You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListCommission Management from A to Z

February 06 2017

The agent commission is one the most important things that brokers manage--and often one of the most complicated. Every company has its own commission structure, and it's common for individual agents within a firm to be on different commission plans. Additionally, agents have differing anniversary dates, splits, and recurring charges.

All these variables mean that the room for error is high--mistakenly pay an agent less than what they're owed, and they're unhappy, stop producing and may even switch firms. Overpay an agent, and it's your bottom line that's unhappy.

Most brokers mitigate this potential headache by automating commission management. Some use components that are part of their existing back office system or transaction management software, while others use third-party tools for commissions alone.

Regardless of which option you prefer, there are some basic functions that any commission management solution should include. Today, we'll take a look at what those are. To help us get a deeper understanding of what to look for in a commission management program, we turned to Andrew Chishchevoy, co-founder of Brokermint, a back office solution that offers a robust transaction management component.

"What we hear when we talk to companies is that brokers need a system to keep the information in their commission structures 'clean'--the splits, tiers, recurring charges," says Chishchevoy. "This is important because, ultimately, you use that information to pay agents. When the data is incorrect, that's where problems begin."

The Power of Commission Templates

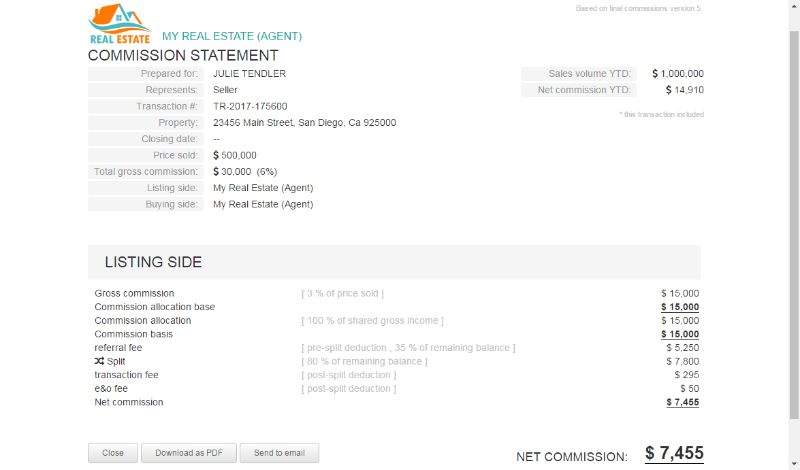

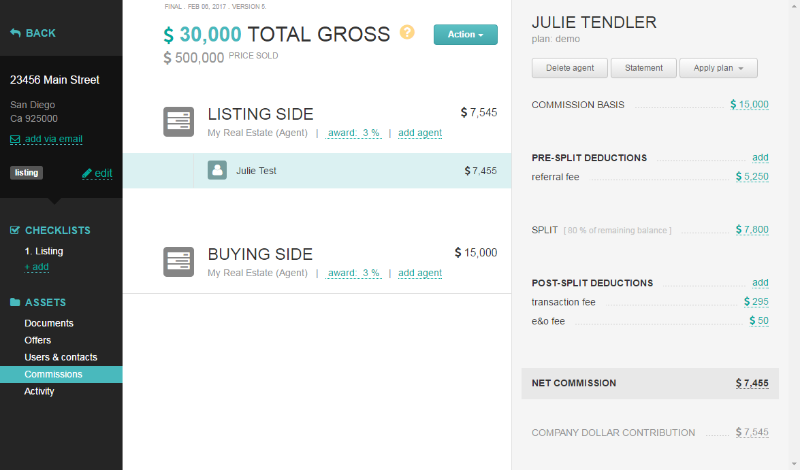

In many commission management programs, including Brokermint, keeping commission structures accurate is accomplished via templates. Brokers or administrators can set up a template by configuring the split or tiers. Templates can be assigned to any number of agents, and multiple templates can be created to handle any needed commission structures.

When evaluating a commission management solution, ask the following questions:

- After configuring the split, can I add pre- and post-split deductions?

- Can I add a percent or flat fee to split options?

- If I have a multi-level commission structure, does this solution offer a sliding scale option?

- If a sliding scale option is available, what time ranges can I select--YTD, previous 12 months, since an agent's anniversary, custom date range?

- When a template is finished, is it easy to copy and customize it?

- Can I add extra income on top of gross commission within a transaction?

- Can I modify commissions on the fly, even after assigning them to a transaction?

- Once commission templates are set up, you'll need to assign them to agents. Is the solution you're evaluating able to assign multiple templates to a single user? Can you set the most frequently used commission plan for an individual agent as the default?

Your templates should also be available to select when you add a new transaction to the system. When a new transaction is added, the commission structure should automatically be the designated default for that agent. If you need a different commission structure for a transaction, it should be simple for brokers or admins to choose an alternate.

Managing Disbursements

Templates are the foundation of a solid commission management tool, but how they handle disbursements is even more crucial. As Chishchevoy notes, this is where 'disconnects' most often happen.

Ask the following of the commission management program you're evaluating:

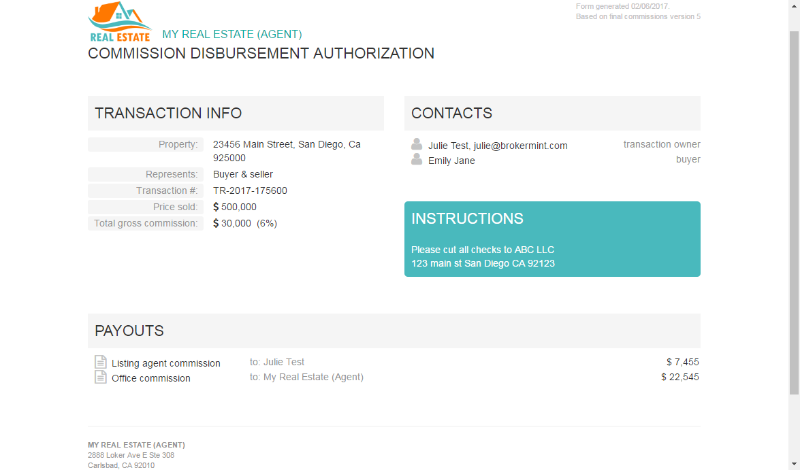

- Can I generate commission disbursement forms and individual commission statements?

- How can I get the commission disbursement authorization--can it be downloaded as a PDF file or emailed from the system?

- Can I brand commission disbursement authorizations and individual statements with my logo and company name?

- Does the system offer deposit tracking?

- Can I review reports and year-to-date sales volume?

- Does this solution integrate with my accounting program so that I can avoid entering data twice?

A 'yes' to the last question above can help your year-end processes run more smoothly. But, in general, automated commission management also helps with this. "The end result of automated commission management is that brokers have correct and valid data at the end of the year that they can give to their accounting person," says Chishchevoy. "This also helps to retain agents because it ensures that brokers pay them according to the initial agreement that they signed--not less, not more."

A commission management system doesn't need all the features listed above--what's important is that the solution you choose meets all your needs. Keep that in mind when evaluating a solution.

Brokermint does offer all the features above, and if you'd like to try its commission management capabilities for yourself, they offer a 30-day free trial. RE Technology members who want to continue using the program after trial are eligible for a 10% discount when they sign up at the link above.

Your turn: Which commission management features are most important to your brokerage? Let us know in the comments below!