You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListRedfin Report: Rochester, Buffalo and Hartford at Least Risk of a Housing Downturn in the Next Recession

September 11 2019

Another recession is unlikely to have a widespread impact on the real estate market, but some parts of the country are at more risk than others

SEATTLE, Sept. 6, 2019 -- Rochester, Buffalo and Hartford have the lowest risk of a housing downturn in the next recession, according to a new report from Redfin, the technology-powered real estate brokerage. While the next recession is unlikely to have a large negative impact on the real estate market, some metro areas including Riverside, Phoenix and Miami have the highest risk.

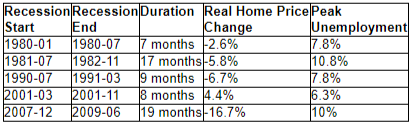

Since 1980, there have been five official recessions in the United States. In all but the 2007-2009 Great Recession, inflation-adjusted home prices only declined an average of 2.7 percent from the month before the recession began to the final month of the recession, according to the home price index data from Robert Shiller. With the Great Recession still fresh in Americans' memories, the idea of a housing crash is psychologically linked with an economic recession for many people. But historically, that usually hasn't been the case.

The Great Recession is a major outlier in the relationship between home prices and recessions, largely because the overinflated housing market was its major cause. But the housing market, which remains strong, is unlikely to be a culprit or victim of the next recession.

"Home prices are high right now, but they're high because there's not enough supply to meet demand, which means there's not a bubble at risk of bursting," said Redfin chief economist Daryl Fairweather. "Most of today's financed homeowners have excellent credit and a cushion of home equity, making them unlikely to default on their mortgage even if their weekly grocery bill grows or their stock portfolio shrinks in the next recession."

Fairweather continued, "If the U.S. enters a recession in the next two years, it will likely be caused by the global trade war. U.S. industries that rely on exports, like the automotive industry and the agricultural industry, would be the most vulnerable and susceptible to layoffs. Homeowners who are laid off may not be able to continue covering their monthly mortgage payment and may be forced to sell their homes. And would-be homebuyers won't feel so confident about making a big purchase when they don't feel confident about their job security or their financial wellbeing. That could cause declines in home prices in markets whose economy depends on global trade, but home prices nationwide are likely to hold steady."

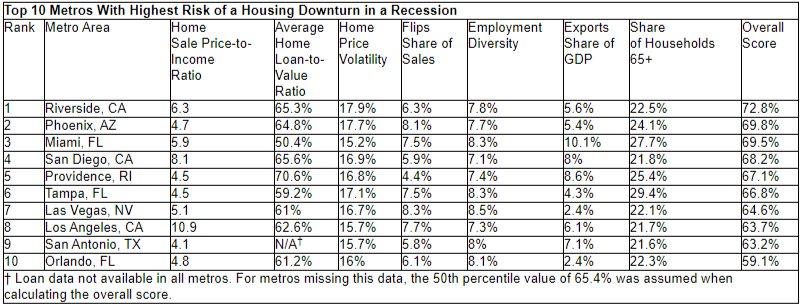

Whatever does end up causing the next recession, housing markets in certain metro areas are at greater risk of negative impacts like declining prices and a glut of homes for sale. To identify the local housing markets most likely to feel adverse effects from the next recession, we looked at the following factors:

- Median home sale price-to-household income ratio (weight: 1.5, higher is riskier)

- Average loan-to-value ratio of recently-purchased homes (weight: 1.5, higher is riskier)

- Home price volatility, measured by the standard deviation of home prices year-to-year (weight: 1.5, higher is riskier)

- Share of home sales that are flips (weight: 1.5, higher is riskier since flipping can be volatile in a shaky economy)

- Diversity of local employment (weight: 1.0, less diversity is riskier)

- Share of the local economy dependent on exports (weight: 1.0, higher is riskier during a trade war)

- Share of local households headed by someone age 65 or older (weight: 0.5, higher is riskier)

The metro area with the highest risk of a real estate dip during a recession is Riverside, California, with an overall score of 72.8 percent, followed by Phoenix (69.8%) and Miami (69.5%). The areas at most risk are many of the same regions where housing was hit hardest by the Great Recession, clustered in Southern California, the Southwest, and Florida. These are all areas where home prices tend to be more volatile than other parts of the country. This is likely due to their relatively high loan-to-value ratios, and larger share of the market that is dominated by home flippers. These markets tend to attract a lot of investor activity, which can drive prices up, leading local homeowners to take on more debt to afford homes in their area.

The metro area with the lowest risk of a real estate dip during a recession is Rochester, New York, with an overall score of 30.4 percent, followed by nearby Buffalo (31.9%) and Hartford, Connecticut (33.9%). The areas with the least risk are heavily clustered in the Northeast and the Midwest. This is due to a number of factors, including more affordable home prices, less investor activity, and local economies that are less prone to volatile boom-bust swings.

None of the metro areas in the top 10 with the lowest risk of a housing downturn is west of the Mississippi. The lowest score in the West was Denver, with an overall risk score of 41.5 percent, ranked 12 on the list. The sole metro on the West Coast with a risk score below 50 percent is San Francisco at 42.9 percent, which already began to slow earlier this year and therefore has less risk of a price downturn when the next recession hits.

To read the full report, including the full list of metros and their relative risk of a housing downturn in the next recession, please visit: https://www.redfin.com/blog/next-recession-housing-market.

About Redfin

Redfin is a technology-powered real estate brokerage, combining its own full-service agents with modern technology to redefine real estate in the consumer's favor. Founded by software engineers, Redfin has the country's #1 brokerage website and offers a host of online tools to consumers, including the Redfin Estimate, the automated home-value estimate with the industry's lowest published error rate for listed homes. Homebuyers and sellers enjoy a full-service, technology-powered experience from Redfin real estate agents, while saving thousands in commissions. Redfin serves more than 85 major metro areas across the U.S. and Canada. The company has closed more than $85 billion in home sales.