You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListZillow Is the New Craigslist

February 11 2019

We recently wrote a piece that looked at the lifecycle of marketplace startups, specifically as it relates to real estate technology. A key theme is that the incumbents, most notably Craigslist, spawned a slew of companies that focused on a single vertical and benefitted by going deeper to provide a better consumer experience.

Today, there exists a similar emergence when looking at Zillow—successful companies and applications are being developed by focusing on certain features within its platform. The question is, are companies that offer more singular value, but perhaps do those few things better, better off than a platform like Zillow that can offer more components of the transaction in a single place?

It depends on who the user is—a consumer or a professional.

Those Who Try to Do It All...

You know the saying — those who try to do it all rarely do anything well. Craigslist, eBay, Yahoo! and other early internet enterprises benefitted from using technology to establish a two-sided marketplace, where the value and competitive advantage arose from the interactions among the platform's users. Slowly, companies began to carve out portions of Craigslist and build more in-depth, consumer-friendly, and niche-y offerings (and many of them exceedingly well):

The Craigslist Carve-Up [Source]

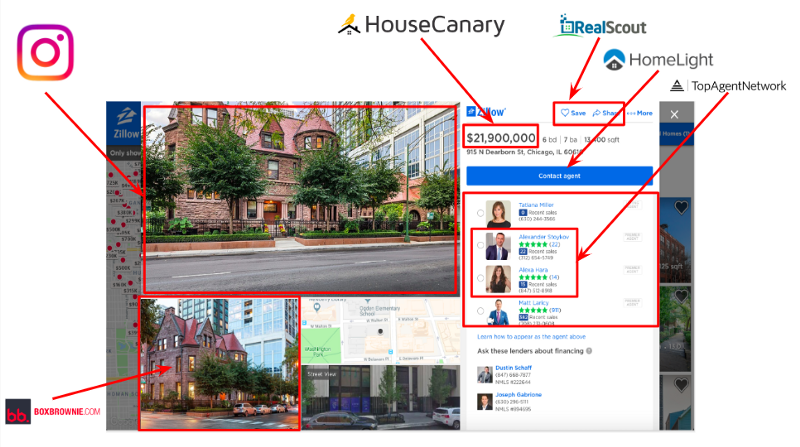

Looking at Zillow, it's easy to identify a few of the main areas of dissection:

- Photo Editing and Sharing (BoxBrownie and Instagram)

- Sharing Listings (RealScout, Homesnap)

- Valuations and Analytics (HouseCanary)

- Agent Referrals (Radius, Homelight)

- Agent-to-Agent Connections (Top Agent Network)

Not unlike how investors did not react well when Zillow announced it had purchased a mortgage originator to take the company deeper into the transaction, those who stray from their core competencies often times invite unintended risks.

"Zillow shares hammered, stock falls 16% after purchase of Mortgage Lenders of America." — Geekwire, August 17, 2018

A key difference between Zillow and Craigslist, of course, is that all of these features are funneled back into the Zillow platform because they're all related to the same offering — buying or selling a home. If someone builds out a better car washing service, it has no effect on the dating portion of Craigslist (to an extent, the traffic to Craigslist does — more below on this impact to Zillow). However, there are potential risks for Zillow.

Homelight, which we have discussed in the past, offers competition to Zillow's Premier Agent program by offering to recommend and connect consumers and agents. If consumers find value in Homelight's matching algorithm, they are less likely to click through on a Premier Agent advertisement. Similarly, if companies like Homesnap are successful in drawing consumers away from portals, the value proposition of Zillow is eroded.

Should Zillow focus on establishing a competitive advantage within its features? Fortunately for Zillow shareholders, the answer is essentially no.

Single Features Do Not Extract All the Value

At Homebloq, we're big believers in the value of platforms. By that, I mean a technology that focuses on two-sided marketplaces where the value is promoting connections—in our case, between consumers and brokers and between brokers themselves. Similarly, while Zillow doesn't do everything well, it provides enough overall value by configuring the necessary components.

