You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListDiscovering Local Opportunities By Assessing National Trends

September 17 2017

Staying up to date with trends affecting commercial real estate should be easier than ever. We have a multitude of informed experts at our disposal via social networks, news outlets, and a myriad of newsletters that magically appear in our inboxes. All of this information can become overwhelming, but through careful curation of who you pay attention to, you can begin to see the opportunities through the trees.

Take for example the Commercial Real Estate Alert from NAR. In it are a number of trends that could impact your CRE business –– from demographics impacting the use of space, to sustainable building features becoming increasingly important for tenants/investors, to getting your next project financed through a crowdfunding website.

If we lived in a homogeneous world, it would be easy to implement these national trends on a local level, but we all know that every market is different. The question, then, is how do you become more knowledgeable about local opportunities while reducing the risk of jumping into the newest trend?

The answer is a simple formula: good local market knowledge plus data results in fewer risky decisions. First, though, we need answers to questions such as, "Where are we in the cycle?" and "Which sectors in my market are ripe for change of use?" or "Which sectors are approaching a transition point?"

This is where your local market knowledge comes into play, and to help, we look to Dr. Glenn Mueller's The Commercial Real Estate Cycle which identifies the twin cycles that drive real estate –– the physical and financial. This insight enables forecasting of the two components of every real estate investment: rental income and price appreciation.

Now that you have a decent idea as to which sector you want to focus on, it's time to collect data to see which new business model or building method is most apt to be supported by your local community. Your journey might start at the U.S. Census Bureau, then to the Department of Labor, followed by the local Department of Transportation, until eventually you get a pretty good understanding of local demographic and economic conditions, but even then you won't really know the preference of the community.

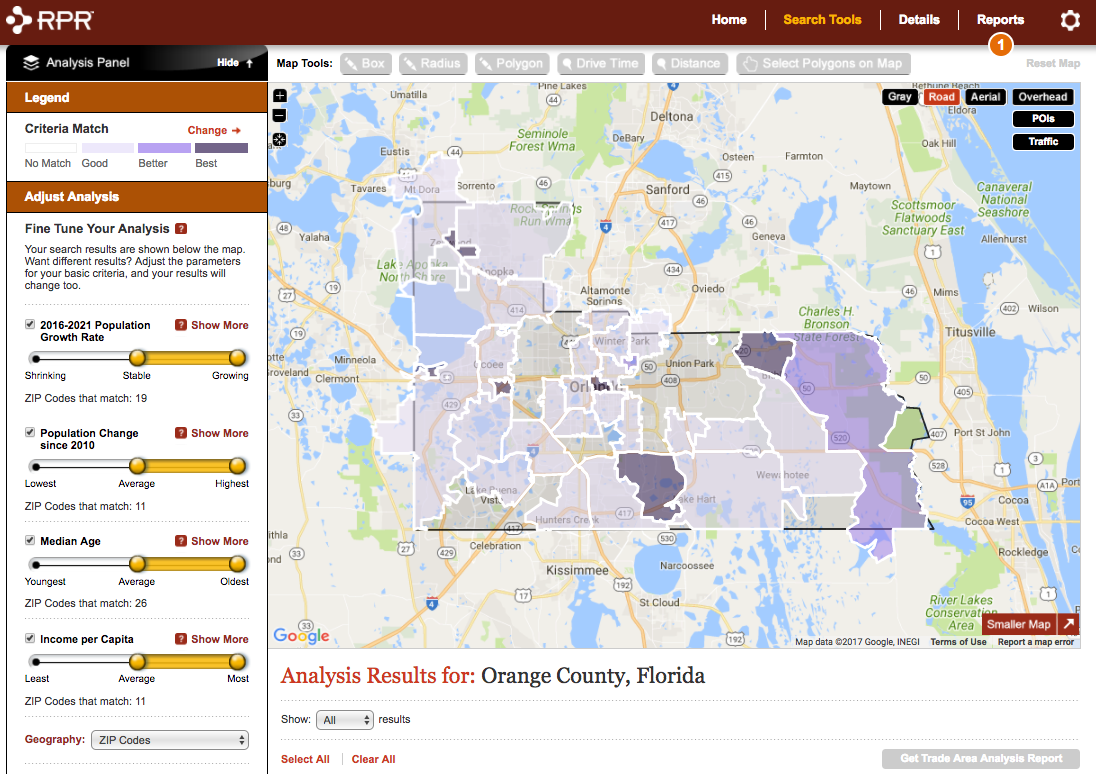

So what is an efficient, data hungry Realtor® to do? This is when RPR, your NAR member benefit, kicks in. RPR is a consolidated resource for all types of economic and demographic data with the added benefit of community preferences via Esri tapestry segmentations.

Let's look at a scenario in which we believe there is an opportunity to capitalize on the budding co-working office space industry. A good first step would be to analyze established co-working spaces to see if we can identify community attributes that may lead to discovering a local area that will support a similar business. In RPR Commercial, we can run Trade Area Reports for locations where national operators exist (WeWork and CoLab) or regional operators (SharedSpace Atlanta) and see what supportive attributes of those communities jump out, such as:

- High population change 2010-2016

- Over 50,000 population

- Lower median age and high 20s/30s

- Low unemployment

- Employment Sector – Professional, Scientific, Technical

From there, we can go to RPR Commercial's attribute based site selection tool and search our local market for communities with similar characteristics. With those areas identified, the next step is to search the best matches for properties (check out CommercialSearch to supplement available property data). Once we find a property, we can add our knowledge about the building to the detail page and run a full Trade Area Report to confirm community support. We can even perform an investment analysis factoring in cash flows, renovations, and one time expenses to ensure our IRR meets the investment goals!

To view the original article, visit the RPR blog.