You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListIt's a Sellers Market. So Why Aren't More People Selling Their Home?

July 17 2022

If you're an agent, you've recently heard (and maybe said) this line: It's a seller's market. With housing inventory at a record low and home prices still rising, that conventional wisdom begs the question: If it's a seller's market, why aren't more people selling their homes?

If you're an agent, you've recently heard (and maybe said) this line: It's a seller's market. With housing inventory at a record low and home prices still rising, that conventional wisdom begs the question: If it's a seller's market, why aren't more people selling their homes?

1. The Most Eager Sellers Have Already Sold

Why aren't more owners listing their homes? In part, because people who were most eager to sell already have.

For nearly two years, ultra low mortgage rates resulted in a supercharged housing market. Sellers were listing homes and often receiving dozens of offers, some of which came above already sky-high listing prices.

Homeowners who wanted to sell had ample time to get their home on the market and sell it at a high price. And they did.

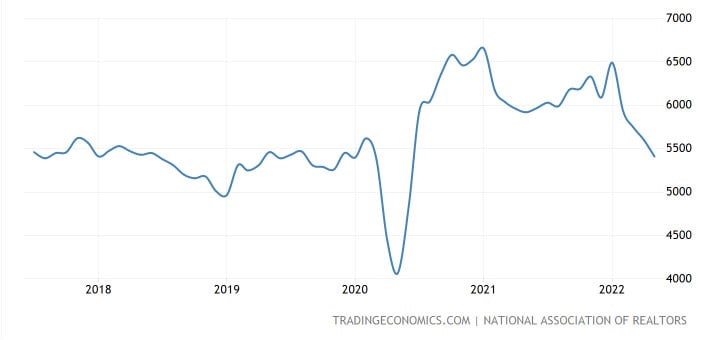

Just consider the below chart displaying existing home sales from 2017 to 2022. Existing home sales are the clearest proxy for tracking the rate at which owners are selling their homes.

It's evident that home sales bottomed out in the early spring of 2020, when COVID-19 was first declared a pandemic. But sales rebounded at a record rate after the Federal Reserve slashed interest rates and mortgage rates plunged to a record low. Throughout 2020 and 2021, sales of existing homes were at their highest level in years, and have only this year begun to taper towards a pre-pandemic normal.

Basically, fewer homes are hitting the market now because more homes than anticipated were sold 6, 12, 18, or 24 months ago. Many of the most interested sellers have already hit the market – it's been a seller's market for some time.

2. Mortgage Applications and Buyer Interest Is Down

People are motivated to sell their homes when they know there is strong buyer demand. Right now, a sustained drop in mortgage applications indicates less buyer demand for homes in 2022 than preceding years.

Mortgage applications are for consumers the first step of obtaining a home loan, and as such, are often used as a gauge of industry-wide housing demand.

Mortgage applications are down a full 15% year-over-year, which most experts attribute to surging mortgage rates. As mortgage rates rise, fewer buyers are qualified to seek one, tampering overall buyer demand.

With less buyer demand, would-be sellers may figure that it's better to wait out the market and not list a home until mortgage rates fall. Fewer mortgage applications suggests a housing market that's in the process of cooling. People who don't need to sell a home now may think that today's market – still low on housing inventory and hospitable for sellers – will be more promising in a few years, after interest and mortgage rates have stopped rising so rapidly.

3. Sellers Usually Also Have to Buy – and That's Not Currently Easy

The final and arguably most significant factor keeping home sellers out of the market is epitomized by a question: "If we sell, where are we going to go?"

You can't blame sellers for wondering. Usually, selling a home means buying a new home in its stead, and right now, that's hard because:

-

Buyers are facing high mortgage rates: Mortgage rates have risen at their fastest rate in decades. Sellers who also need to buy a home risk trading into a higher mortgage rate, blunting the financial windfall of selling a home.

-

Home prices are still high: Housing prices aren't rising at the breakneck clip of 2020 and 2021, but are still formidable. Low inventory means that for sellers, finding the right new home at a reasonable price is not guaranteed, or even likely.

-

The newly built home market is difficult: Potential home sellers can't easily upgrade to a newly built home. For one, new homes simply aren't being built at the rate of demand, with inflation and supply-chain snarls jumping the cost of supplies and materials. Plus, buyers of newly built homes pay a hefty price when mortgage rates rise. The time between agreeing to a contract on a newly built home and moving in can last up to a year – putting buyers at risk of being on the hook for much higher borrowing costs than first anticipated.

Clearly, there are compelling factors keeping home sellers out of the market. But for agents, market tumult and uncertainty may signal an opportunity. Those who want to sell a home still can, even as rates rise, because inventory is so scant. And people looking for homes are starting to find a market with more reasonable home prices and fewer bidding wars – which may encourage them to hire an agent and buy before mortgage rates rise even more.

To view the original article, visit the Homesnap blog.