You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListMary Meeker's 2016 Internet Trends: 3 Takeaways for Real Estate

June 15 2016

One of my favorite research rituals is the annual release by Mary Meeker of her Internet Trends Report, the latest of which was issued on June 1. Meeker was catapulted into the financing world spotlight as the lead manager at Morgan Stanley for Netscape's IPO in 1995. Later that year, she and Chris DePuy at Morgan published The Internet Trends, and it quickly became the definitive digest of the current state of the Internet, as well as discerning big-picture trends.

One of my favorite research rituals is the annual release by Mary Meeker of her Internet Trends Report, the latest of which was issued on June 1. Meeker was catapulted into the financing world spotlight as the lead manager at Morgan Stanley for Netscape's IPO in 1995. Later that year, she and Chris DePuy at Morgan published The Internet Trends, and it quickly became the definitive digest of the current state of the Internet, as well as discerning big-picture trends.

Meeker would go on to serve as a research analyst for another notable Morgan Stanley IPO in 2004: Google. Today, Meeker is a partner with the Silicon Valley venture capital firm of Kleiner, Perkins, Caufield & Byers, and continues to publish the most definitive annual report on the Internet. Like Warren Buffett's annual letter to shareholders, it has become one of my annual must-reads.

Presented in a slideshow format, this year's report – available in a PDF here – is over 200 pages long and is packed with economic, cultural, business and technology data that is so comprehensive, it is mind numbing. So here's my attempt to extract just three key takeaways that should be of particular interest to the real estate industry. In truth, there are dozens more, but this is an attempt to show that the full consumption of this report is worth the chore.

Trend: Global aging

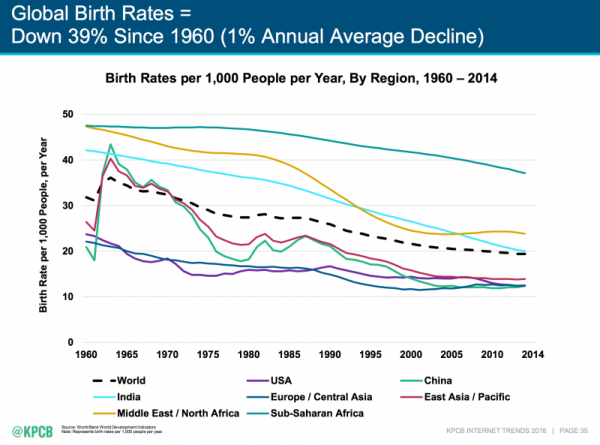

Global birth rates are down (39% decline since 1960) and global life expectancy is up (36% increase since 1960). This is true in the U.S., as illustrated by these charts from the report:

Takeaway: This is a huge demographic trend in the U.S. that will have a long-lasting impact on real estate, from the types of homes we are building, to where we are building them. Initially, we are entering the early stages of an era when Millennials are going to have to buy Baby Boomer homes as the Boomers downsize and the Millennials build families because Millennials are aging, and starting to have more children too.

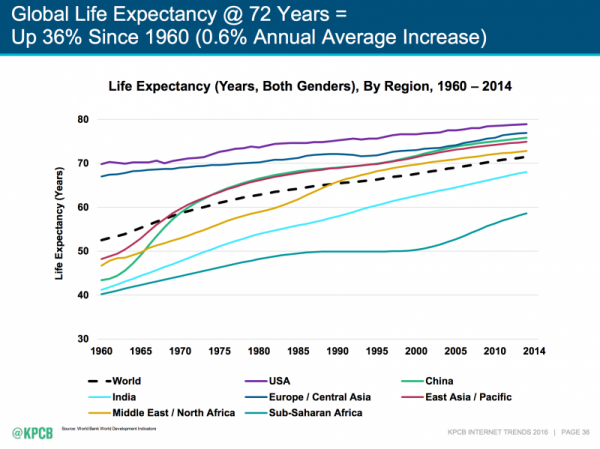

The challenge is there are more single Millennials, and more of them are unemployed. As Meeker's report notes, these two generations are very different, so real estate sales professionals need to understand how to serve both. The report notes that Millennials are more urban, more single, more diverse, better educated, but also are underemployed, as shown here:

