You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListComp Talks: Real Estate Agents (Part 1 of 2)

January 09 2019

Real estate agents have faced many challenges in the recent past, including the advent of Zillow and online portals, and now the pressure to reduce fees and/or adopt a fee-based compensation model.

Real estate agents have faced many challenges in the recent past, including the advent of Zillow and online portals, and now the pressure to reduce fees and/or adopt a fee-based compensation model.

The investment advisory industry offers great insights into this transition, as it is one that has been adopting a move to fee-based compensation over the past 20 years. Should the real estate industry follow suit?

Compensation for Investment Managers

Michael Kitces, founder of XY Planning Network, details here how since the late 1990s, the finance industry has undergone a shift from commission to fee-based compensation. Almost gone are the days of advisors incentivized to put clients in certain mutual funds that offer higher commissions and incentive structures based on quantity of clients, not quality of service.

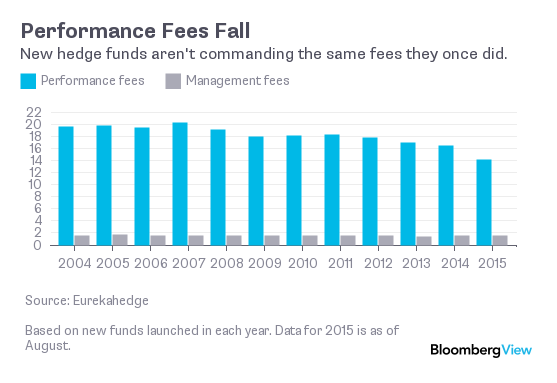

As a CFA Charterholder and asset management professional, I'll admit the allure of working at a hedge fund capturing a 2 percent fee based on the amount of money I manage plus an additional 20 percent of any profits is tempting. Alas, these types of fee structures are quickly becoming a thing of the past as clients have become more aware of both the fact that even small fees can eat up significant profits and the inability for average money managers to justify these sorts of fees.

Fees are falling in the hedge fund industry

The pros appear to outweigh the cons for managers, per Kitces, who claims, "For any individual advisor, though, the reason to transition to doing fee-based advisory...[is] simply because it allows for building a bigger and more successful advisory business."

Due to the fact that advisory relationships are continuous, and not transactional, business growth will always depend on the number of clients, while a "recurring revenue business makes it possible to separate 'selling' clients from the less-expensive process of servicing them."

The Principal-Agent Problem

Transitioning to a fee-based model eliminates the incentive for advisors to take unnecessary risk, do bigger transactions, and sell products that pay bigger commissions to the advisor. In a parallel to the real estate industry, it challenges the conflict of interest for agents to put clients in more expensive homes to boost their commission check (similarly, for mortgage brokers to offer the maximum to a borrower). The flip side of course is it also could remove the incentive to go the extra mile for a client (or outperform your peer).

credit: biggestquestions.com

The far opposite extreme is a salaried position, which would obviously level the compensation across the industry, remove the incentive for excessive risk taking, but also remove the incentive to become a top performer and the ability to differentiate oneself and more easily grow your business (via lower overheard without salaries to pay). Not to mention, this would kill the independent contractor status that, as Cara Ameer notes, allows agents to operate with more flexibility against the trade-off of always being on.

Can This Be Applied to the Real Estate Industry?

The obvious difference between asset managers and real estate agents is that the latter perform a one-time service as part of a single transaction. Financial advisors and other stewards of assets manage money continuously throughout the client relationship. Additionally, financial advisors and money managers generally have a settled payment timeline once a client is acquired (subject of course to certain, more detailed performance based compensation arrangements) whereas real estate agents don't know when or exactly how much they'll be paid (if at all) for their efforts.

The overall goal, as Cara again notes, should be to transition the real estate compensation structure to one that reflects and incentivizes quality and service over transaction volume by charging a professional service fee.

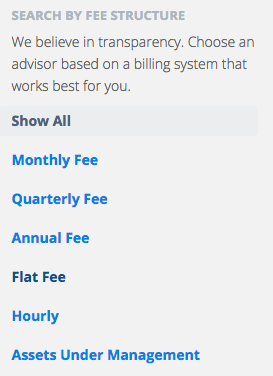

XY Planning Network allows searching by fee structure. Could this find its way into residential real estate?

A closely aligned example is already available in the financial sector: XY Planning Network has created a marketplace for financial advisors that, for a fixed flat, monthly, quarterly, or annual fee (as well as an AUM-based approach) offers virtual advice and consultations.

