You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListThe real reasons millennials aren’t buying homes and what you can do about it

September 10 2015

Part 1: The real reasons millennials aren't buying homes

Many experts have argued that affordability, student loans or fear of being tied down are the primary reasons millennials are not buying homes. The real reasons, however, might be quite different from what the conventional wisdom suggests.

Many experts have argued that affordability, student loans or fear of being tied down are the primary reasons millennials are not buying homes. The real reasons, however, might be quite different from what the conventional wisdom suggests.

Although many people believe that millennials don't want to be tied down with a home, a recent Redfin study indicates otherwise.

According to Nela Richardson, the chief economist at Redfin, "92 percent of millennials who don't own a home say they plan to buy in the next four years."

Richardson believes the big driver for homeownership is having children. In fact, the Redfin survey showed that 38 percent of U.S. millennials said they would, or have, put off a wedding or honeymoon to afford to buy a home. As Richardson says, "Mortgages before marriage."

So what is keeping millennials from entering the housing market? Here are the factors at play:

Student loans: not the real issue

A study from TransUnion found that student loan impact on rates of millennial homeownership might be overblown.

"Despite an unprecedented rise in student loan balances over the past decade, a new TransUnion study found that student loan obligations do not inhibit younger consumers' ability to access and repay other consumer credit categories such as auto loans and mortgage compared to peers without student loans."

According to Charlie Wise, vice president of TransUnion's Innovation Solutions Group and co-author of the study, "About 50 percent of people aged 18 to 29 have credit scores that qualify them as nonprime borrowers — a percentage that has been steady since 2005.

"What has changed is lending standards, which became stricter in the aftermath of the recession."

A study from Credit Karma (based on a sample of over a million of their members), reported that consumers between the ages of 18 and 34 have an average credit score of 624, just four points above the minimum credit score of 620 to obtain a loan. Scores of 720-plus are required to obtain the best rates and terms.

Millennials don't know how to start

A study from ZeroHedge.com concluded, "While we were certainly not surprised to learn that excessive student loan and credit card debt were responsible for keeping many of America's youth from buying their first home, we were surprised to discover that for millennials in around one-third of U.S. states, the chief impediment is apparently 'not knowing how to start.'"

The big disconnect

The Harvard Joint Center for Housing Studies recently estimated that about 50 percent of the 25- to 34-year-old renters in the top 85 metropolitan areas have the income and credit scores to qualify for a mortgage today. That's approximately 5.5 million renter households!

So how come they're not in the market? According to Freddie Mac's Christina Boyle, the reason is that they are misinformed about the amount of the required down payment.

"Consumers persistently overestimate the size of a down payment they need in order to finance a home, and this lack of education is harming the housing market ... Specifically, 38 percent of the 25- to 29-year-olds, and 42 percent of the 30- to 34-year-olds said lenders demand down payments of 15 percent."

Moreover, "Roughly 60 to 72 percent of first-time homebuyers don't believe they can get a mortgage and are underestimating their potential for qualifying for a conforming, conventional mortgage with a low down payment ... The statistics for 2014 show that 1 in 5 borrowers who took out conforming, conventional mortgages put down 10 percent of less."

The real reason millennials might not be buying

Rob Chrane, the founder and CEO of DownPaymentResource.com, recently hit on what might be the most important reason millennials are hanging back from purchasing their first home: their fear of rejection.

Many millennials were raised in an environment where everyone wins. Because of that, most are reluctant to engage in situations or activities where they might experience rejection.

Furthermore, unlike the Gen Xers and the baby boomers who saw huge runups in their real estate values, many millennials watched their parents struggle with their house payments or even experienced losing their home in the last downturn.

Combine all these factors together with the lack of inventory, tight lending standards and millennials' misconceptions about the amount of down payment that is required to purchase, and you have a potent combination that has resulted in reluctance to buy.

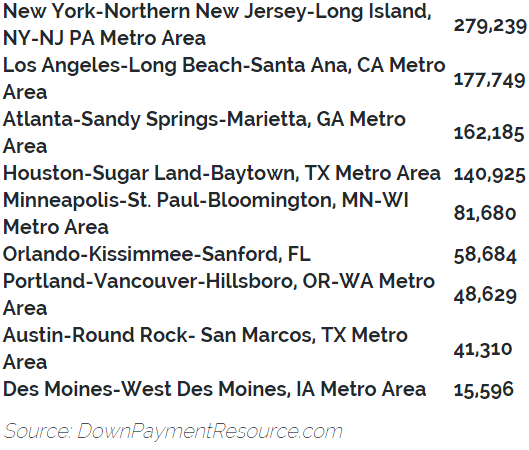

To understand the magnitude of this challenge, Chrane used the Harvard JCHS study to project how many millennials in several of the country's major metropolitan areas could qualify to buy a home today. The results are staggering:

There is a gold mine for agents who are willing to put the time in to convert these renters into first-time homeowners.

