and we are seeing the benefit in higher home equity levels. The western half of the U.S. has experienced particularly strong gains in home equity recently," said Frank Martell, president and CEO of CoreLogic. "In July 2019, South Dakota and Connecticut were the only two states to post annual home price declines. These losses mirror the states' home equity performances during the second quarter as both reported negative home equity gains per borrower."

For ongoing housing trends and data, visit the CoreLogic Insights Blog.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.