Viewed in this manner, real estate agents could offer their services based on a tiered scale (for example, 2 percent for the first 100k spent, and an additional 1 percent for every 100k up to some predefined, market-specific maximum) or a flat fee, which is growing in popularity on platforms such as Redefy and Houwzer. An advantage investment managers have is the assets are considered "sticky" because, more times than not, the cost to research another advisor, close and move accounts, and worry about potential tax events outweigh the benefits of actually changing managers. This is less so in real estate, where buyers can more easily look at homes with no commitment to an agent and change their mind down the road (hello, Zillow Premier Agent!).

In a world where the next generation of homebuyers (yes, you, Millennials) expects data fast and information freely, simple service agreements and transparent cost structures will certainly be favorable. The awkward situation of requesting payment for services rendered (i.e., setting up an MLS search or showing listings) without an agreement can be avoided by having an upfront conversation to ensure there is consent and a service agreement, including fees to ensure compensation, is not beyond imagination in the industry (certain legalities are likely to exist that have created challenges for a la carte services).

What Does This Mean for Agents and Brokers?

From one angle, a transition to a fee based model would significantly increase the barriers to entry because the timeline for breakeven would be extended in many cases. While agents who are ultimately unsuccessful the first year or two and pursue other careers would likely be less affected (less % of 0 is still 0), those who are successful would likely see smaller payouts.

Redfin is an interesting case study, given its hybrid model (salary-like compensation and payout based on transaction completion — to be covered in more depth in Part 2). In conversations with real estate agents who work at boutique firms, the perception of this model is that is has lowered the barrier for entry to becoming a real estate agent, which in turn has lowered the quality of agents, service, and reputation. Whether or not that is true, it is hard to argue with the logic from an incentive perspective.

Ultimately, compensation has to be justified by the value added. For real estate agents, none would argue that the work they provide doesn't justify a percentage of the asset, which in this case is the home. However, does an agent who works his or her tail off for a client who buys a $200k house deserve half the commission for one who works half as hard for a client who buys a $400k house? These are similar to the questions that have been asked of investment advisors and it is obvious where the industry has gone. Different skills are differently valued across different times (fresco painters in medieval times, computer programmers today), and while agents will continue to be relevant for the foreseeable future, how they are valued is likely to change.

Compass CEO Robert Reffkin

Aided by technology, home buyers are contributing more than ever to their own buying process, and are likely going to continue to be able to claw back fees from agents to the point where, as Compass CEO Robert Reffkin prophesied, it could result in the demise of the traditional brokerage model. This is likely to be more complicated as the iBuyer market grows (a la OfferPad, Opendoor, and new entrant Zillow), given buying agents will be removed from the transaction and prices reflect algorithmic-based financial buying decisions and lower prices (as opposed to strategic, which more commonly align with consumers).

In the End

It's easy for agents to feel the very real pressure on their job roles as their grip on historically monopolized data (home listings) is no longer theirs, startups featuring artificial intelligence and machine learning threaten to disintermediate their role, and fee compression pinches their wallets.

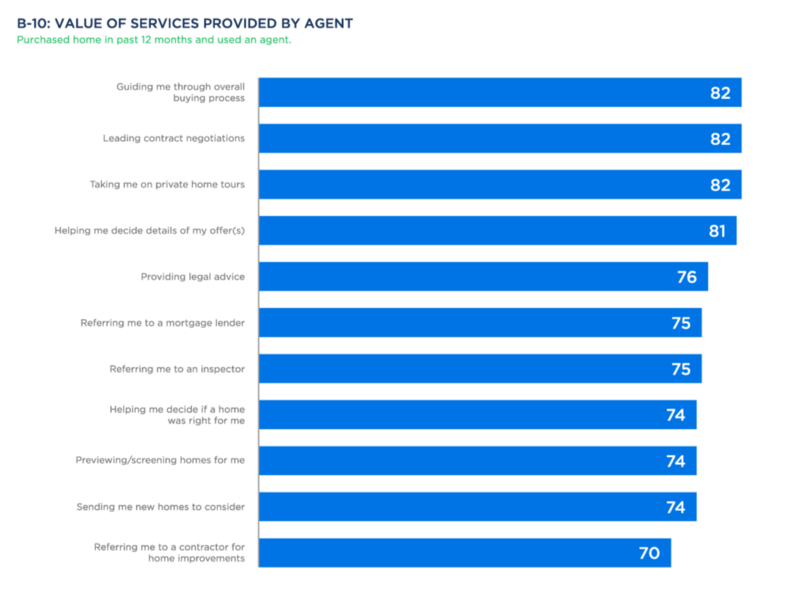

Agents are still a valuable part of the home buying experience (credit: Zillow)

However, studies by both the National Association of Realtors and Zillow confirm this: agents aren't going anywhere. Agents certainly need to continue to adapt to these changes, but those who continue to provide excellent customer service, carve out niche offerings, educate clients, and welcome technology will continue to thrive. It's likely time to seriously add to the list considerations around compensation.

To view the original article, visit the Homebloq blog.