You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListBeyond Spreadsheets with Real Estate Financial Modeling Tools

December 31 2017

More than a year ago, RPR decided it was time to upgrade what it offered for analyzing real estate investment opportunities. Based on years of REALTOR® feedback, we scoured the internet and trade show floors to assess what was available and began narrowing down our list of potential partners.

More than a year ago, RPR decided it was time to upgrade what it offered for analyzing real estate investment opportunities. Based on years of REALTOR® feedback, we scoured the internet and trade show floors to assess what was available and began narrowing down our list of potential partners.

One of those companies, Real Estate Financial Modeling, LLC (REFM), built a platform called Valuate® that seemed to not only meet but exceed many of our wants, so we ran a test group that gave us the thumbs up to move forward with a partnership. From that point, Founder/CEO Bruce Kirsch and the REFM team have worked non-stop to expand this platform. We wanted to share with you a little about this journey.

Nathan Graham: When we first partnered, Valuate® "just" offered the long-term hold analysis. What enhancements have happened since?

Bruce Kirsch: As you hinted, we started off with a very capable, but somewhat limited system compared to what we have now. You could look at cash flows and investment returns for any income producing property, which remains the core of what we do today, but a lot of improvements have been made, many directly from RPR user feedback. Below are the highlights.

NG: I think I know the answer to this, but what was the most difficult feature to implement and what made it so complicated?

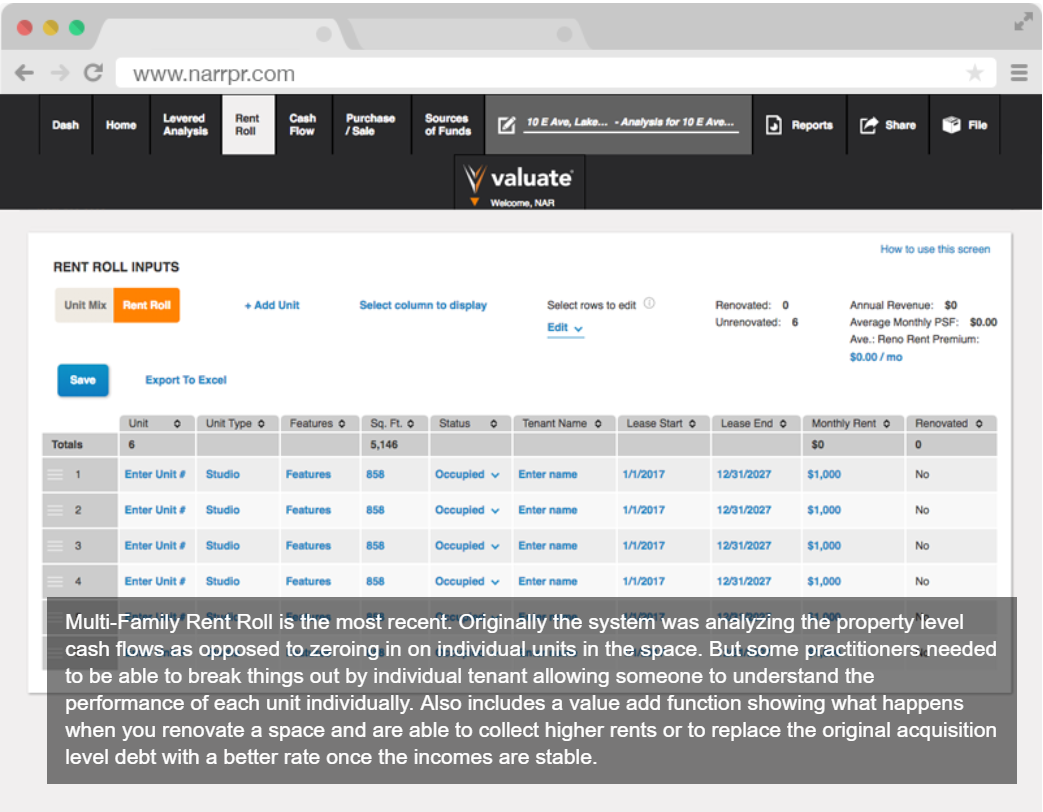

BK: The user interface update was a massive project where we basically rebuilt the entire platform. This was a huge process that included testing on multiple screen sizes and making small tweaks to ensure a consistent feel across all devices. However, the most challenging was the most recent, which called us to retrofit the old multi-family analysis process to include the new rent roll and value add features.

NG: With that trip down memory lane in mind, what do you see as the next headache to take on?

