You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to List10 Reasons Why You Should Sell Your Brokerage... or Not

December 26 2018

Today's real estate market is equally primed for those real estate broker/owners who want their company to be acquired by another and for those wishing to acquire an existing company. - Tami Bonnell, CEO of EXIT Realty International

Not among the estimated $2 billion invested in the real estate space last year, according to T3 Sixty, is the continued M&A activity within the space. Tami Bonnell, the CEO of EXIT Realty International, released a white paper suggesting now is the best time for brokerage owners to cash out, and examines the reasons for both acquiring or being acquired.

The Reasons to Buy or Sell

Mirroring activities found within the public markets, historically low interest rates and ultra-competitive markets have forced many owners to consider an acquisition as a means to derive additional competitive advantages. Bonnell lays out the top ten reasons to acquire a brokerage:

- Profitability: Acquiring a more profitable firm than yours has the opportunity to increase overall profits.

- Headcount: Adding new teams of agents.

- Market Share: Acquiring additional market share in your existing location or a new one.

- Increase Management Talent: Join forces with top talent elsewhere.

- Location, Location, Location: Similarly to #3, move into a more profitable, higher growth, or more stable market.

- New Energy: New talent and energy can often boost performance.

- Get Lean: Reducing overhead by consolidating back-office resources.

- Newer Facilities: Like their offices more? Buy it.

- Leverage Existing/Better Marketing: Expand your marketing channels more easily then creating them from the ground up.

- Add Niche or Specialty: A must have for the future, carving our a differentiating factor for your brokerage.

According to the National Association of Realtor's 2017 Profile of Real Estate Firms, 79 percent of brokerages have a single office and average three licenses. It's understandable why these firms feel pressure to, as Bonnell points out, keep up with technology, stay relevant in the market, and maintain adequate inventory to bolster sales volumes.

We've previously discussed how agents who simply do the minimum will earn the minimum (or zero). Adding to this is the fact that, according to NAR's 2017 Member Profile, the average age of a REALTOR is 53, with just 4 percent under the age of 30. This no doubt fastens down the challenges of adopting relevant technology and balancing growth with stability needed with retirement around the corner.

But is it really the best route?

Not So Fast

As a student of finance, it's hard to ignore the well known downsides to mergers and acquisitions. Namely, the cyclical nature of markets and the fact that synergies between firms are not always realized.

Cyclicality

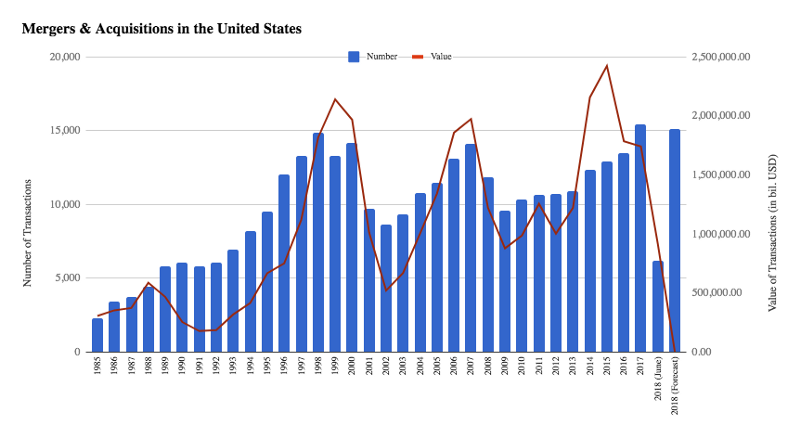

Markets by nature are cyclical. Booms and busts are inevitable, and while the US economy is certainly thriving (by most standard metrics), we're likely not at a risk of near-term bust. However, M&A activity and talk does appear to ramp up near the peaks of market cycles:

[Source]

As you can see, M&A activity peaked prior to both recent market crashes and has continued to grow in 2018. I am of course not suggesting we're staring down from the peak at this moment, but often times when many think M&A is a great idea, it can be at the worst time.

Synergies Are Not Always Realized

Secondly, not all mergers and acquisitions lead to a happy marriage. Just ask Microsoft, who in 2015 wrote down their entire acquisition of Nokia, to the tune of more than $7 billion. For a myriad of reasons (poor management fit, poor timing, inability to consolidate operations), M&As can simply fail.

Bonnell doesn't clarify the risks of a merger, but these should carefully be considered. She does discuss the top ten reasons why you should consider selling your brokerage if approached. These reasons include lack of profitability, internal disputes and legal issues, and personal considerations such as the need to retire, cash out, or simply burn out.

The flip side of course then is who wants to buy a business that's unprofitable, entangled in corporate drama, or about to experience brain drain?

To Slow Down or Speed Up?

Many smaller companies can't afford the technology, are afraid of it, or don't want the responsibility of keeping abreast of the latest innovations. Now is the time to make a move. -Tami Bonnell

This brings to light a challenging irony: in order to stay relevant, firms need to ramp up adoption of technology, develop niche offerings, pound the pavement for new leads, and stay focused, all while facing a unique opportunity to cash in and step out (and timing it right).

Consolidations are likely to continue, with mega firms such as Compass and Keller leading the way. Both are hyper-focused on technology, but in what will forever be a relationship driven business, technology alone doesn't equate to success.

Hudson, a North Shore firm in the suburbs of Chicago, was just bought by Compass. Firm owner Steve Hudson told Crains, "There are things we can't do as a small company. (Compass' tools will) allow us to do our jobs better and more efficiently."

Do agents at boutique firms that have worked hard to build relationships, carve out a niche, and sustained past threats from technology want to sell to Compass? Should boutiques that need technology need to sell to Compass in order to acquire it?

To view the original article, visit the Homebloq blog.