You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListGeneration Z Needs to Start Saving $304 a Month Now to Buy a Home By Age 30

February 04 2019

Location will be deciding factor in Generation Z's homeownership success; Midwest and South offer more affordable options

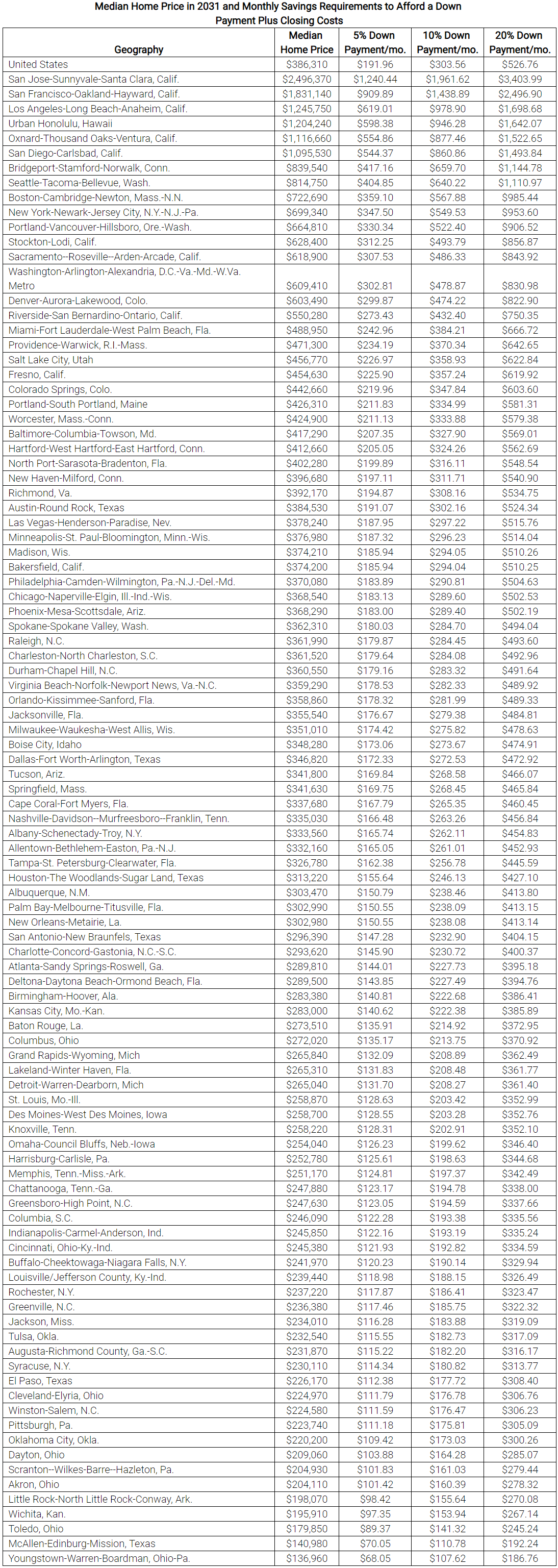

SANTA CLARA, Calif., Jan. 31, 2019 -- Nearly 80 percent of Generation Z wants to own a home before age 30, and a new analysis released today by realtor.com®, The Home of Home Search℠, shows they will need to save $304 every month for the next 12 years to buy with a 10 percent down payment plus closing costs on a median priced home. According to the analysis, the median priced home in the U.S. is projected to cost $386,310 in 2031, when today's 18-year-old members of Generation Z turn 30.

The analysis, which includes a 13-year forecast for median home prices in top 100 metros and different down payment savings plans, projects Generation Z will need to save the most to purchase a home in San Jose, Calif. where they will need to save $1,962 per month. The next most expensive locale is San Francisco ($1,439/mo.) followed by Los Angeles ($979/mo.), Honolulu ($946/mo.), and Oxnard, Calif. ($877/mo.). According to realtor.com®'s analysis of Optimal Blue mortgage data, in 2018 the typical under-30 home buyer used a seven percent down payment to successfully complete their home purchase. On average, in the top 10 most expensive metros, members of Generation Z will need to save an average of $948 a month, starting on their 18th birthday, to afford a 10 percent down payment and typical closing costs by the time they turn 30 years old.

The median priced home in 2019 is expected to cost $265,000, but over the course of the next 12 years, the price is expected to increase nearly 50 percent, specifically another 46 percent to $386,310. This assumes prices grow at a very modest 3.2 percent per year over the next 12 years.

"Choosing to live in one of the U.S.'s larger and more expensive metros, especially on the West Coast, is going to make homeownership a difficult task, but that doesn't mean that Gen Z should give up on their dreams," said Danielle Hale, realtor.com®'s chief economist. "The most important thing they can do is start saving as much as possible early on and let compound interest do the heavy lifting for them. They may also want to consider more affordable areas or different down payment amounts. Some widely available programs allow down payments as low as 3 percent, but a lower down payment can mean higher ongoing monthly costs. As with most decisions, there are pros and cons and a buyer needs to think these through to determine what's best for them."

Midwest and South offer opportunities for an easier savings plan

While the analysis reveals potentially daunting West Coast future home prices and monthly savings amounts, Generation Z can look to the Midwest and South for more affordable housing options. Youngstown, Ohio, topped the list of the most affordable metros, where Generation Z would only have to save $108 per month. It was followed by McAllen, Texas ($111/mo.), Toledo, Ohio ($141/mo.), Wichita, Kan. ($154/mo.), and Little Rock, Ark. ($156/mo.).

With an average median home price of $191,381 in 2031 for the top 10 most affordable metros, an 18-year-old member of Generation Z will need to save an average of $150 a month, starting on their 18th birthday, to afford a 10 percent down payment by the time they turn 30. That comes out to saving $798 a month less than the average monthly saving required for the top 10 most expensive metros.

20 percent down payments paint a different picture

While 10 percent down or less is far more common among first-time and younger home buyers, some members of Generation Z may want to use a 20 percent down payment to qualify for a lower mortgage rate and have a much lower monthly payment, but that might not be feasible in the nation's most expensive metros. On average, for the 10 most expensive metros in the U.S., Generation Z will need to save $1,645 a month for a 20 percent down payment and closing costs. That is $697 more every month than if they are aiming to put 10 percent down. While 20 percent has historically been the benchmark, this isn't true for first time homebuyers, and Generation Z should consider varying levels of down payments when planning to purchase a home, especially in higher cost metros in the U.S.

Methodology: This analysis assumed an 18-year-old member of Generation Z started saving on his or her birthday, contributing the exact amount every month into a savings account with a fixed three percent annual return, compounded monthly. They will make their home purchase in 2031 on their 30th birthday, after making exactly 144 deposits over exactly 12 years. The calculated savings amount required includes money for a downpayment and typical closing costs of about 3.6 percent for first-time home buyers. Forecast median home price data comes from Moody's Analytics (economy.com).

About realtor.com®

Realtor.com®, The Home of Home Search, offers an extensive inventory of for-sale and rental listings, and access to information, tools and professional expertise that help people move confidently through every step of their home journey. It pioneered the world of digital real estate 20 years ago, and today is the trusted resource for home buyers, sellers and dreamers by making all things home simple, efficient and enjoyable. Realtor.com® is operated by News Corp [NASDAQ: NWS, NWSA] [ASX: NWS, NWSLV] subsidiary Move, Inc. under a perpetual license from the National Association of REALTORS®. For more information, visit realtor.com®.