You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to Listzavvie Releases New Midyear Seller Preferences Report

July 29 2021

Record-low inventory in markets across the U.S. made it easy to sell a home in the first half of 2021 -- but increasingly harder to find and buy one. That made moving tricky for the 70% of sellers who also needed to buy a home.

Record-low inventory in markets across the U.S. made it easy to sell a home in the first half of 2021 -- but increasingly harder to find and buy one. That made moving tricky for the 70% of sellers who also needed to buy a home.

Fortunately, new ways of selling and buying are meeting consumer needs in the difficult market. "Power Buyer" companies offer services that enable consumers to buy their new house before selling their current home. And, cash offers from iBuyer companies became stronger than ever and increasingly available.

A new midyear zavvie Seller Preferences Report details the explosive growth of Power Buyers and several other new selling solutions available to homeowners throughout the U.S. between January and June 2021.

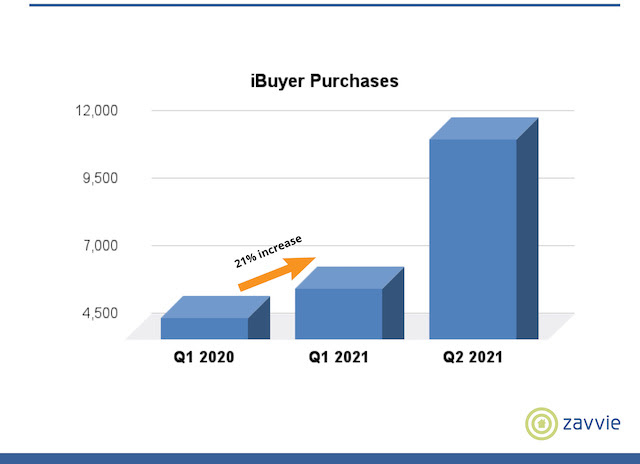

Released today by zavvie, a brokerage-branded marketplace connecting brokers and their clients with Verified Buyers, the report also details that iBuyers are back. In Q1 2021 they exceeded their pre-pandemic levels one year ago by 21%. And in Q2 2021, iBuyer purchases rocketed to nearly double their Q1 2021 total.

But the biggest trend is the rapidly growing influence of Power Buyers (a term coined by real estate tech strategist Mike DelPrete). Power Buyers provide homeowners with "buy before you sell," "sale leaseback" and "cash offers" services. Power Buyer firms include EasyKnock, Homeward, Knock and Ribbon.

The new zavvie report found that in the first half of this year, more sellers than ever utilized the services offered by a range of companies that are fundamentally changing how residential real estate works.

Stefan Peterson, zavvie Chief Data Officer and Co-Founder, explains the impact on the typical consumer. "A Denver buyer with a traditional mortgage and a loan contingency had to make offers on an average of seven homes before winning the day," Peterson said. "Homebuyers with all cash averaged just 1.1 submissions before getting their offers accepted. Power Buyers give homeowners a massive advantage in today's marketplace," he added.

The zavvie Seller Preferences Report is the only ongoing review of its kind for every selling solution available to homeowners throughout the U.S. The report looks specifically at activity among iBuyers and the increasing influence of Power Buyers nationwide. It examines offer strength, offer acceptance rates, service fees, market availability, buy boxes, average concessions, and time to close for selling solution providers.

The zavvie Seller Preferences Report 2021 highlights:

- Power Buyers are showing explosive growth: Ribbon reports demand for cash offers has increased 10x in 2021. EasyKnock's Q1 business grew 70% from the previous quarter. And Knock expanded from three markets at the end of 2019 to 49 markets by the end of June 2021.

- iBuyers are making better offers: iBuyer purchases by Opendoor, Zillow Offers, Offerpad and Redfin Now, on average came in at 104.1% of market value during the first half of 2021.

- "Buy boxes" expand: The average home sale price for iBuyers increased 22% by June 2021, as the average iBuyer purchase price jumped at the end of 2020 from $280,000 to $344,000 in Q2 2021.

- iBuyers are lowering fees as average concessions, service fees plummet: Average consumer costs of selling to an iBuyer dropped 25% by midyear 2021. iBuyer service fees dropped in Q2 2021 to 5.1% versus 7.2% in 2020. Moreover, the average concession charged to sellers for home repairs fell in Q2 2021 to 1.9%, down sharply from 3.8% in 2020.

- iBuyers want more: In iBuyer markets, eligible inventory increased from 32% to 43%.

- Power Buyers top iBuyers with higher price points: Average transaction price for Power Buyers was nearly $430,000, or 25% higher than the average transaction price for iBuyers ($344,000).

- Power Buyers drive more cash offers: Various Power Buyers reported growth for cash offers provided sellers ranging from 2x to 10x compared with Q4 2020.

- Offer acceptance rates up for both Power Buyers and iBuyers: Sellers accepted 37% of offers provided by Power Buyers through June 2021, up from 31% in 2020. The iBuyer offer acceptance rate also increased in the first half of 2021 to 5.7% versus 4.6% in 2020.

- Faster closings: For iBuyers across all markets, the average time to close midyear 2021 was 38.3 days versus 48.5 days for 2020.

- Power Buyers and iBuyers both win high consumer satisfaction scores: Both posted impressive customer satisfaction scores – roughly 9 out of 10 – indicating their customers would do it again.

The complete zavvie Seller Preferences Report is available for free at zavvie.com/seller-preferences.