If you want to know more about how to tap into this lucrative market, read onto to part two.

Part 2: How to feed the first-time buyer pipeline

If you're a new agent who would like to start making income right from the start or an experienced agent who is looking for new sources of clients, I've learned strategies that can help you achieve this goal in your market.

Open your eyes to tenant representation

I recently spoke with Zach Schabot, the executive vice president of Bamboo Realty. One of his top recommendations for both new and experienced agents is to open your eyes to tenant representation.

He doesn't mean getting into property management. Instead, it's about helping people who are just getting started, or are moving into a rental for other reasons, to find a rental property.

This approach has been a particularly beneficial for his new agents. His new agents no longer have to wait months to get their first commission check.

Instead, their rental commission checks are issued shortly after the lease agreement is signed. In fact, some of his new agents who have specialized in tenant representation have hit six-figure incomes their first year in the business.

In terms of where to meet clients who are leasing, many real estate offices receive requests for rental properties. Because most agents don't want to work this market, consider pursuing these leads instead.

To do this, familiarize yourself with the major apartment subdivisions that provide both short- and long-term rentals, and that will pay you a commission.

A primary reason this approach is so effective is that short-term rentals allow people to test out an area or lifestyle before they decide to buy.

Moreover, as your younger renters grow in their careers, they typically evolve from renting to becoming first-time buyers.

All you have to do is to stay in touch, as well as provide them with information on resources to help them with their down payments.

Educate renters about how to become homeowners

Matt Barker, co-founder of the Barker Hedges Group at Re/Max Results, explained how his agents help renters become homeowners.

"We used to do mailers to apartment complexes but are now Web-focused. We created MinnesotaFirstTimeHomeBuyer.com six years ago, and through blogging and word of mouth, it has become known as a useful resource for first-time buyers."

If you visit their site, you can see why. They have aggregated everything a buyer would need to begin their journey to homeownership.

They hold buyer seminars and provide plenty of print resources for buyers to educate themselves. But most importantly, they provide a rich array of resources for assistance for both down payments and special loan programs for first-time buyers.

"Minnesota has a high number of down payment programs, and we have educated our team about the programs," Barker said.

"DownPaymentResource.com (which provides resources for down payment assistance throughout the U.S.) has been a huge help in expanding our reach."

Barker's website includes links to city, county and other down payment assistance resources. As a result, many first-time homebuyers contact them up to a year before they are ready to purchase.

In addition to DownPaymentResource.com, HSH.com has compiled a list of homebuying assistance programs for borrowers in each state.

Programs vary from state to state and are usually targeted to first-time buyers who have never purchased or repeat buyers who have not owned a home in the past three years.

For example, California has eight different statewide programs. These include:

- First-time buyers.

- Repeat buyers (CalPlus and CalPlus FHA).

- Mortgage credit programs that help new owners reduce their federal income tax liability.

- Energy-efficient loans to fund home improvements that make homes more energy efficient.

- Down payment assistance (ranging from junior loans of $7,500 to $15,000 to assist with down payment fees).

- Job-specific programs for groups such as teachers, firefighters and police.

Barker explains how this approach has created a competitive advantage for his company:

"Most agents won't put the time in to educate the consumer, but this is our passion and helps us give back.

"Our customers are often looking for one year out or more, so the follow-up is key. We are customer service-focused in our follow-up — in fact, so much that we are in the process of hiring licensed customer service agents to increase our touches with the consumers.

"There are no magical scripts. Instead, we focus on learning more about someone's situation. When you come from a customer service angle, the buyers will let down their guard to work with you."

In terms of where to find first-time buyers, Barker says they are everywhere. Getting focused on a segment and extending the effort is key.

Blog on your website, amp up social media, use your sphere, door-knock — get the word out any way you can.

If you can use a new source of regular income, working with lessees and first-time buyers may not be easy, but can be a source of both immediate and long-term income.

One of the best things about being in real estate is seeing the happiness your clients experience when they walk into their first home — a home they wouldn't be in without your assistance.

To view the original article, visit the Down Payment Resource blog.