On the flip side, single-feature apps can often lose appeal and value when it comes to lead conversion. How valuable is your broker website if you cannot effectively engage leads to provide their contact information or set up a search? How much value are you losing posting your listings to Instagram if a buyer can't easily let you know they're interested in the property? This 'heat-loss-during-transfer' occurs when apps are great at generating initial value (leads or traffic), but require brokers to move offline to engage with the lead. Take Homelight again. When matched, the consumers' contact information and survey answers are passed to the broker, and the consumer gets calls from Homelight as well as the broker(s). Having to take that relationship off the platform can kill conversion.

There seems to always be a missing piece in real estate technology. So many apps and tools have some, but not all, of the pieces to the puzzle. Could, in fact, Zillow deliver the ultimate solution?

Zillow the Brokerage: Fact or Fantasy?

Before we hypothesize what it might look like for Zillow to answer the call, it is unfortunate to think back to 20 years ago and the opportunity that stood in front of every MLS in the country: Zillow before Zillow. Ah, what should have been. Between MLS consolidation, whatever is (no longer) happening with Upstream, and business as usual, it's not happening anytime soon.

Given Zillow's enormous brand recognition and monthly traffic across its web and mobile app, what would it look like for the company to flip the switch and become a brokerage? Why would it do it?

Reasons for:

- Leverage enormous monthly traffic and technology to capture more leads than potentially anyone else

- Become the one-stop shop for all things home buying and selling

Reasons against:

- Direct competition with thousands of other brokerages

- Cannibalization of Premier Agent revenue

Public market valuation based on being a real estate brokerage, not a tech company (just ask Redfin, who is a technology leader in the space, and their valuation is similar to Realogy — both of which are half of Compass' private market valuation. It will be interesting to see what value the market places on Compass if and when they go public — tech company or real estate brokerage? But I digress.).

What we have here is basically another Redfin, Realogy, Keller, etc. but with more leads. The issue is it would be corporate suicide to drop the drawbridge over their competitive moat and invite in the competition. Zillow is unique in that they chose to monetize the traffic, not the transaction—for now. Why would they want to handicap themselves by becoming a brokerage?

Is It Compass? Redfin? Keller?

While none of this trio will likely ever admit it, there is a striking similarity among them as each is trying to lead the rat race to becoming the most tech-savvy brokerage. The commonality is the recognition of the importance of an 'end-to-end' platform.

@Properties threw shade at Compass in Chicago [via TheRealDeal.com]

The only one in my mind who could conceivably do it is Compass, only because they have a country's GDP in cash, but the jury is still very much out on their ability to capitalize. At some point, whether it's a massive market correction, another competitor, a bad acquisition or the like, Compass won't be able to rely solely on acquisition to grow. To do this, they will likely have to come down from the luxury market and go for volume (quantity over quality), competing more directly with the likes of Redfin. Compass is also staking a lot of value in both its technology (too early to judge returns on that investment) and branding (hard to argue there's a lot of brand awareness and appeal for consumers who transact so infrequently).

So What Are We, the Consumers, Left With?

Where do we go from here? Consumers are left in a weird spot: there are so many incomplete tools. You can look at homes on Zillow, but not easily engage with your agent. You can benefit from Compass' technology only if you're working with a Compass agent. You can find a lead on Homelight, but then have to rely on nurturing and efforts to convert. More:

- Build vs. Buy - Great agents don't always have the ability to build amazing tech themselves.

- Portal Disengagement - Portals lead to poor engagement with clients

- Business Model Blockage - The most able company, Zillow, to provide a technology to solve this can't become a brokerage

- Intellectual Property as an Advantage - National franchises that have great tech have to hide it

Will Zillow continue to assemble the Death Star, moving deeper into the transaction, and disrupt the industry for which it is the face, or will the white knights of Silicon Valley strip it to pieces and somehow assemble an end-to-end?

To view the original article, visit the Homebloq blog.