You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListHow Craigslist Taught Me About Real Estate Pricing

September 12 2013

Guest contributor Mike Sparr of Goomzee says:

I had an interesting epiphany recently, thanks to some recent sales on Craigslist and deeper analysis of my company's data feeds in real estate markets around the U.S. There appears to be a direct correlation between median listing price in a market, and the quantity of price reductions throughout the life of the listing. I mention my Craigslist experience because I recently listed some football season tickets and an 8-year-old four-wheeler for sale and noticed interesting analogs to the negotiations leading to the sale of both items.

I had an interesting epiphany recently, thanks to some recent sales on Craigslist and deeper analysis of my company's data feeds in real estate markets around the U.S. There appears to be a direct correlation between median listing price in a market, and the quantity of price reductions throughout the life of the listing. I mention my Craigslist experience because I recently listed some football season tickets and an 8-year-old four-wheeler for sale and noticed interesting analogs to the negotiations leading to the sale of both items.

On a whim, I wanted to see if I could sell off an unused pair of season tickets to our local college football program. I have three pair and typically only use two pair. I posted the tickets for sale on Facebook first and immediately had interest, questions, and even a couple low-ball offers. If I were desperate to sell these tickets, I may have entertained or negotiated some of the offers, but they were several hundred dollars less than what I desired (despite the fact the season opener was days away and the full season tickets' package value would decrease).

I then decided to post the tickets for sale on Craigslist to expand my potential audience. The interest came in a little slower, but these people were more transaction focused. I had an offer the first day, but it was for the season less the first game, and they wouldn't increase their offer to match my desired price less what I knew I could sell the first game for. I declined the offer and waited. A day later, I had a full price offer from someone in Great Falls, MT (160 miles away) and we met that Saturday before the game and made the exchange. I secured my full price sale with only one day remaining before my package value would drop, but was rewarded for my patience.

The same scenario occurred with my four-wheeler. I had a four wheel ATV with plow, winch, etc., with only 272 miles on it after eight years. I only used it to plow my driveway during winters and didn't have time to use it recreationally, so it was practically new. I found pricing online via eBay and aggregated listing sites and posted it at a fair price.

Within a day, I had a trade offer and one low-ball offer. I declined both. It didn't matter to me if I sold the four-wheeler or not, but I didn't want a depreciating asset that I couldn't use (especially with an 18-month-old daughter and a newborn on the way) for the next few years.

Again, I was rewarded for my patience as I received two more email requests three days later asking if it was still available. One person wanted to see it, and I scheduled a meet the next evening. They were willing to write me a check for full price that night. I asked that they wait until the next day so I could prepare paperwork, remove plates, etc. and they bring cash or cashier's check instead and they agreed. As I reveled last night with my pile of 100 dollar bills, it got me thinking about similar trends I'm seeing in our listing data feeds in different markets.

My company, Goomzee, provides productivity tools for real estate agents nationwide. As part of our service, and also channel partnerships, we integrate with the local market multiple listing service (MLS) via a data feed. We leverage this listing data to either prevent double entry for agents who want to promote their listings over mobile devices, or we also allow the search for listings via web/mobile devices as a service sponsored by the MLS itself.

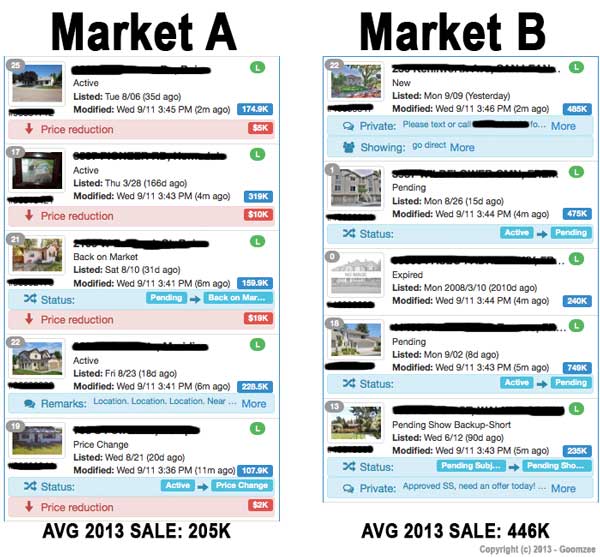

To ensure our data is accurate and in sync with the MLS system, our engineers needed to build analytics and real time monitoring of the data feed so both our staff and the MLS staff can QA the data and troubleshoot for any inaccuracies. In exposing this real time activity, almost like Facebook's activity stream, you can start to see trends from one market to another.

Today, while monitoring some markets with a median listing price under $200,000 and average sale price around $200,000, I noticed far more price reductions on their listings throughout the day compared to other markets with higher median listing prices. This got me thinking about my recent Craigslist experience, and the economic factors that revolve around listing prices in a commission-driven sales model.

The trend I recognized revealed that there are far more price reductions in lower median listing price markets than there are in higher median listing price markets. It does make sense, if you think about the economic pressures agents face when compensated solely on commission. In a "low price" market, an agent must close more transactions per month to earn a decent living than an agent in a "high price" market. As such, the pressures to close more transactions in these markets might lead to a trend to drop the price faster than one needs to. I wonder if they were more patient, like my recent Craigslist experience, would they be able to hold out for a higher price and earn more for their clients.

It will be interesting to continue to observe this trend and see if there is scientific evidence backing up what I've casually observed. I also wonder how much influence the economy pressures agents in "low price" markets to close more transactions has over their clients' decision to lower the price vs. other lower pressure "high price" markets.

This is a slippery slope, of course, because the client may be struggling to make payments and needs to solve cash flows, etc., or if they hold out longer they lose thousands monthly in ongoing payments.

If anyone has more data on this phenomenon I recently observed, I welcome their thoughts on aggressive price reduction strategies vs. standing your ground.

To view the original article, visit the Goomzee blog.