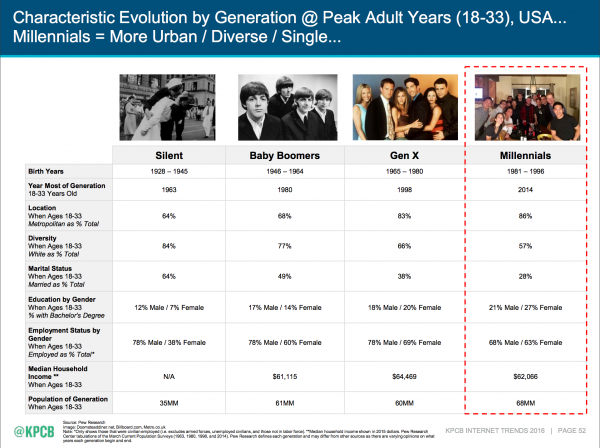

Trend: 35 to 54 year olds still have 50% more buying power than Millennials

Meeker's report doesn't say this, but it shows it. It instead notes that 27% of the population is now Millennials, and that's the biggest chunk of the U.S. population in terms of a segment. The report also touts that the spending power of Millennials "should" rise significantly in the next 10-20 years. No surprises there. But Meeker's own chart shows that the real sweet spot for household expenditures – i.e. purchasing power – remains with Gen X and the Boomers. In fact, those who are ages 35 to 64 have more than double the purchasing power of Millennials, which supports this article from the Hawaii Life Real Estate's "Worthshop 5" conference last fall, as the charts show here:

Takeaway: Until the Millennials become a significant driver of overall home sales, real estate professionals will need to focus on the Boomers first and Gen X second for the next 10 years. That's where not only purchasing power resides and will reside for the near term, it is also where the numbers are: the Gen X (60 million) and Boomers (61 million) populations combined outnumber Millennials (68 million) by nearly two-to-one. This also isn't in Meeker's report, but the wealth of the Boomers is crippling when compared to any other segment.

Trend: Mobile may be king, but most apps are a crapshoot

Meeker's math makes the case that very few apps are actually used by consumers: the average U.S. mobile user has about 37 apps, less than one-third of them (12) are used daily, and 80% of one's time is spent in just three apps: Facebook, Chrome and YouTube, as shown in the chart below. Moreover, the growth of mobile is clearly generational. The comparison of the different communications channels – and the popularity and the differences of each mobile channels among the generations is tremendously insightful as shown in the second chart below:

Takeaway: Real estate needs to reconsider its investment in apps. Tens of millions of dollars are being invested in what appears to be a largely failed strategy. Mobile First has far more promise when you look at the generational usage of mobile technology, even by Boomers.

Worth mentioning

Meeker's report dedicates nearly 20 pages to Big Data, called "Data as a Platform," and points out the growing concerns being generated around privacy and security, as data tracking becomes commonplace. She also dedicates more than 20 pages to cars and technology, including the remarkable impact of Uber and driverless cars. But her greatest focus is on China and its growing impact on the world of technology, with 30 pages detailing the growing role China is playing throughout the tech ecosystem. Again, this report is chock full of interesting data and surprises.

Among other notable trends:

- She gives a shout out to the "Image-Based Platform Houzz" by using it as a prime example of the effectiveness of "Content + Community + Commerce."

- Amazon Echo and its voice as a computing interface and a huge, growing and pervasive trend (and one arguably, real estate needs to watch as the smart home is finally realized).

- On transportation, she asks if the "backseat" of the car will be the place where auto manufacturers focus their attention because of the impact of shared transportation and automated vehicles.

- And some most troublesome statistics: Global Government Debt loads are high and rising faster than GDP: Up 9% annually over the last 8 years versus 2% GDP Growth for 50 Major Companies.

Finally, my favorite slide that simply uses two photos of Shanghai – taken from the same perspective – one in 1987 and the other in 2016 to illustrate the magnitude of China's growth over the past two-plus decades:

After you read the report, share with us your favorite "takeaways" for real estate by adding your comments below.

To view the original article, visit the WAV Group blog.