You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListAs Predicted, Case-Shiller October 10- and 20-City Composites Show Annual Depreciation

January 02 2012

This artice comes to us from the Zillow Real Estate Research blog.

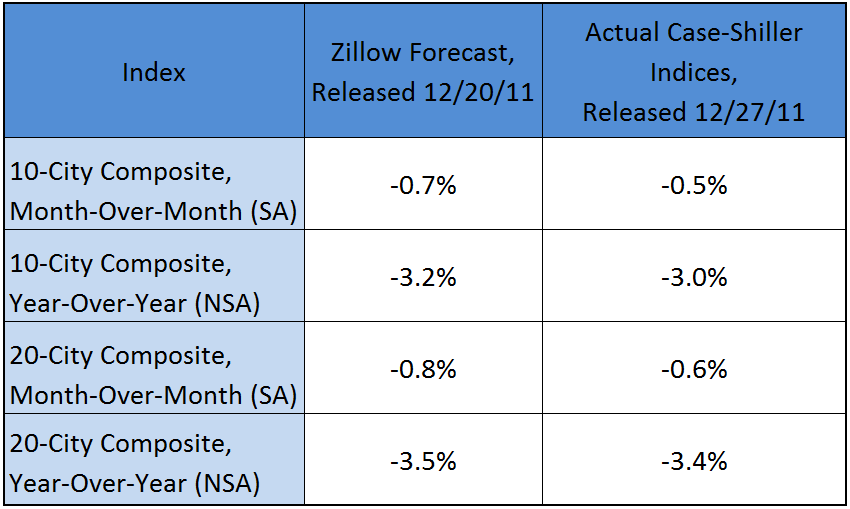

This morning, the S&P/Case-Shiller Home Price Indices showed that the not-seasonally adjusted October 10- and 20-City Composite declined -3.0% and -3.4% on a year-over-year basis, in line with Zillow’s forecast, which we released last week. On a seasonally adjusted monthly basis, the 20-City Composite fell 0.6% from September to October while the 10-City Composite fell 0.5%. The table below shows how our forecast compared with the actual numbers.

“On a seasonally adjusted basis, the pace of home price depreciation remained high in October, reflecting the continued imbalance in supply and demand despite recent stronger sales of new and existing homes,” explained Zillow Chief Economist Dr. Stan Humphries. “With foreclosure re-sales still making up about twenty percent of monthly sales in October, and another large percentage made up by short sales, we still have an environment where increased sales can put downward pressure on prices. And unfortunately, we don’t expect to see a decrease in the volume of foreclosures in the monthly sales mix in the near-term. In fact, we do expect to see higher rates of foreclosure liquidation accompanying a settlement from the states’ attorneys general in the context of the robo-signing issues with some lenders and servicers, and this may translate into a higher volume monthly foreclosure resales.”

To see how Zillow’s forecast of the September Case-Shiller indices compared, see our blog post from last month.

To view the original article, visit the Zillow Real Estate Research blog.