You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListWhat Real Estate Stocks Suggest about Life after Shelter-in-Place

May 06 2020

If you are an active trader in the stock market who purchased shares during the free fall, you may have witnessed the greatest gain in 30 years. Many real estate stocks rebounded quite nicely, but others still have much to gain. For the purposes of this article, we are choosing the two-year chart.

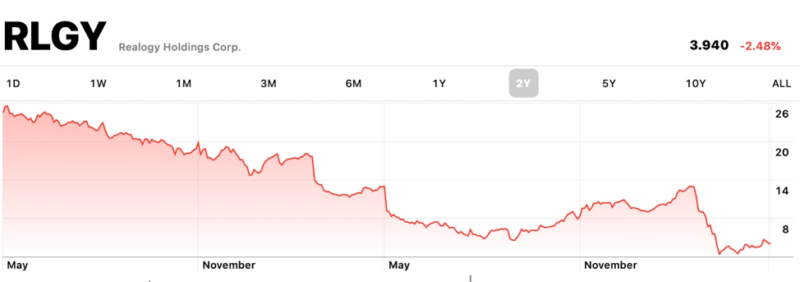

Most to Gain: Realogy (RLGY)

Realogy dropped to a low of $2.90 per share. Before shelter-in-place orders (SIP), Realogy had a high of about $14 per share and traded comfortably around the $10 mark. At today's prices around $4 per share, this is a buy that should easily recover to $6 per share or higher. A looming concern is Realogy's debt load – but with low rates and refinancing incentives, liquidity should not be overly troublesome. Remember, Realogy is a bit of a hybrid, owning brokerages and franchises.

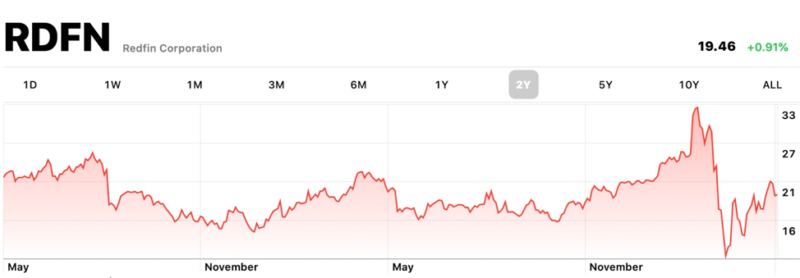

Fastest Recovery: Redfin (RDFN)

Before SIP, Redfin traded pretty comfortably in the range of $16 per share. Today it has shown the checkmark type of rebound that many did not expect until after SIP is lifted. The stock's 52-week high is $32.77 per share, but only traded over the $21 range for a handful of months. In trading today at $19.46 per share, Redfin has mostly recovered the steep losses. Redfin is mostly a real estate brokerage with emerging home services service lines.

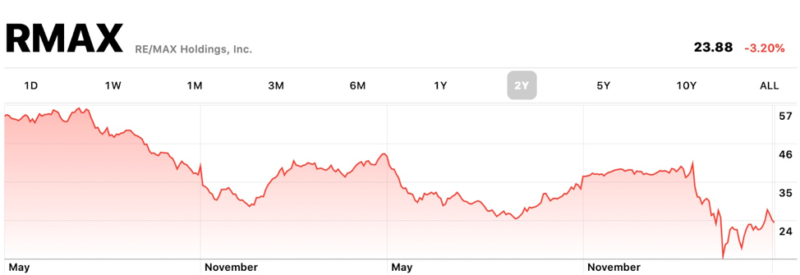

Strong and Steady: RE/MAX (RMAX)

Shares of RE/MAX are hovering around the $23 share price, up from lows of $14.40. In looking at the summer trough between June and September last year, the stock traded comfortably in the $25 to $30 range.

There is some upside to RE/MAX with a long forecast that will take it up closer to the $30 range as recovery shapes up. RE/MAX is mostly a franchise organization.

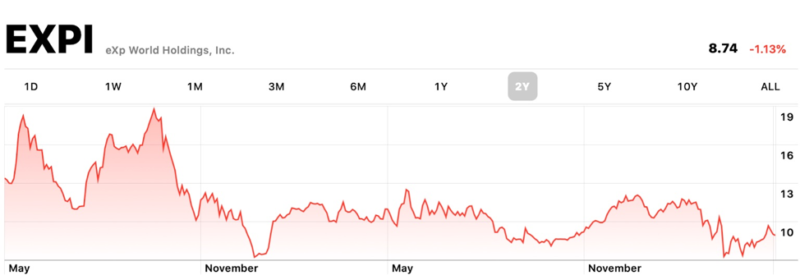

Follow the Bouncing Ball: eXp (EXPI)

As you can see from the chart, shares of eXp tend to trade with more volatility than many other stocks in this article. The company has been growing very significantly in both agent count and dollar volume, but the stock has not tracked with those benchmarks. The stock is trading off its 52-week highs of $12.55, but is really close to the $10 price that represented the pre-SIP floor. It was a soft stock last summer from August to November, when it dropped down into the range it is trading at now.

As a brokerage, eXp is a lot more like Redfin. More than Redfin, eXp was perfectly positioned for SIP with their virtual brokerage concept that has agents working from home all of the time. As a virtual brokerage, their SIP losses should have been dampened, and they mostly were – dropping to a low of $6.51. But surprisingly, investors did not pile into the stock given that they do not need to modify their business at all to adapt to post-COVID operational styles. It's in their DNA. The stock should rebound back above the $10 as soon as business returns to normal. If this stock is picked up by more institutional investors, that could lead to steady gains and lower volatility.

All information on this page is personal opinion and not direct financial advice.

To view the original article, visit the WAV Group blog.