You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListHow 2020 Changed Homebuying and Selling

January 26 2021

In the first week of March 2020, hundreds of thousands of home sellers put final touches on their properties before their agents listed them for sale. At the same time, a new and deadly coronavirus strain was sweeping the globe. Within a matter of weeks, home sales would plummet to their lowest levels since the housing crisis of 2007, and by year's end, 2020 changed homebuying and selling in drastic ways.

In the first week of March 2020, hundreds of thousands of home sellers put final touches on their properties before their agents listed them for sale. At the same time, a new and deadly coronavirus strain was sweeping the globe. Within a matter of weeks, home sales would plummet to their lowest levels since the housing crisis of 2007, and by year's end, 2020 changed homebuying and selling in drastic ways.

A Shift in the Active Season

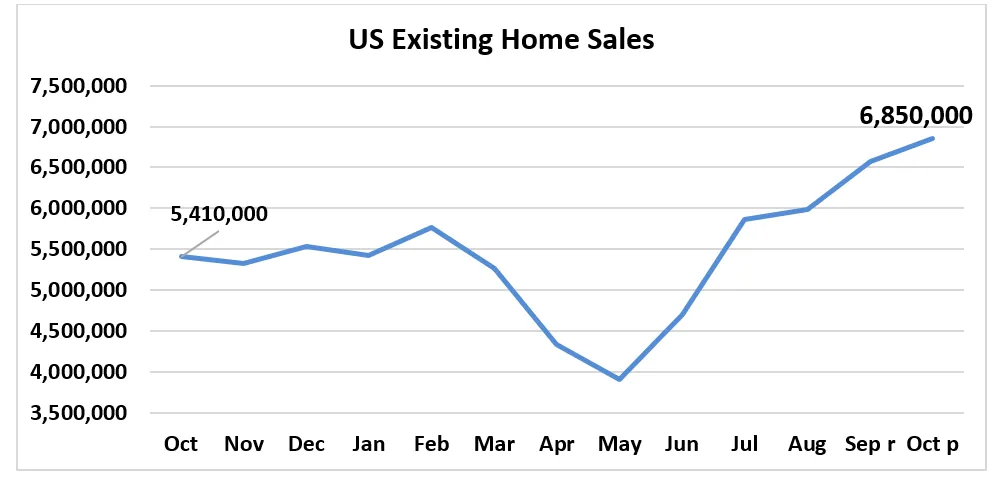

On the eve of what is typically the busiest real estate season each year, lockdowns and shelter in place orders shut the nation's economy down overnight. By April, new listings were down 40%, and thousands of new sellers who couldn't wait for markets to settle down significantly underpriced their homes. Nationwide, home sales dropped to their lowest levels since the housing and financial crisis over a decade prior. Soon enough, however, free-falling housing markets began to stabilize.

Source: National Association of Realtors

A flood of young, first-time buyers – many of whom had saved years for a down payment and were not intimidated by the challenge of buying amid lockdowns, bought while rates were at record lows. So many purchased in April that the first-time buyer share of sales rose from 32% to 36%.

By August, more homes were being sold than before the pandemic. October's sales of existing homes were 26.6% higher than they were in October 2019, and the national median home price reached an all-time high.

Virtual Real Estate Tools

Selling homes typically involves showings, appraisals, contracts, and closings, where buyers and sellers meet to sign documents to complete the deal. All of these involve face-to-face interaction.

Prior to the pandemic, innovators had created new ways to use technology to sell and buy homes remotely. These virtual options were usually seen as "nice-to-haves," but not necessarily integral to the buying process. But, when the pandemic hit, real estate agencies quickly adopted these methods to make real estate transactions possible and counteract the severe decline in physical tours.

Virtual showings – some in 3D with exterior shots from drones − allowed buyers to tour homes from their computers and follow up with their agents for answers to questions.

