You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListWhy One Top-rated Real Estate Valuation Model Is Better Than the Rest

September 15 2022

Some may be surprised to learn that one of the nation's most accurate and highly-rated real estate valuation models is behind closed doors. And for good reason.

Some may be surprised to learn that one of the nation's most accurate and highly-rated real estate valuation models is behind closed doors. And for good reason.

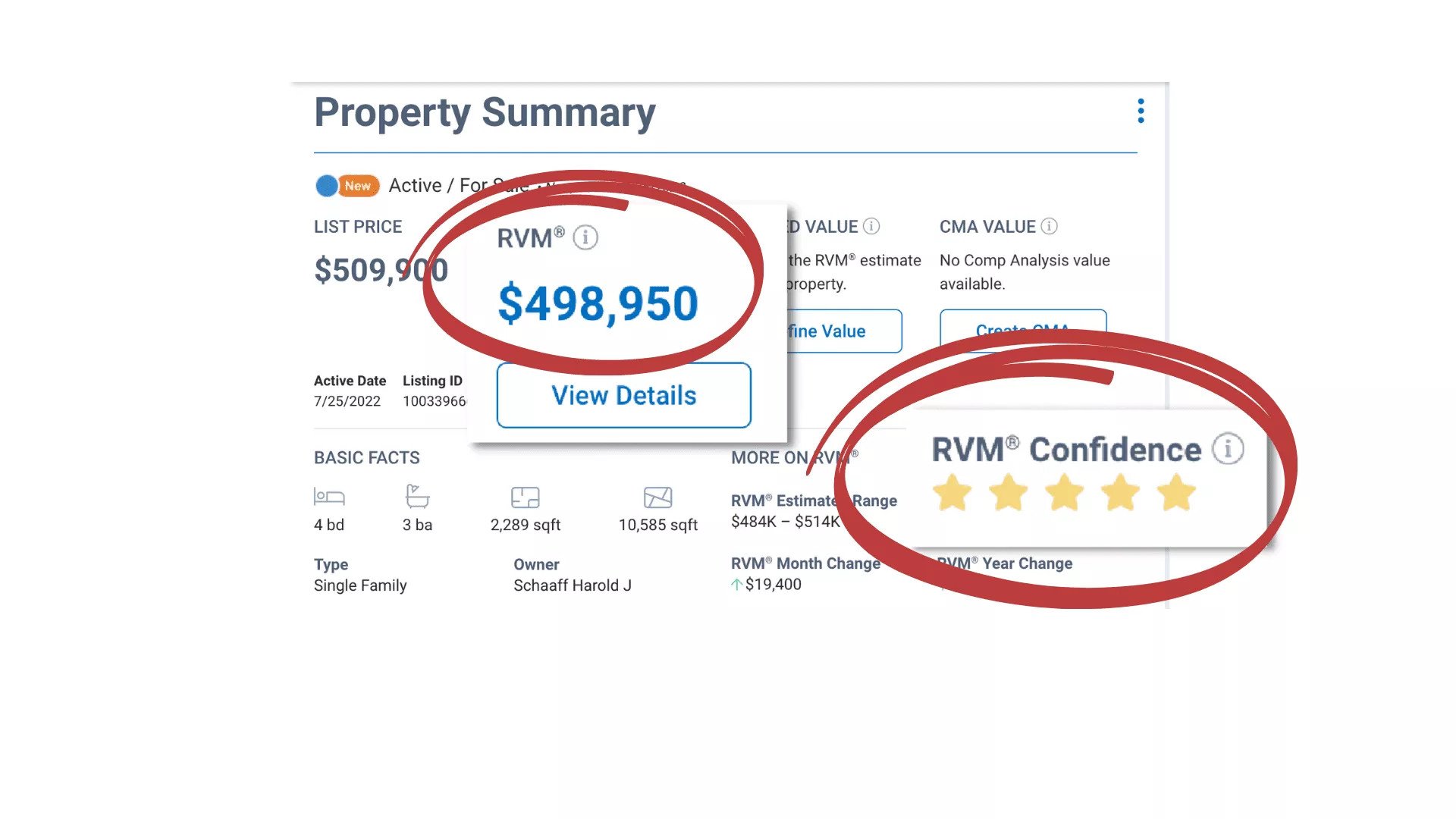

Tested by leading independent companies for accuracy and hit rate, the Realtor Valuation Model (RVM) has shown consistent high performance. Those "accuracy and hit-rate" indicators—primary measures of automated valuation model (AVM) quality—are regularly analyzed across multiple markets and a wide variety of market conditions.

Difference in the data

The one-of-a-kind RVM, offered by Realtors Property Resource® (RPR®), continually outperforms other models thanks to its unique algorithm. Unlike traditional AVMs, the RVM's proprietary formula applies on-market and off-market MLS listing data plus publicly recorded sold data to form its estimation. In contrast, AVM estimated values draw solely from publicly recorded sold data.

Those unique attributes are foundational to the RVM, yet the tool and its capabilities extend far beyond simply displaying an estimation. The RVM's powerful customization features are such that only a licensed REALTOR® is considered qualified to interpret, refine, and deliver accurate estimations, in addition to dozens of other data, analytics and reporting functions found within RPR.

"Any automated valuation model is only as good as the underlying data and the algorithm used in the calculation," says RPR COO and general manager Jeff Young. "It takes a REALTOR®'s experience and local market knowledge to provide consumers with true market values. This is even more important in the rapidly changing market we see in 2022."

RVM® Cornerstones of Credibility

- On- and off-market MLS listing data + public record sold data = estimation

- Only REALTOR®-owned automated valuation product.

- Incorporates REALTOR® market expertise and customization.

- Confidence score describes expected accuracy of estimated value

RVM as a starting point

As the only REALTOR®-owned automated valuation product, the RVM turns a traditional AVM on its heels by offering users customizable refinement tools. Attributes not found on consumer-facing real estate sites.

This distinct advantage allows users to refine the RVM by home improvements made and/or needed, property facts, and market conditions—typically based on knowledge of the property or an on-site visit. AVMs do not factor in a property's condition; instead relying on "average condition" scenarios when determining value.

In defense of the AVM, accurate estimations of comparable on-market properties can be obtained using a prior physical inspection. Yet, according to Karen France, RPR senior vice president of market engagement, those values can fail to live up to true market realities.

"Many things can distort the estimated value of a property. A home might be unusual compared to its neighborhood counterparts or access to off-market data is limited," says France.

"If an MLS shares only on-market listings with an AVM provider, rather than both the on- and off-market information that they share with RPR, the valuations tend to fall short of an accurate estimation."

Plus, adds France, AVMs draw from public records sources, which can be inaccurate, incomplete, and slow to record transactions.

The 5-star confidence score

Lastly, the RVM offers a one-to-five star confidence score that describes the expected accuracy of a property's estimated value. Based on the outcomes of multiple automated valuation models, higher scores are defined by narrower valuation ranges. The opposite is true for lower scores. The ranges are beneficial guideposts that help REALTORS® navigate list-price discussions with potential sellers.

RVM Margin of error for confidence scores

To date, RPR's Realtor Valuation Model® is in a class by itself among automated real estate valuation models. Learn more about this valuable tool.

Editor's Note:

RPR encourages REALTORS® to educate consumers on the important difference between AVMs, RVMs and appraisals. RVMs and AVMs are not meant to serve as appraisals. REALTORS® determine market value that must be validated by an appraiser. Lenders rely only on an appraisal.

To view the original article, visit the RPR blog.