You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListWhy Isn't Redfin Bigger?

April 21 2019

In the Beginning...

Ten years ago, if pitched you a company that is building a fully integrated technology platform in the real estate sector and would soon have hundreds of millions of visitors to its website annually with so many leads it passes them off to agents at other brokerages, you'd probably open your wallet to invest.

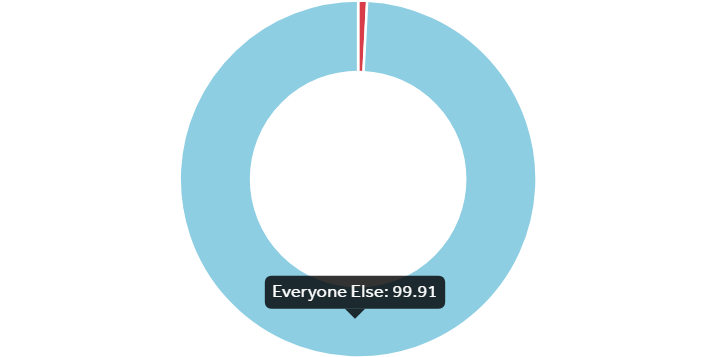

If today I told you that company has a less than one percent market share (0.81 percent by value of homes sold per Redfin), you'd likely be disappointed. Why? Because with all the tech, capital, leadership, and traffic, Redfin has been unable to meaningfully take market share across the country.

Per Redfin's 2018 Year-End Financials

This may be due to two reasons:

- The company's business model lends itself to less experienced agents, which its compensation model continues to support

- The company has an execution problem when it comes to converting traffic to business

The Redfin Model

We've previously discussed at length the pros and cons of discount brokerages and salary-based compensation. Suffice to say, Redfin's salary and review-based bonus is appealing to less experienced, part-time, and often sub-par agents.

Why? Because commissions act as incentives that, when done correctly, align the interests of both the agent and the client. We've also discussed at length the commission model, so I will leave that for alone for now. Redfin counters this lack of incentive by basing bonuses on reviews.

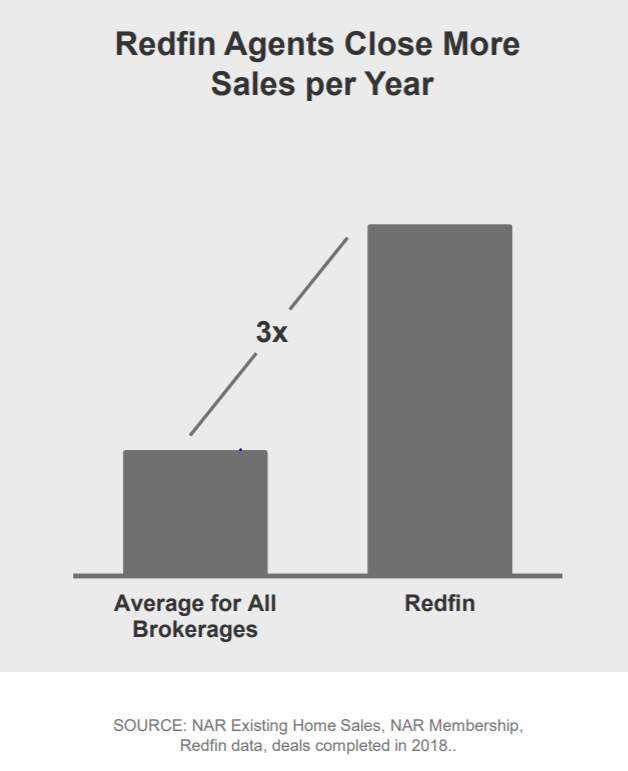

Again, there are numerous issues with reviews as a scoring mechanism — mostly related to the fact that reviewers tend to operate at the margins, meaning generally only those who have extreme views (one way or another) tend to opine. Even with required reviews (Uber), it is challenging to derive meaning from a user review—especially in a low-frequency environment. How reasonably can we judge quality based on 6-12 reviews per year? Redfin agents, to counter this argument, do partake in more transactions per year, but of course each agent handles only part of the transaction in many instances, adding noise to the review system.

- More on This Subject: How iBuyers Die

I am not doubting that knowing you're being reviewed by the client at the end of the transaction bears meaning to the agent, but how much weight can you put on them? More meaningful, however, is the fact that being paid a salary puts the onus on Redfin to cut ties with underperforming agents. This matters when comparing to traditional brokerages where underperforming agents are forced out more naturally (they simply just don't make any money). This, however, appears not to play out as much as expected, given the commonly known shape of the industry that follows the Pareto principal: 80+ percent of the earnings are earned by 20 percent or fewer participants. Too many underperforming agents are still licensed.

The first argument any non-Redfin agent makes is that their discount model counterparts are simply subpar agents. The fact that Redfin pays a salary means that agents who elsewhere would not be earning a living (and therefore exit the industry) can make a living and remain in the profession. Aside from compensation, in talks with many, many agents who have worked with Redfin agents on both sides of the transaction, it has become clear that many feel clients can lose out on the savings offered through Redfin's discounted rate via the agent not maximizing an offer, not being shown a listing, etc. These are the implicit costs of doing work with a Redfin agent.

Let me pause here because this of course is entirely anecdotal, and non-Redfin agents should, to an extent, downplay the value-add of competitors. The truth is a lot has gone right for the company as well — they're the only brokerage with any sort of branding power, and that matters. Again, how much it matters is an open debate when looking at the company's historic inability to translate traffic to customers.