Relaxed Appraisal Requirements

Appraisals usually require access to a home's interior, but pandemic restrictions and safety measures interfered with this process. To keep the market moving, mortgage lenders, with permission from Fannie Mae and Freddie Mac, began using exterior-only appraisals and electronic signature options. Satellite photos became tools of choice to examine the condition of roofs and the quality of landscaping, while e-notarizations like DocuSign spiked in use. Many e-closings now take place in areas like parking lots, with cars parked together so buyers and sellers can simultaneously review, exchange, and sign documents.

"We are learning to work in a totally different environment than before," says Barry Storch, president of the Pasadena Foothills Association of Realtors. "Virtual training, virtual education, and virtual events have shown us that we are flexible and eager to learn new technology and basically learn to do business in a brand new way. We are living life and work experience like The Jetsons!"

Coronavirus Clauses

Standard real estate contracts contain force majeure clauses that protect buyers and sellers from their contractual obligations should circumstances beyond their control, such as natural disasters, arise. Real estate agencies have changed their contracts to add contingency clauses that allow either party to postpone a closing or even back out of a deal without penalty if COVID-19, or any future pandemic, were to be the cause of such actions.

These protect both parties from such pandemic-caused delays as a title search or an appraisal that was inaccurate or delayed by the pandemic. "There might be delays – bank delays, title company delays – with everything that's going on," Gov Hutchinson, assistant general counsel at the California Association of REALTORS® (CAR), told Mansion Global. Hutchinson helped draft a coronavirus amendment that is now available to all of CAR's 200,000 members.

Coronavirus clauses will probably become permanent additions to standard real estate contracts. Real estate agencies may also add similar force majeure clauses may to protect buyers and sellers from the effects of global warming, such as forest fires and rising sea levels.

More Timely Market Data

2020 changed homebuying and selling for consumers, but it also forced market economists to develop faster reporting methods.

From contract to closing, transactions typically take six to eight months. Sales, prices, time on market, and other vital data are not final until closing. Real estate data traditionally are gathered and released every month to track these metrics, and for most purposes, this has proved to be adequate. Most prices don't change from contract acceptance to closing, and fewer than 5% of pending sales fail.

However, during the earlier days of the pandemic, real estate economists and analytics companies developed several new ways for buyers and sellers to track market trends faster than pending home sales. These included:

- In early March, NAR began conducting and releasing weekly "flash" surveys of Realtors and released weekly reports.

- ShowingTime, a service providing lockboxes for real estate agents, initiated monthly reports on lockbox access, using its monthly report to track regional and national buying activity during the pandemic.

- SentriLock, a leading maker of digital lockboxes for home sellers, launched a service that enables buyers to tour vacant homes without an agent being present. It also began publishing a monthly Foot Tracker report based on Sentrilock data to measure buyer interest.

Flash surveys and weekly reports ended when housing markets stabilized in June. However, real estate consumers can still find more current data than traditional monthly market reports at NAR's Pending Home Sales and Weekly Housing Monitor, along with ShowingTime News, Weiss Analytics' weekly Ticker, and Sentrilock's Foot Tracker Report. Some state and local real estate associations, MLSs, and many local brokerages publish weekly reports on local markets.

Changed for Good?

With all the changes consumers and industry professionals have had to embrace, it leaves many wondering: Did 2020 change homebuying permanently? Right now, it looks like some changes might last longer than others, and most will remain as options for agencies even after the pandemic subsides. The "coronavirus clauses" amend the current force majuere clauses and will remain in standard contracts, while exterior appraisals will continue to be available for refinances. It's hard to know how many agencies will continue to offer virtual showings and e-closings, so it's something to monitor as 2021 progresses.

Steve Cook is the editor of the Down Payment Report and provides public relations consulting services to leading companies and non-profits in residential real estate and housing finance. He has been vice president of public affairs for the National Association of Realtors, senior vice president of Edelman Worldwide and press secretary to two members of Congress.

To view the original article, visit the Homes.com blog.