You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListWhy is flood insurance so $#@!&^% confusing?! We break down the facts.

March 10 2021

Let's face it, flood insurance is confusing and time-consuming.

Why is this?

Well ... the government is involved; flood insurance is not a part of Homeowners insurance; and there are a lot of qualifying questions before a client qualifies for flood insurance.

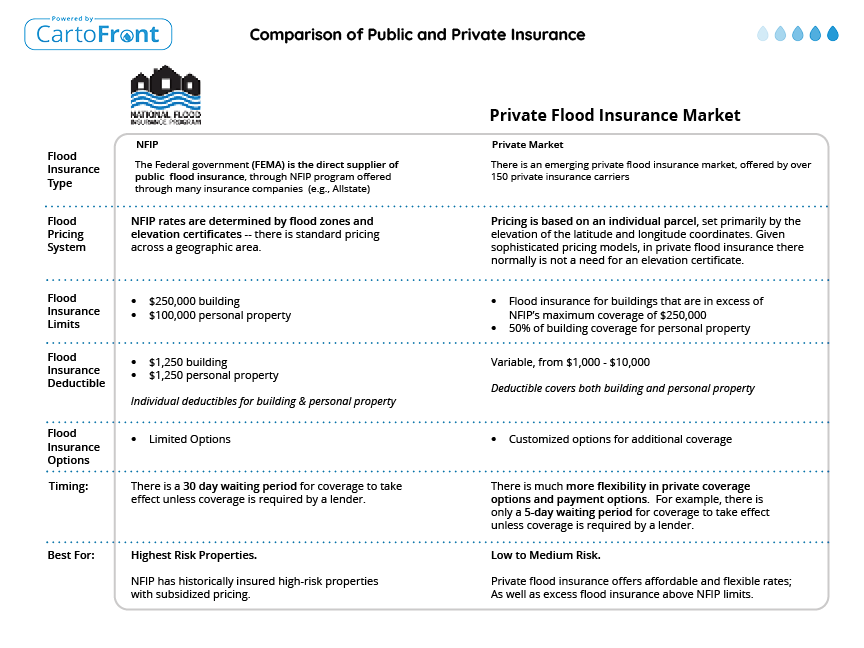

But, the biggest cause of confusion is the fact that there are actually two different flood insurance systems offered to US homeowners:

- The National Flood Insurance Program, or NFIP, run by FEMA

- The emerging Private Flood Insurance market, offered by over 150 private insurance carriers

NFIP

NFIP was formed in 1968, and has evolved multiple times over the last 53 years.

The government program is designed to protect all Americans at risk of flooding, regardless of location across the country.

The basis of the system are flood zones, which all have a special designation:

- Low and Medium Risk: Zone X

- High Risk: Zones AE, AH, AO, V, VE

NFIP updates the flood zone maps annually, yet with the rapid increase of climate change, the maps may not accurately reflect a property's real flood risk . This news article points to New Data That Points To Hidden Property Risk.

NFIP offers flood insurance coverage in a standard program:

- $250,000 maximum flood insurance for building

- $100,000 maximum flood insurance for personal property

- $2,500 deductible

- Limited options for additional coverage

- Elevation Certificate may be required

- Standard pricing based on Flood Zone Designation

Historically, NFIP is the most affordable in high risk zones, where the government has subsidized the flood insurance rates to make the program affordable to all Americans.

For properties beyond the $250,000 maximum, homeowners that choose NFIP may need to secure additional flood insurance coverage through 'excess' or 'surplus' flood insurance, which is offered by the Private Market.

While uniform in approach, NFIP presents many 'gray' areas as it relates to properly assessing property risk. For example, while a home may have a Zone X designation, 25-30% of all flood insurance claims are paid in these "less hazardous" areas.

Private Flood Insurance

The emerging Private Flood Insurance Market is based on an individual property.

Every private insurance carrier has a data intensive pricing model that calculates individual flood insurance rates based on the individual property's characteristics, allowing for customization of the quote based on the homeowner's needs.

As a comparison to NFIP, private insurance carriers offer coverages that provide greater financial protections with other enhancements:

- Flood insurance for buildings that are in excess of NFIP's maximum coverage of $250,000

- 50% of building coverage for personal property

- A range of deductible options, from $1,000-$10,000

- Customized options for additional coverage

- Elevation Certificates may only be required in special cases

- Individual pricing based on data points specific to the specific parcel and its location

Private flood insurance provides flexibility of coverage options, and the ability to customize to the individual property's needs.

NFIP Changes Starting October 1, 2021

Going forward, NFIP will be making changes to modernize its program to 'mirror' the private market.

Currently targeted to start October 1, 2021, NFIP will begin to use Risk Rating 2.0, a new flood insurance pricing model that will evaluate individual property risk. This government briefing outlines the specific program enhancements.

What Can I Do?

Regardless of the differences between NFIP and Private Flood Insurance, you should consider integrating 'the flood insurance conversation' to your real estate practice. Climate change poses flood-related challenges for an increasing number of homeowners - but by introducing this important topic, you can help them gain peace of mind while purchasing their dream home.

If you are interested in learning more, access our free eBook: Everything You Always Wanted To Know About Flood Insurance* (*But Were Afraid To Ask)

If you are interested in learning more, access our free eBook: Everything You Always Wanted To Know About Flood Insurance* (*But Were Afraid To Ask)

CartoFront is a technology services company that is simplifying flood insurance for REALTORS®, their clients, and insurance agents. If you are interested in learning how you can bring CartoFront to your MLS for free, please contact [email protected]