You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to List5 Simple Steps to Scale Your Real Estate Business to the Next Level

January 21 2021

Aren't you tired of being too busy?

Aren't you tired of being too busy?

If you're drowning in work, can't give your clients the attention they deserve, and can't find free time for yourself or your family, that's a good indicator it's time to scale your real estate business. By scaling your business, you can reassess your processes and create the infrastructure necessary to properly manage and facilitate its growth. If you scale successfully, you'll increase your income, have more time for clients, family, or yourself, exert less energy on less important tasks, and ultimately increase your market share in your area.

In this article, we'll show you five steps to scale your real estate business:

1. Evaluate Your Real Estate Business and Plan to Scale

To begin scaling your business, you must evaluate your real estate business and its historical information first. By reviewing your past sales, expenses, amount of work/hours spent working, task priorities, and marketing metrics like page visits/clicks/conversions, you can assess your numbers to forecast your future performance. Since your historical information is the foundation for forecasting your future sales/profits, your projections will be more accurate if they are more detailed and thorough.

A. How to Forecast Your Real Estate Business's Annual Sales Growth

Let's say you've been in the real estate business for three years. You have three years of performance data like sales, expenses, profits, and marketing metrics that you can use to forecast the future. To get the most accurate data, use your month performance data and its sum to determine your annual performance.

After you've determined your Average Sales Growth Rate, you can use it as a constant for growth to forecast the amount of potential future revenue. For example, if you earned $1,000,000 of Revenue in Historical Year 1 and $1,100,000 in Historical Year 2, your Average Sales Growth Rate would be 10%. To forecast Year 1's Revenue, simply multiple Historical Year 2's Revenue by the Average Sales Growth Rate 10%, then add the result to Historical Year 2's Revenue:

- Year 1's Revenue Forecast = (Historical Year 2's Revenue x Average Sales Growth Rate) + Historical Year 2's Revenue

- $1,331,000 = ($1,210,000 x .1) + $1,210,000

Finally, complete these steps for Year 2 through 5:

- Year 2's Revenue Forecast: $1,464,100 = ($1,331,000 x .1) + $1,331,000

- Year 3's Revenue Forecast: $1,610,510 = ($1,464,100 x .1) + $1,464,100

- Year 4's Revenue Forecast: $1,771,561 = ($1,610,510 x .1) + $1,610,510

- Year 5's Revenue Forecast: $1,948,717 = ($1,771,561 x .1) + $1,771,561

Therefore, your real estate business's revenue would increase by $617,717 over five years at a constant growth rate of 10% and $1,100,000 base revenue.

Since real estate is highly influenced by seasons, use the difference between monthly growth rates instead of the annual growth rates to calculate projections more accurately (March Historic Year 2 – March Historic Year 1 = March Sales Growth Rate).

Based on this information, you can determine the amount of monthly and annual transactions and their average prices required to hit a certain revenue or growth goal.

B. How to Forecast Your Real Estate Business's Expenses

Your business expenses are the costs associated with running your real estate business. You should have a separate bank account to keep your business and personal costs split up – it's much easier to manage and track your budget this way.

The most accurate way to forecast your expenses is by following a similar process as the Sales Growth Forecast step above. First, calculate your historical monthly expenses for the past two years. If certain fees are paid annually, divide them by 12 months to calculate the monthly expense. Then compare the historical expenses for Historical Year 1 and Historical Year 2 to calculate your Expenses Growth Rate:

- Expenses Growth Rate = (Historical Year 2 Expenses/Historical Year 1 Expenses) – 1

Once you've calculated the Expenses Growth Rate, you can use it to calculate the Expense Forecast for Year 1:

- Year 2 Expenses Forecast = (Year 1 Expenses x Expenses Growth Rate) - 1

Alternatively, you can estimate your Monthly Expenses and Expense Growth Rate to calculate a less accurate 5-year Expense Forecast. Note: If you choose to estimate your Expenses Growth Rate, it is better to overstate and have extra budget than it is to understate and have run out of budget early.

Some real estate business expense include costs associated with: office overhead, phone, vehicle, productivity software, marketing, education, training, commissions paid out, business meals, travel for work, general business, licenses, fees, and other expenses that help you do your job. Again, be as detailed, accurate and as thorough as you can if you want to the most accurate forecast. Many of these business expenses are tax deductible, so you get a hefty tax refund by tracking your spending in detail and reporting it to the IRS on your taxes.

With this information, you can properly budget, find the necessary amount of funding, etc. over the next five years.

C. How to Forecast Your Real Estate Business's Profits

After you've calculated your Sales Growth and Expense Forecasts, you can use those results to estimate your Profits Forecast. Your Profits Forecast can be calculated by subtracting your Expenses from your Revenue. By creating a 5-year Profits Forecast, you can paint a picture and more accurately predict the growth of your real estate business.

