You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListRoad Map to Listing Syndication

July 28 2014

Listing syndication to online portals is in the throes of a revolution in real estate today. Listing syndication has followed a philosophical pattern first envisioned by the German philosopher G.W.F. Hegel in his triadic process – thesis, antithesis, and then synthesis. This paper will walk though the first two phases of the process, discussing the evolution of the original thesis of listing syndication followed by the new roots of today's chaotic antithesis.

Listing syndication to online portals is in the throes of a revolution in real estate today. Listing syndication has followed a philosophical pattern first envisioned by the German philosopher G.W.F. Hegel in his triadic process – thesis, antithesis, and then synthesis. This paper will walk though the first two phases of the process, discussing the evolution of the original thesis of listing syndication followed by the new roots of today's chaotic antithesis.

The industry is developing a plethora of new models to transmit listings for online advertising at a pace that is eroding the effectiveness of the process in a significant way. However, out of this chaos of antithesis we are beginning to see a glimmer of new publishers who seek to be the best possible partners to brokers. A new synthesis is on the horizon.

The Birth of Listing Syndication

From 2004 to 2006, listing syndication to online publishers played an important and strategic role in the success of real estate brokers. At the time, firms in competitive markets who carried between 100 and 150 listings were spending $1 million annually on print advertising.

The print advertising was not effective in generating many leads, but it was done because the seller insisted and the agent agreed. There is something magical about seeing your home and your agent's photo in the newspaper that stirs the soul. Unfortunately, print was not financially sustainable. Brokers needed a way out. Consumers had already fled to the internet for property search, and brokers needed a way to cut their advertising budget.

Portals solved the print crisis by offering marketing to millions of consumers shopping for listings on Yahoo, AOL, Google, MSN, and so many others – more reach at a fraction of the cost. Newspapers became nursing homes where advertising dollars went to die. Brokers took up the initiative of manually duplicating listing input onto publisher websites, or providing crude FTP data feeds.

To the credit of the founders of ListHub, namely Ira Luntz, Mark Wise, and Luke Glass, syndication emerged as a simple construct. There was one company, and they handled the listing syndication needs for the entire real estate industry. Their business model was disruptive in that it was a free service. MLSs could offer the service free to their participants (brokers).

WAV Group performed a case study on syndication effectiveness in 2008 to understand the emerging trend of MLSs providing syndication services. At issue was the age-old consideration of the MLS leveling the playing field by giving every broker the ability to access push button listing syndication. At that time, brokers were more than willing to pass the burden of syndication over to MLSs.

Kelli Charbonneau, Vice President of Operations at Dickson Realty in Reno, was quoted as saying, "A primary role of the MLS is to provide data services to brokers and agents. We support and applaud NNRMLS [MLS in Reno, Nevada] for their leadership in taking this burden off of our shoulders, and embracing all brokers in their listing syndication strategy. It would be great if all boards supported us in the same way."

At the time, ListHub supported 21 publisher sites: Google Base, Yahoo, Trulia, Zillow, AOL Real Estate, Homescape, MyREALTY, Hotpads, Vast, CLRsearch, Military.com, Backpage.com, FrontDoor, Local, Home and Land (customers only), ReloHomeSearch (Leading RE members only), Cyberhomes, Oodle, Propbot, Lycos, and LakehomesUSA. Today, they publish to more than 200.

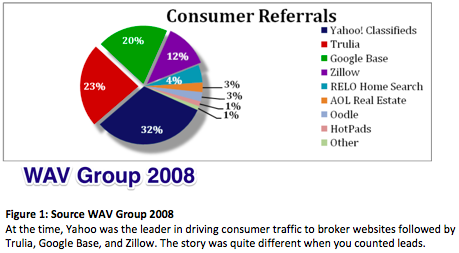

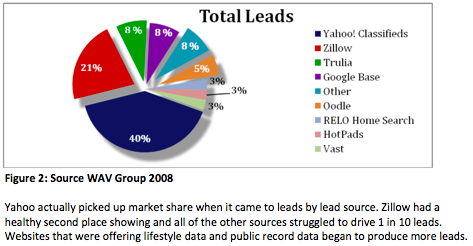

Our case study focused on the benefits of syndication to brokers. Unlike print, digital advertising can be measured in terms of clicks and leads. Here is a snapshot of the data at that time:

At the time, Yahoo was the leader in driving consumer traffic to broker websites, followed by Trulia, Google Base, and Zillow. The story was quite different when you counted leads.

Yahoo actually picked up market share when it came to leads by lead source. Zillow had a healthy second place showing and all of the other sources struggled to drive 1 in 10 leads. Websites that were offering lifestyle data and public record data began to produce more leads.