You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListCoreLogic Reports May Home Prices Increased by 3.6% Year Over Year

July 01 2019

Annual U.S. home-price growth accelerates for the first time in 14 months

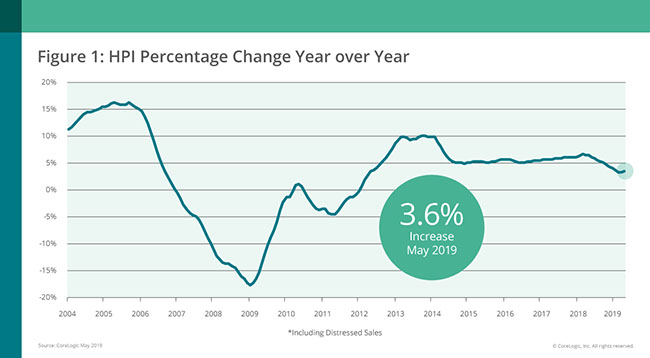

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI) and HPI Forecast for May 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 3.6% from May 2018. On a month-over-month basis, prices increased by 0.9% in May 2019. (April 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

After several months of moderation earlier this year, the CoreLogic HPI Forecast indicates home prices will increase by 5.6% from May 2019 to May 2020. On a month-over-month basis, home prices are expected to increase by 0.8% from May 2019 to June 2019, bringing single-family home prices to an all-time high. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

"Interest rates on fixed-rate mortgages fell by nearly one percentage point between November 2018 and this May," said Dr. Frank Nothaft, chief economist at CoreLogic. "This has been a shot-in-the-arm for home sales. Sales gained momentum in May and annual home-price growth accelerated for the first time since March 2018."

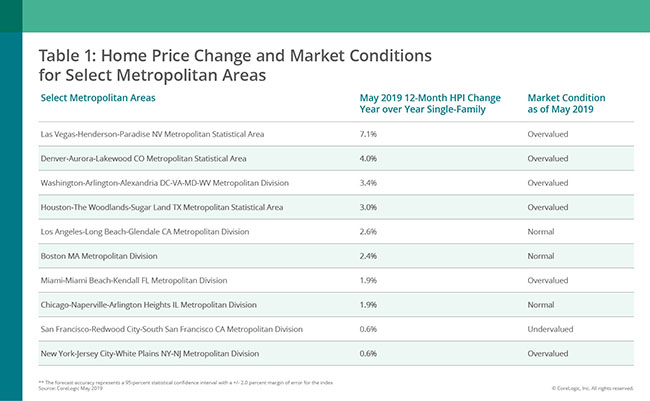

According to the CoreLogic Market Condition Indicators (MCI), an analysis of housing values in the country's 100 largest metropolitan areas based on housing stock, 38% of metropolitan areas have an overvalued housing market as of May 2019. The CoreLogic MCI analysis categorizes home prices in individual markets as undervalued, at value or overvalued, by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals such as disposable income. As of May 2019, 24% of the top 100 metropolitan areas were undervalued, and 38% were at value.

When looking at only the top 50 markets based on housing stock, 42% were overvalued, 16% were undervalued and 42% were at value. The CoreLogic MCI analysis defines an overvalued housing market as one in which home prices are at least 10% above the long-term, sustainable level. An undervalued housing market is one in which home prices are at least 10% below the sustainable level.

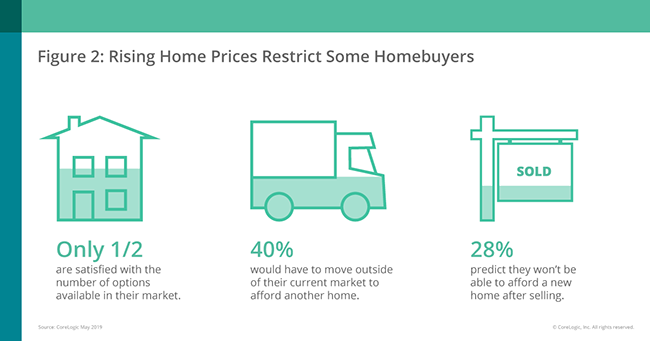

During the first quarter of 2019, CoreLogic together with RTi Research of Norwalk, Connecticut, conducted an extensive survey measuring consumer-housing sentiment in high-priced markets. Given the significant increases in home prices in these markets, homeowners are questioning their ability to afford replacement homes, and 28% of homeowners reported they are concerned they won't be able to afford buying a new home in the future. Only half of the respondents are satisfied with the number of options available in their market, and 40% of homeowners who are considering selling said they would have to move outside of their current market to afford another home.

"The recent and forecasted acceleration in home prices is a good and bad thing at the same time," said Frank Martell, president and CEO of CoreLogic. "Higher prices and a lack of affordable homes are two of the most challenging issues in housing today, and every buyer, seller and industry participant is being impacted. The long-term solution lies in expanding supply, which will require aggressive and effective collaboration between policy makers, state and local government entities and home builders."

About the CoreLogic Consumer Housing Sentiment Study

In the first quarter of 2019, 1,002 renters and homeowners were surveyed by CoreLogic together with RTi Research. This study is a quarterly pulse of U.S. housing market dynamics. Each quarter, the research focuses on a different issue related to current housing topics. This first quarterly study concentrated on consumer sentiment within high-priced markets. The survey has a sampling error of +/- 3.1% at the total respondent level with a 95% confidence level.

About RTi Research

RTi Research is an innovative, global market research and brand strategy consultancy headquartered in Norwalk, CT. Founded in 1979, RTi has been consistently recognized by the American Marketing Association as one of the top 50 U.S. insights companies. The company serves a broad base of leading firms in Financial Services, Consumer Goods, and Pharmaceuticals as well as partnering with leading academic centers of excellence.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.