You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListHow Many Houses Should Buyers 'Date' Before They Settle Down?

February 14 2019

The 37 Percent Rule

How many people should you date before you commit to one? What about candidates to interview before making a decision? Parking spots to pass by before choosing?

How many homes should buyers look at before submitting an offer? How many offers should they review before accepting?

As with any decisions where comparisons are being made, committing is scary. If you commit too soon, you risk out on a better option down the road. Too late, and you may have passed up the optimal choice. Thankfully, there is a simple mathematical rule that may help home buyers consider how long to search and when it's time to decide.

Known most commonly as The 37 Percent% Rule (nerd alert: contains math, here's the friendly version), it helps define the minimum number of options one needs to review before making an informed decision. The challenge, of course, (using dating as an example) is suitors don't simply line up at the same time, instead arriving in random order, making comparisons more challenging. The second challenge is the fact that once you've declined one, you often cannot go back to them later. So how do you make the best choice?

Turns out it's pretty simple: you reject the first 37 percent of lifetime suitors (assuming we know that figure—more below) and then pick the next person. Of course, this is just a heuristic and not a perfect solution and relies heavily on being able to guesstimate how many potential suitors there are for you out there—but mathematically speaking, it is the optimal solution.

Could we apply this to real estate, knowing how many homes on average a buyer visits to know when a decision should be made? How about sellers, given a likely range of offers and the cost of waiting?

Application to Home Buyers

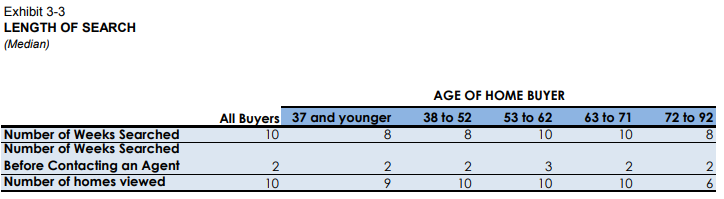

According to NAR Research, buyers aged 38 to 71 view a median of 10 homes. Applying the rule of 37 percent makes the optimal decision time 3-4 homes into process. How realistic is this and how does the ability to do more side-by-side comparisons via Zillow affect this paradigm?

[Source]

BASE CASE

Taking the study at face value suggests buyers should be able to decide pretty early on in the search. However, given the high risk nature of this decision and the lack of homogeneity among homes, I would expect this decision point to be slightly higher. Boyfriends and girlfriends can be dumped over a text message. A house? Not as easily. This means the decision making process needs to be done more carefully, and over a longer time period. Given the number of homes one will want to see is influenced by many factors, using the estimated length of search may be a simpler task.

The 37 percent rule can also be applied to a timeline. According to the 2018 NAR Home Buyers and Sellers Generational Report, the median length of time buyers searched for a home is 10 weeks, with two weeks searching prior to working with an agent. The rule then suggests letting buyers look for 3-4 weeks without the pressure to make a decision, then jump on the first home that fits the criteria thereafter. As an agent, you likely know a realistic time frame for your clients, and can alter the decision point as necessary.

PORTAL INFLUENCE

Another differentiation in choosing a home is the ability to actually line up homes side-by-side so the order is less random. Almost all buyers start their home search online, viewing multiple homes simultaneously. Even buyers who are physically visiting listings can knock out multiple homes on the same day, devaluing the application of the 37 percent rule.

REALISTIC APPLICATIONS

The most realistic application for a fun study like this is advising clients. Perhaps agents can skip the math but impart the lesson to stressed or anxious buyers that they can relax and not worry about making offers on the first 3-4 homes they see. Similarly, for those clients who insist on seeing house-after-house with no sense of decision making, agents can reassure them that at some point they can be confident they're making a good decision and don't need to wait for the absolute perfect home.

Lastly, this advice is likely geared towards an aggressive seller's market when time is of the essence. On the flip side, encouraging buyers to make decisions faster has no place when time is on their side.

Application to Home Sellers

What about sellers who must decide when to accept an offer? Similarly, how can sellers confidently let offers come and go, knowing they may have passed up the best offer they're going to receive?

Turning down each offer comes with a more explicit cost — another month's mortgage payment, upkeep, staging, etc. According to Brian Christian and Tom Griffiths, authors of Algorithms to Live By (2016), sellers benefit from full information because sellers know the exact dollar amounts of offers (to help rank and decide) and can establish a likely range of incoming offers based on the home's fair market value. Knowing this information means sellers and their agent have a more clearly defined threshold to determine the minimum acceptable offer and can ignore anything below that number.

In a very simple instance, sellers should accept the first offer above the minimum they receive. If sellers don't have to worry about their savings running out, they can be infinitely choosey.

More realistically, however, sellers have to weigh the cost of waiting, and the minimum value is a bit more fluid. The value of passing on an offer comes down to the probability of receiving a better offer multiplied by how much better the next offer is, compared to the cost of waiting (the mortgage payment, for example).

p ≥ 1- sqrt(2c)

The examples provided by Christian and Griffiths provide for a home that has an expected offer range of $400,000 to $500,000, if the cost of waiting is:

- $1 = accept a minimum offer of $499,552.79

- $2,000 = accept a minimum offer of $480,000

- $10,000 = accept a minimum offer of $455,279

- $50,000 = accept the minimum of $400,000

How about a home with an expected offer range of $515k to $550k? If the cost of waiting is:

- $1,000 = accept a minimum of $541,633

- $3,000 = accept a minimum of $535,508

- $5,000 = accept a minimum of $531,291

Clearly, the higher the cost of waiting, the lower the offer you should be willing to accept.

SUMMARY, PLEASE?

Given I'm writing this on a Sunday morning, I'd like to step back from the math for a moment and summarize what this means. While the math (to me) is fun, working with sellers to understand how there is a real cost to waiting and holding out for a high offer can help in making a decision. Alternatively, if sellers have $50,000 in savings and a monthly cost of $5,000 while they are engaged in selling their home, they have at most 10 months to hold out, and more realistically significantly less time as emptying the bank account is not desirable. Associating time with money could help sellers understand their timelines better and move forward with accepting offers. This approach can help take the nerves out of declining or accepting offers.

To view the original article, visit the Homebloq blog.