2. Get Funding to Finance Scaling Venture

You know what they say about making money—you must spend money to make money. The amount of money needed to finance your scaling venture will depend on your plans, strategies, and goals. Your scaling expenses include purchasing new software that can manage your growth volume, staff to run non-related real estate tasks like accounting, a new building to house your real estate business, and other costs. With a little research and calculations, you can forecast your business expenses to help you reduce risk for investors and procure the necessary funds to cover those costs.

A. Yourself (Bootstrapping)

Perhaps you've been saving for a vacation and have some extra cash lying around. If you do, you can use it to finance your scaling venture. Alternatively, you can provide ancillary services, similar to a side hustle, to increasing funding too. If you invest in yourself, give yourself a loan that you will pay back by a specified date.

B. Family, Relatives, and Friends

Mothers, fathers, uncles, aunties, brothers, sisters, spouses, grandparents, and friends can help you finance your scaling venture. Acquiring money from these sources can be easier if you have a good relationship with them. Regardless, you should paint a picture of your businesses' growth potential when you pitch your scaling idea in order to reduce the perceived risk by the investor. You can communicate your growth potential by calculating your sales, expenses, and profits forecasts for the next five years along with a comprehensive scaling plan and a payback plan with interest.

C. Lenders

A lender is like your business partner who can help you finance projects— like scaling your real estate business. To help you find the best option, research at least three lenders when you shop around for one. Give them your sales, expenses, and profits forecasts to show them your growth plan, the amount of profits you'll incur, and the amount of time it will take to pay them back. If you're prepared with reports like these, you'll have more leverage to negotiate a lower interest rate for your loan. Typically, they'll have set interest rates for these types of loans and create a payment plan, but that will vary per lender.

After evaluating your business for scaling and growth opportunities, the second step to scale your real estate business is to acquire funding to finance your scaling venture. Getting the money is easier and reduces the perceived risk by the investor if you can paint a picture of your scaling plans and goals. You can construct this picture by calculating your sales, expenses, and profits forecasts along with your strategies to grow. Once you acquire funding, you can use it to enhance your infrastructure by purchasing technology and/or staff to help you manage work and scale your real estate business.

3. Establish Infrastructure to Support Scaling

Imagine your client flow doubles overnight. Would your current infrastructure and systems support this influx of new business? Probably not. For the same reason you wouldn't try to fit 100 people into a 10-person boat, your real estate business can't handle that many clients. If your business can't handle an increase in business, your infrastructure and systems need to be upgraded so they have the capacity to manage all the new clients you will generate as you scale your business.

If you plan for growth, you plan for success. That means establishing the right infrastructure to support your scaling venture for real estate business. Before you start planning, ask yourself these questions:

- How will I consistently generate enough leads to hit my GCI goal?

- What systems do I need to support, manage, and track the increase of leads, clients and transactions?

- Is there technology that can support my business' growth and make processes more efficient?

- Will I need to hire staff to help me?

- How will I ensure each client and transaction gets treated with the same focus?

Let's go back to our imagination where our client flow doubles overnight. When brainstorming ideas that support your business if it doubles, you must examine and come up with solutions at each stage of the lead's journey. These stages include:

- Consumer

- Lead

- Qualified Lead

- Client

- Evangelist

Simply put, a consumer is unaware of you or the real estate services you provide – at this stage, the consumer isn't looking to buy or sell a home. They convert into a lead when they engage your brand and give you their contact information – at this stage, the lead is usually interested in your real estate services but are window shopping for a home and are less motivated. A lead converts into a qualified lead when they engage with your brand more frequently – at this stage, the qualified lead will stay on your website longer, open your emails, save listings, and even reach out to you to schedule a meeting. A qualified lead becomes a client once you've agreed to work together – at this stage, communication is frequent, homes are being shown, and offers are being made. A client becomes an evangelist when you dazzle them, help them achieve their real estate goals, and complete the transaction – at this stage, the evangelist is enthusiastic about your services and recommends you to their network.

For your business, that means focusing and upgrading systems that support:

- Lead generation (consumer to lead)

- Follow up, tracking and nurturing (lead to qualified lead)

- Conversations (qualified lead to client)

- Client/transaction management (client to evangelist)

To generate more leads, you can increase your ad budget, diversify your lead sources, or farm new territories. You can upgrade your follow up, tracking, and nurturing systems by automating them with personalized messages that provide value and send at the perfect time. You can elicit more conversations by implementing a system that notifies you when a lead displays red flag behaviors that signal their readiness to be contacted.