So let's forget everything I just said and focus on something that is measurable, because there are absolutely plenty of high quality Redfin agents. The brokerage simply wouldn't exist if that were not true to some extent. So if not quality entirely, is it quantity?

Execution Risk

We dove into detail execution risk when looking into iBuyers, and in that piece I posed a similar question to Redfin: How can a company with so many leads and so much traffic fail to meaningfully grow market share?

This points to a significant gap in churning traffic into cash. Zillow has figured out the lead-generation machine (as it continues to figure out the workflow as an iBuyer and mortgage provider). Redfin apparently has not.

What does this mean? It means simply that buyers still value using high quality agents, and that those agents are not Redfin agents, or consumers do not believe them to be. As great as Redfin's technology may be for consumers, it doesn't make a difference when they're considering with whom to buy or sell. Add to this the fact that more and more consumers are using Zillow and Redfin to find a home, then finding and using an agent either elsewhere or when properties have been selected.

Every large brokerage is racing to develop an integrated platform Redfin seems to have developed best. Therein lies an irony: spending too much time and resources developing back-end technologies that primarily benefit brokers risks leaving out benefits to the ultimate end-customer: consumers. What good are leads if they don't convert to closed sales?

This is why iBuyers are a serious threat, despite the advances of technologies such as KW Command — they're focusing on the consumer, and whoever wins with the consumer wins the game, that's it. No amount of AI-based marketing will matter if it's not being seen or engaged with. The rub, of course, is that brokerages need to focus on tools for their brokers; they need tools to manage the back of the house. Companies that are "agent-light" and don't employ agents, but provide benefits to consumers, do not have to worry about that. The issue there? Consumers are not giving up on agents. This is why Zillow, Opendoor, and others are retaining the agent within the nucleus of their business model. Wonder why Redfin isn't growing leaps and bounds? Look no further than the gap that exists between its technology and its agents.

The Ultimate Business

What does the ultimate business in real estate look like? Is it Compass? Is it Zillow? Google Homes? Amazon Agents? We don't know yet, but with the timeline to innovation shortening (Zillow as a mainstay took about 10 years, we're likely looking at a five-year period to whether or not iBuyers are for real), we should know the answers soon. We do know, however, the requirements:

- Integrated Backend: CRM + Marketing + Analytics + Reverse Prospecting shared across agents that allow for easily creating marketing campaigns, tracking effectiveness, and managing through a CRM.

- Lead-Generation Machine: A unique way to generate both high quality and high quantity leads.

- Consumer-Facing Tech: Engaging technology to help buyers that includes real-time MLS listings and notifications, messaging, and the ability to understand buyers' activity.

- Advanced Tools for Sellers: CMAs, the ability to connect with a buyer's agent when a buyer shows interest, and competing reasons to list with an agent than sell to an iBuyer.

The Holy Grail of real estate technology is one everyone in the space is demanding. Given the above, there are some obvious reasons nobody has been able to achieve it yet. Given the coopetition necessary in real estate, it's hard to imagine one firm building a world-beating technology platform because it can only purposefully serve one brokerage. Brokerages may be best served sharing data and insights among each other, as they do with many technologies offered through MLS associations.

How much value would LinkedIn have if it was owned and managed by only a single recruiting firm, with only its own job seekers?

A similar challenge exists on the consumer-facing side, as consumers benefit from more free flowing information (pay attention, MLSs!) and competition. This means an ability to more easily find and compare agents and evaluate their offerings.

From a marketing perspective, agents are likely best served dropping marketing efforts that focus on their sales volume, brokerage ranking, and listings because consumers don't care, have no brand loyalty, and with so much of those, they become white noise, respectively. We are strong advocates of inbound marketing that provides more meaningful content to consumers in order to create an impression and generate an audience.

So What Should Redfin Do?

How can Redfin grow? Look no further than high performing teams. What commonalities exist? They're well-branded (check), have a roster of agents with deep expertise and intimate knowledge of their local markets tied together with strong relationships (not check), and in general tend to be more willing to adopt technology that supports more specialized roles (sorta check).

Redfin has dominant branding power, and is one of the few in the industry that can claim that. What may work against Redfin, however, is the same brand is viewed as a big-box retailer and a brand that doesn't strike consumers as local. Would Redfin be better off franchising or re-branding to better suit local markets? This would be a worthy and interesting experiment.

Quality agents are always necessary for success. Gone are the days where agents are critical to the home search, so growing headcount translated to increasing top and bottom lines. "Discount" often connotes "low quality" and it's very likely, given the above, that Redfin's agents are simply getting beat by better agents in their market. Could a more traditional compensation model work better? A hybrid or something new? Hourly?

One thing Redfin does is attempt to spread the transaction across different people to promote higher quantity. On the downside, this means consumers often working with multiple people (annoying) as opposed to a single contact. Redfin may be better off going all-in on a team model that truly creates specialists but retains a single point of contact - almost like 'hubs' within local markets.

We are at inflection point in the industry, and while a lot of players have come into the space, there has yet to be a significant change in the business model and economics. We have seen the foundation begin to shift, however, with Redfin and Zillow leading the way. How will this play out? We shall see, but we at least know that nobody has yet been crowned king.

To view the original article, visit the Homebloq blog.