You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListHome Buying Pays Off Fast, but Hurdles Remain For Renters

April 08 2015

SEATTLE, April 8, 2015 -- Even though buyers in most markets can break even on a home purchase in less than two years, nearly half of renters in a newly released survey said their credit or finances keep them from buying a home.

Of renters surveyed by Zillow®, 16 percent said they can't qualify for a home loan, 18 percent said they can't afford taxes, maintenance and other costs associated with homeownership, and 13 percent said they don't have enough savings for a down payment. About a quarter said they struggle to pay their rent.

According to the survey, 82 percent of renters are long-term renters, and 57 percent are long-term renters who have lived for a long time in the same home.

Just 14 percent of renters said they aren't staying long enough in the same place to buy.

Zillow's survey sheds light on why some renters are not buying homes, despite historically low interest rates, prices that remain below peak levels in many areas and rising rents. Mortgage math aside, 20 percent of renters said they simply prefer to rent.

"If the buy versus rent decision were about simple math, we'd likely have millions more homebuyers in the market, because the equation is tilted heavily in favor of buying," said Zillow Chief Economist Dr. Stan Humphries. "But no matter what the numbers say, buying a home is a huge commitment. Every day, Americans make decisions to buy or rent based on any number of personal dynamics, including preference, flexibility needs, family factors and, yes, financial considerations. There is no right or wrong choice, and it's important that America's housing market maintains a number of affordable options for renters and buyers, no matter their preferences."

Over the last year, as home-price appreciation has slowed down, the length of time it takes to break even on a home purchase grew slightly in most major metros. The breakeven analysis looks at how long it takes to come out ahead on a home purchase versus renting the same home, recouping the costs of buying, including taxes and maintenance.

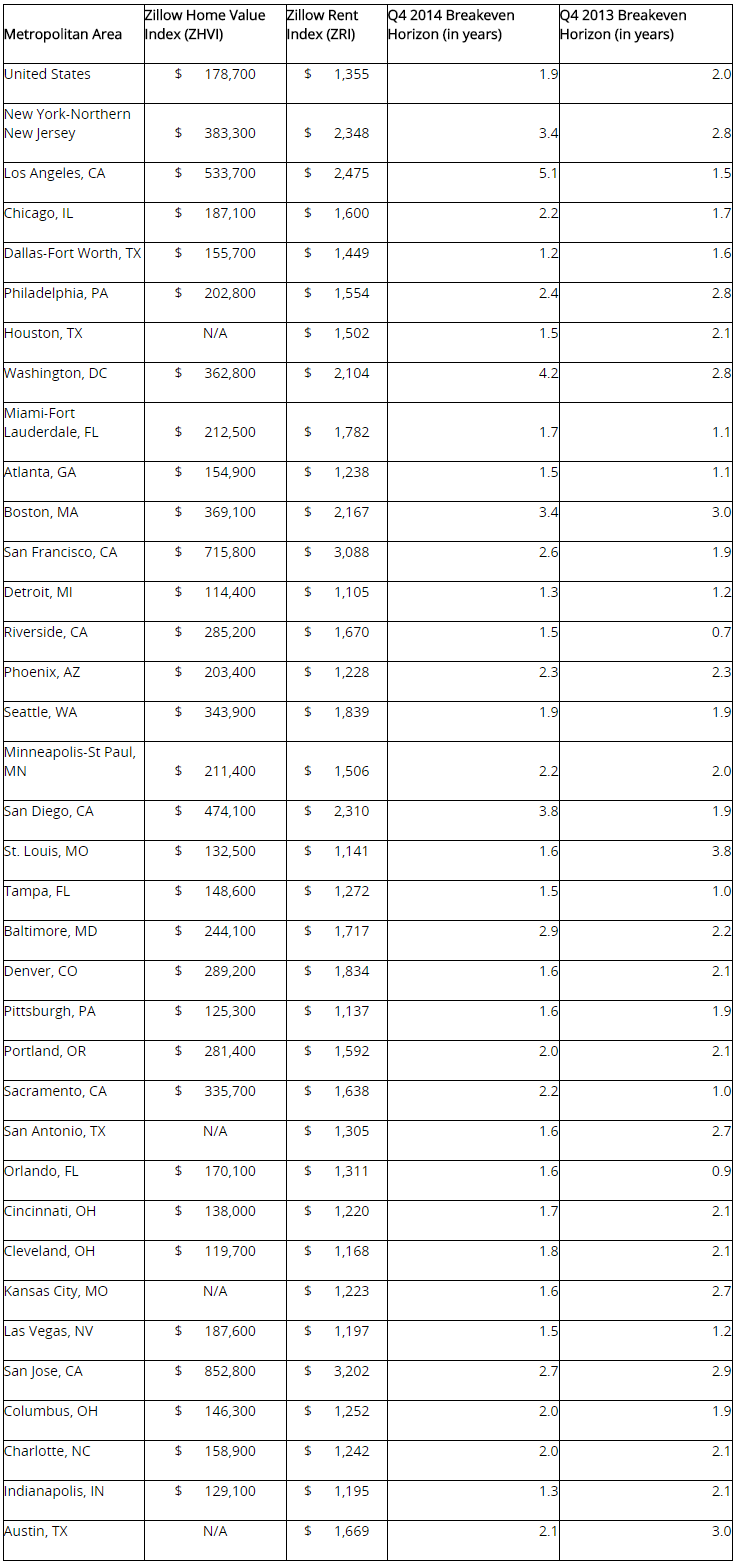

Among the top 35 metro areas in the U.S., Dallas-Fort Worth had the lowest breakeven horizon, at 1.2 years. Indianapolis, Ind. and Detroit were next at 1.3 years. The highest breakeven horizons were in Los Angeles, at 5.1 years, Washington D.C. (4.2 years) and San Diego (3.8 years). The national average is 1.9 years.

Zillow's breakeven horizon incorporates all costs associated with buying and renting, including upfront payments, closing costs, anticipated monthly rent and mortgage payments, insurance, taxes, utilities, maintenance, and renovation costs. The horizon also factors in home equity growth for buyers, and, for renters, income earned if they invested the same amount of money into an interest-bearing account. It also factors in historic and anticipated home value appreciation rates, rental prices and rental appreciation rates.

About Zillow

Zillow® is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with the best local professionals who can help. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow's Chief Economist Dr. Stan Humphries. In 2015, Dr. Humphries co-wrote and published the New York Times' bestselling "Zillow Talk: The New Rules of Real Estate." Dr. Humphries and his team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Zillow also sponsors the bi-annual Zillow Housing Confidence Index (ZHCI) which measures consumer confidence in local housing markets, both currently and over time. Launched in 2006, Zillow is owned and operated by Zillow Group (NASDAQ: Z), and headquartered in Seattle.