You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListConsumers' Housing Sentiment Is Plunging. Is the Real Estate Market Imploding?

August 21 2022

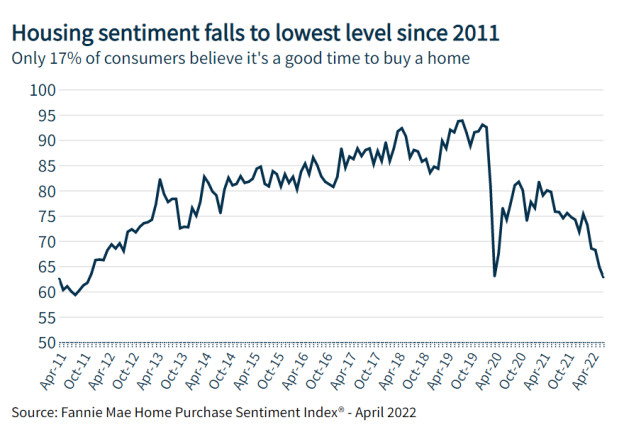

Last week's Home Purchase Sentiment Index (HPSI) update from Fannie Mae told a clear, concerning story: Homebuyers and sellers are concerned about the real estate market.

Last week's Home Purchase Sentiment Index (HPSI) update from Fannie Mae told a clear, concerning story: Homebuyers and sellers are concerned about the real estate market.

In fact, consumer housing sentiment has fallen to its lowest level in over a decade.

Only 17% of consumers Fannie Mae surveyed said they believe it a good time to buy a home. Sixty-seven percent of consumers think it's a good time to sell, but that's down from 76% just a few months ago.

What's going on? Why are consumers so concerned about the housing market? Does dropping consumer housing sentiment mean the real estate market is collapsing?

Buyers Face Low Inventory, Higher Mortgage Rates, High Prices

Prospective buyers have reason for pessimism. For one, housing inventory remains below pre-COVID-19 pandemic levels. There simply are not as many homes as the market as interested buyers, and this pumps up demand for and the price of every listed property.

In 2022, listing inventory has actually trended upwards, but this is mostly due to another trouble spot for buyers: higher mortgage rates.

Higher mortgage rates are a side effect of the Federal Reserve raising interest rates to combat inflation. Mortgage rates have dropped this month, but the 30-year fixed average rate this week is still above 5%, around double what it was during parts of 2021. The result is buyers who must agree to more expensive monthly payments than they would have a year ago.

Finally, persistently high home prices have dampened buyer enthusiasm about the housing market. Over the past 12 months, home prices grew by 19.7%. While some predict that home prices will remain stagnant – or perhaps even drop – in the next year, buyers are still feeling the sting of home prices that have risen rapidly over the past two years.

Sellers Encounter Tapering Home Price Growth, Price Cuts, and Difficulty Finding a New Home

The current housing market has a reputation for being inhospitable to buyers. So what reasons do sellers have to complain?

At a glance, the market is still much better for sellers than buyers. But seller sentiment is dropping for a few reasons, most notably:

- More homes on the market are getting a price cut: This summer, roughly 1 in 7 homes on the market had their prices lowered. That's nearly twice the frequency of last summer, when only 1 in 13 homes lowered their initial listing price.

- Speculation about home prices tapering or dropping: Just as buyers feel stung by two years of rising home prices, sellers feel anxious about expert predictions that home prices are on the verge of tapering or dropping. People hate to feel they missed the moment, and some sellers have expressed frustration at the possibility that they would have been better off selling in the recent past.

- Sellers usually become buyers: All the problems afflicting homebuyers? Sellers feel them, too. Remember that sellers typically become buyers – getting rid of one place to live comes with the necessity of finding a new home. Rising mortgage rates, in particular, make sellers pessimistic about re-entering the market, and more likely to delay selling until inflation abates.

It still may be a seller's market, but it's not the seller's market it was 3, 6, or 12 months ago.

Buyers and Sellers Still Have Options

Dealing with anxious consumers is part of your job as an agent. But even if their concerns are founded, you can assure them that their ambitions to buy or sell a home aren't melting down.

Remind buyers that mortgage rates haven't risen as quickly in the past two months, and may not rise significantly for the rest of the year. You can also make sure buyers are aware of options such as adjustable-rate mortgages (ARMs) and buying down points on a mortgage rate.

For sellers, your best bet is to reiterate that demand for homes still outstrips supply. Getting the best possible offer on a home listing takes more effort and advertising than it may have a year or two ago, but it's still possible to sell a home and re-enter the market in a strong position.

To view the original article, visit the Homesnap blog.