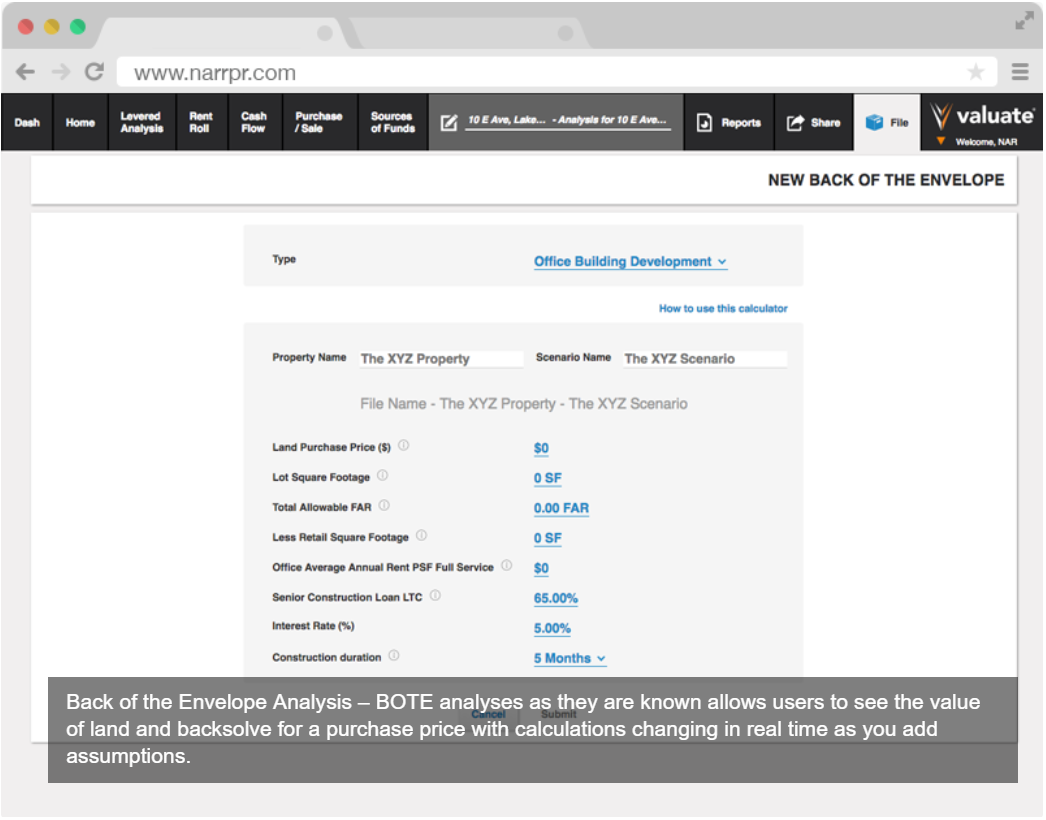

BK: Well hopefully we have learned a lot from these other enhancements that will help us move forward with a smoother path. But, the next thing on the list is to complete the Back of the Envelope (BOTE) analysis suite for the other commercial property types.

NG: As if your plate isn't already full with your software build, I understand you've also committed time to co-author a textbook?

BK: Yes, indeed that's true. I was the editor of Dr. Peter Linneman's fourth edition of Real Estate Finance and Investments: Risks and Opportunities, and I am currently co-authoring the fifth edition that will be released in 2018. It's a neat project to be a part of as the textbook has traditionally supported over 100 top colleges and universities and numerous companies in advancing their financial and investment strategy.

NG: One of the things that piqued our initial interest in Valuate® was your real estate experience. Will you share a little about how you got started?

BK: I have always had a curiosity about real estate, but never studied it. So when I arrived in Philadelphia to attend Wharton Business School, I wanted to focus on a career that would have me in an industry with long lasting, tangible products and naturally became more drawn to the sector. So in 2005, I obtained my MBA in real estate and started my career in Washington D.C. with a developer focused on land acquisition and condo development.

NG: That was an interesting time to get into the industry. How did it go?

BK: Well, it was the best time in the world for a short period. But when the party stopped, I needed to figure out what was next. After a short attempt at starting my own company, I found myself back in the development world focused again on analysis and searching for the hidden insights amongst all the calculations and formulas. Ultimately, my love for real estate and investment analysis helped form the idea that became REFM.

NG: So to say you're dialed into the industry is an understatement. I'm curious as a participant in both the real estate space, what is your take is on the overall commercial technology sector?

BK: I think the most drastic change has come with the adoption of platforms being developed using API programming. Historically, in order to expand the functionality of a platform, you would have to build it or buy it. Now we have the third option of API integrations, which allow one platform to seamlessly pass a user into another, like we have within RPR. This is creating a lot of excitement.

NG: To close, what is one CRE tech company that you are intrigued by most right now?

BK: I was blown away by envelope.city which comes out of the architectural side of the industry and focuses on zoning in New York city. It allows you to instantly draw a 3D model of a potential building on any site. For us, it is interesting because it ties into Valuate's BOTE calculators, which can do the financial analysis for the project.

Do you use Valuate and have a story to share, or maybe an idea to improve the system? Feel free to comment on our Facebook page!

To view the original article, visit the RPR blog.