4. Use Technology to Scale Efficiently

Isn't technology wonderful? With all the technological advancements that have been made in just the past twenty years, we've gained the ability to access any song, movie, book, or piece of information instantaneously; have face-to-face conversations with humans across the global; and automate repetitive tasks so we can focus on more meaningful responsibilities. Technology allows us to perform our jobs effectively, more efficiently, and with less errors and labor. Technology is the tool that can propel your business to the next level and is key to scaling your real estate business.

Real estate professionals that use technology to scale their business should focus on automation and integrated systems. Why? Because they help you create more efficient processes. Automation will help you reduce manual work by completing repetitive tasks more efficiently and at a lower cost. Most importantly, since automation will manage many time-consuming tasks, you'll have more time and energy to focus on clients or your family. Using integrated systems will help you centralize contacts and other information, making it easier to access and manage.

Examine your real estate business and search for areas to implement technology to help you support more volume, more efficiently. Then break those areas down into tasks and decide whether that task can be automated. These areas include business operations like marketing, sales, client management/services, accounting, and human resources.

Integrating your systems and tools will help you stay organized and work more efficiently. Your system should, at a minimum, combine your CRM, listing management tools, emails, texts, lead tracking, website, social media tools, real estate marketing tools (e.g., home search, CMA), and automation tools. Systems that link together, such as your MLS to your website to transfer listings or from third parties like Zillow to forward leads, centralize information, decrease the amount of places needed to log into, information you must remember, and data you must transfer.

In addition to software, you may also need to invest in hardware like phones, computers, tablets, printers, fax machines, etc.

5. Build a Team to Scale

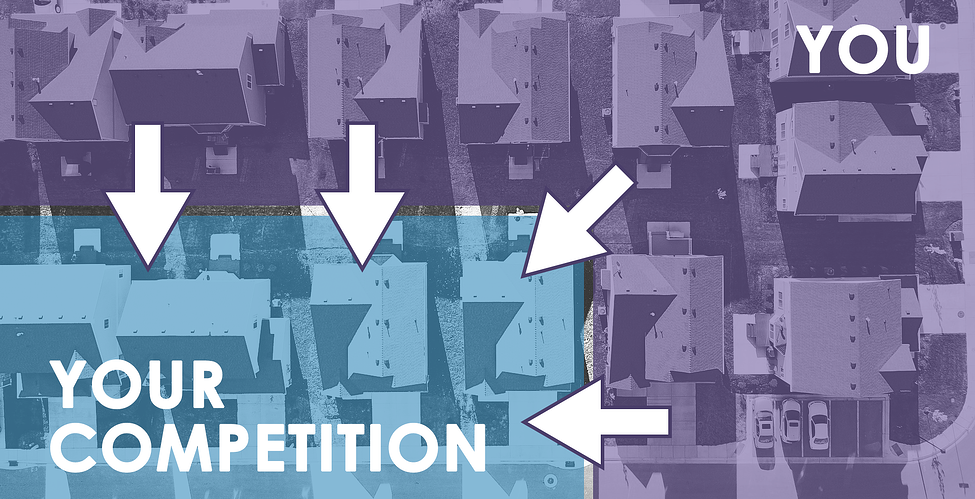

Technology can give you the upper hand against your competition, but you might need to hire people to manage the technology, excess clients, and/or other aspects of your real estate business as needed. A strong business is built around people with varying strengths that can contribute in ways that you might not be able to or want to.

What are your strengths and weaknesses? Which tasks can you delegate? These questions will help you focus on your strengths so you can do what you're best at and focus less on your weakness.

Now, imagine a world where you can focus on real estate tasks like your clients and less on time-consuming administrative/operational tasks like accounting, lead management, digital marketing ads, and social media. This world can be a reality if you hire the right staff.

A. Recruiting and Hiring

- Create realistic goals around when and who you'll bring on as team members

- Prioritize recruiting around positions that will have the greatest short-term impact when starting your business.

- Have a repeatable system for interviews and onboarding – building a team is no different than other key systems in your business, like lead generation or conversion.

- Onboarding and training are as important as making good hires

B. Reverse Engineer Your Success

- Your business will be built on your experiences and the systems you have in place to be successful.

- How do you take those plans and make them work for multiple people?

- Set goals/expectations from the outset, and plan on being involved in finding ways for your team members to achieve them.

- Remember – a goal that can't be measured and documented is just a wish.

Your staff can be a competitive advantage if you have a quality hiring process. Not only can they make your business better, but they can give you the free time to work on tasks that you want to. If you can hire reliable employees that you trust, you can decrease your weekly hours and spend more time with your family.

To view the original article, visit the Zurple blog.